Red Deer's Best Car Insurance Rates

Youre just a few clicks away from the best auto insurance rates in Red Deer.

Compare Alberta insurance quotes from top providers

How to get Alberta car insurance quotes on RATESDOTCA

Ready to compare quotes and save?

Tell us about your vehicle

Answer a few basic questions about your driving & car insurance history.

Compare your quotes

See quotes from multiple insurance companies side by side.

Choose the right coverage

Find the right protection for your vehicle.

Secure your rate

Connect with the provider and secure your rate.

What people say about our quotes

Based on 6,448 reviews

Amazing

Very helpful and easy to use

Safe travels

Easy quick selection of rates

Easy quick selection of rates

J K

Great help in finding the best rate!

Great help in finding the best rate! Thanks a lot!

Ruthielyn opina

I like how I can quickly I can select…

I like how I can quickly I can select travel insurance. The web site had an issue earlier but seemed to correct itself.

Dennis

prompt service

Respnded quickly, recommended company was excellent

Michael W.

Save time and money with rates.ca

I always use rates.ca for my travel insurance. They compare rates from several insurance companies and I can choose the package that suits my needs. I save time, frustration, and best of all, money. Thank you rates.ca, I will definitely be using your service again in the future.

customer

Compare and save in Alberta

It is no secret that Albertans face some of the highest auto insurance premiums in Canada.

Fortunately, RATESDOTCA is here to help. We work with over 50 of Canada’s best insurance providers, and show you their rates side by side. All you have to do is choose the best one.

FAQ - Frequently asked questions about car insurance in Alberta

Is car insurance mandatory in Alberta?

Car insurance is mandatory for drivers in Alberta, as it is in the rest of Canada.

At a minimum, Albertan drivers must have third-party liability and accident benefits coverage.

How much does auto insurance cost in Alberta?

Your personal premium depends on multiple factors, but according to the Insurance Bureau of Canada, Alberta is the third most expensive province for car insurance.

Based on the latest data from the IBC, Albertans pay an average of $1,316 per year (report released in August 2019). This represents a $65 increase year over year, and is equivalent to a monthly payment of $109.67.

Why is Alberta car insurance so expensive?

Alberta’s expensive car insurance is largely due to population density on the road, distracted driving, and car theft.

Busy roads

Alberta’s two largest cities, Calgary and Edmonton, are also two of the largest cities in Canada. These urban centres are home to some of the busiest roads in the country. Many drivers in a relatively small geographical area unfortunately means more vehicular accidents.

Insurance companies charge higher premiums to help cover the cost of these claims, so drivers in Calgary and Edmonton pay significantly more than rural Albertans on average. The high rates paid by Alberta’s city dwellers drive up the provincial average.

Cell phone use

Alberta has strict laws forbidding the use of hand-held cell phones (or any other electronic device) while driving, but the penalty for distracted driving ($287 fine and 3 demerit points) has done little to curb these offences.

To highlight this point, in 2011 there were 7,829 convictions in Alberta for distracted driving due to cell phone use. By 2012, due to the increasing popularity of smart phones, this number had shot up to 24,428. Despite a high-profile campaign to combat this behaviour, in 2019 the number was still very high, at 20,060 convictions.

Distracted driving is one of the most common reasons for auto collisions, and until the data shows a change in behaviour, insurers will likely be reluctant to offer improved rates to Alberta’s drivers.

Auto theft

Despite being home to just 11% of the population, Alberta reports 30% of Canada’s vehicle thefts. In 2018, Statistics Canada reported that over 60 vehicles were stolen every day in the province. For the last 20 years, Calgary has had the worst record out of all Canadian cities, peaking at 1,000 vehicle thefts per month in 2017.

These numbers are staggering, and with each stolen vehicle resulting in an insurance claim, Alberta’s insurers keep the premiums high to cover replacement costs.

Every year, the Insurance Bureau of Canada release a lost of the top 10 most stolen vehicles. In Alberta, the most stolen vehicles in 2019 were:

1. 2007 FORD F350 SD 4WD

2. 2006 FORD F350 SD 4WD

3. 2006 FORD F250 SD 4WD

4. 2004 FORD F250 SD 4WD

5. 2005 FORD F350 SD 4WD

6. 2005 FORD F250 SD 4WD

7. 2000 HONDA CIVIC Si 2DR COUPE

8. 1999 HONDA CIVIC 2DR HATCHBACK

9. 2004 FORD F350 SD 4WD

10. 2007 FORD F250 SD 4WD

Which company has the cheapest car insurance in Alberta?

Every car insurance company assesses risk slightly differently, and every quote is comprised of multiple risk factors. As a result, it is impossible to say which company is the cheapest, because the insurer offering you the best rate will not be the same for everyone.

If you want the cheapest car insurance in Alberta, spend a few minutes getting quotes. We ask the same questions insurers do, and then show you competing rates side by side. All you have to do is compare coverage options and pick the cheapest policy.

Who regulates insurance in Alberta?

The Alberta Superintendent of Insurance is the provincial regulator, which operates under the framework of Canada’s Insurance Act. The Alberta Automobile Insurance Rate Board (AIRB) is responsible for approving auto insurance rate changes, and deciding how much companies can charge for basic coverage.

What is the grid system and how does it work?

Unlike Ontario, where drivers don’t really know what to expect when their policy is up for renewal, Albertans can predict the amount they will have to pay for basic coverage. They can do this because of a simple grid rating system. This grid outlines the maximum amount motorists can pay for insurance. As a driver, your rates will go up or down depending on multiple factors, but they can never exceed the maximum premium outlined on the grid, for a driver with your record.

You can see where you fit on the grid system by using the Auto Insurance Grid Rate Calculator from the Alberta Automobile Insurance Rate Board.

In Alberta, basic coverage means third-party liability and accident benefits. Optional coverages are not included in the grid system, and prices vary from one provider to the next.

Thanks to a competitive private insurance system, only about 6% of Albertans pay grid rates. This is because insurers must compare the base premium determined by the grid to the policyholder’s quoted premium, and charge the lesser of the two.

How does Alberta’s private auto insurance system benefit drivers?

Unlike the neighbouring provinces of Saskatchewan and British Columbia, Alberta has a private car insurance system. This private market encourages competition between insurance providers, ultimately helping to keep prices down.

What coverages are mandatory in Alberta?

Albertan lawmakers require car insurance policies to include two specific coverages:

The first is personal liability and property coverage (PLPD), also called third-party liability coverage. If you are at fault for a car accident, PLPD helps cover repair costs and medical bills for the other motorist(s). Drivers in Alberta must have a minimum of $200,000 in third-party liability coverage but according to the Alberta Auto Insurance Rate Board, 98% of drivers increase their limit to at least $1,000,000.

The second mandatory component is accident benefits. This provides coverage for medical costs, funeral costs, rehab, death benefits, and income replacement in the event you, a passenger or a pedestrian is injured or killed in an accident. It also provides some uninsured motorist coverage, which is applicable if you get into a collision with a driver who doesn’t have insurance.

These two items are all you need to satisfy the provincial regulations, but most drivers in Alberta opt for additional coverage.

What types of optional coverages are available in Alberta?

The most popular optional coverages provide insurance for your vehicle, whereas the mandatory coverages do not.

- Collision coverage helps pay for repairs to your vehicle if it is involved in a collision with another car or object.

- Comprehensive coverage will pay for damages to your car caused by vandalism, theft, or certain types of weather.

- Specified perils covers only named perils identified in a policy, and is thus a cheaper option than comprehensive.

- Endorsements refers to specific coverages you can add, remove or limit as part of your car insurance policy.

What are some examples of Alberta car insurance endorsements?

There are numerous endorsements, called Standard Endorsement Forms (SEF), available to Alberta drivers. They include:

- Loss of use. You might want to add an endorsement for loss of use (known as endorsement SEF 20) if you rely on your vehicle every day. This would provide you with a rental car (or another form of transportation) in the event your car requires lengthy repairs.

- Increased limit, automobile sound and electronic communications equipment. If you spent money installing a custom sound system, you may wish to get the SEF 38 endorsement, which provides coverage for electronics that you install in your vehicle valued over $1,500.

- Family protection. Family protection (SEF 44) provides additional accident benefits coverage in the event a collision with an uninsured at-fault driver, or one that doesn’t have enough liability coverage of his own. This type of coverage will pay the difference between the at-fault driver’s insurance amount the amount of your claim.

What factors affect Alberta car insurance premiums?

Your address

Where you live will affect your premiums. Drivers living in cities, especially big ones like Calgary and Edmonton, can expect to pay more than rural Albertans.

Your age

Young drivers are charged higher premiums because stats show they're at greater risk of being in an accident. Once you have more experience (generally after six years of claims-free driving), your rate should go down.

Your driving record

As long as you have a good driving record, the more years you've been driving, the lower your premiums will be. In Alberta, every year of clean driving can save you 5% off the grid rates, up to a maximum of 50%.

However, if you’ve been involved in an at-fault accident in the past six years, your premiums will be high. Each at-fault accident moves a driver five steps up the grid. Just one at-fault accident in Alberta amounts to a 50% average rate increase.

Similarly, driving convictions will mean you have to pay more for car insurance. The severity of the conviction, whether it was for a minor, major, or criminal infraction, will determine the impact on your car insurance rate.

Your vehicle

You can expect to pay higher premiums if you drive a sports car rather than a mini van or sedan. This is mostly due to the cost of replacement parts.

Your annual mileage

A driver who only uses their vehicle occasionally will pay lower premiums than one who drives to work and clocks many kilometres each day.

Your coverage needs

The amount of coverage you choose, as well as the amount of your chosen deductible, will play a part in how much you pay for premiums. A higher deductible (the amount you agree to pay in the event of a claim), generally means a lower monthly payment.

What are the standard policy limits in Alberta?

These are the standard policy limits in a basic Alberta car insurance policy:

Mandatory minimum third-party liability:

$200,000 is available for any one accident, but if a claim involving bodily injury and property damage reaches this figure, reimbursement for property damage is capped at $10,000. This ensures $190,000 is available for the more serious payouts for injuries.

Medical payments:

$50,000 per person per accident with a limit of two years. For chiropractic care, massage therapy and acupuncture, the limits are $750, $250 and $250 respectively.

Funeral expense benefits:

$5,000 per person.

Disability income benefits

An employed individual can receive 80% of their gross weekly earnings (maximum $400 per week), for up to 104 weeks. For an unemployed adult, the benefit is $135 per week, for up to 26 weeks.

Death benefits:

$10,000 for head of household plus $2,000 to each surviving dependent after the first survivor, plus $15,000 for first survivor and $4,000 for each remaining survivor; $10,000 for the death of the spouse of the head of the household and up to $400 for family grief counselling.

Right to sue for pain and suffering?

Yes. If injury is classed as “minor.” The maximum award is $5,202.

Right to sue for economic loss in excess of no-fault benefits?

Yes.

How to get the cheapest car insurance in Alberta

Saving on Alberta auto insurance is easier than you think. Follow these 10 tips to secure the best deal:

1. Get winter tires

The province does not require that vehicles be equipped with winter tires during the winter months, but Alberta’s transportation authority recommends them. Insurance companies consider them a key safety feature, so get winter tires usually get you a discount.

2. Install an anti-theft device

Alberta records more annual car thefts than any other province. Even if you live in a quiet and safe area, an anti-theft device like a car alarm or GPS tracker will show insurance companies that you are taking all necessary precautions.

3. Bundle auto with home insurance

Insurance companies offer reduced rates if you use the same provider for multiple policies. In Alberta, home and auto are the most commonly bundled insurance products.

4. Insure all vehicles under one policy

If you have more than one car, insuring them all under one policy can save you as much as 20%.

5. Take a driver’s education course

If you are an inexperienced driver, a sensible way to save on car insurance is to take an accredited driver’s training program.

6. Increase your deductible

Increase your deductible to $1,000 in exchange for lower insurance rates. Just make sure you can afford it in the event of a claim.

7. Drive less

For many Albertans, a car is necessary for their daily commute, but from an insurance perspective, less time spent driving means less chance of an accident. If you have the option of cycling, walking or taking transit to work each day, you could save a lot on your car insurance policy.

8. Pay premiums annually

Ask your insurance provider if you can pay your entire premium up front, rather than smaller monthly payments. Many companies offer a reduced rate for this as it cuts down on their administrative costs.

9. Consider usage-based insurance

A usage-based insurance (UBI) or telematics device is one way of dramatically lowering your annual premium. An app on your phone monitors when you drive, how far you travel, your average speed and braking habits.

Your premium cannot be increased for risky behaviour, but discounts of up to 30% are available for individuals who demonstrate good, safe driving. UBI has been available in Alberta since 2016, but not all insurance companies offer it yet.

10. Shop around

The best way to find cheap insurance in Alberta is to compare quotes from several providers. Thanks to websites like RATESDOTCA, the days of leafing through the phone book and calling around different companies are gone.

Simply spend a few minutes answering our questionnaire, and we will show you multiple rates from Alberta’s top car insurance providers, all in one place.

Facts and statistics about auto insurance in Alberta

Average auto insurance premiums by province

Alberta’s drivers pay the third highest car insurance premiums in Canada. The latest figure represents a 5.2% increase, year over year.

Data source: Insurance Bureau of Canada.

| Province | Average Annual Premium | Average Monthly Premium | Year Over Year Change |

|---|---|---|---|

| British Columbia | $1,832.00 | $152.67 | +9.05% |

| Ontario | $1,505.00 | $125.42 | +4.15% |

| ALBERTA | $1,316.00 | $109.67 | +5.20% |

| Saskatchewan | $1,235.00 | $102.92 | +31.94% |

| Newfoundland and Labrador | $1,168.00 | $97.33 | +3.18% |

| Manitoba | $1,080.00 | $90.00 | 0.00% |

| Nova Scotia | $891.00 | $74.25 | +5.82% |

| New Brunswick | $867.00 | $72.25 | +5.86% |

| Prince Edward Island | $816.00 | $68.00 | +2.51% |

| Quebec | $717.00 | $59.75 | +8.47% |

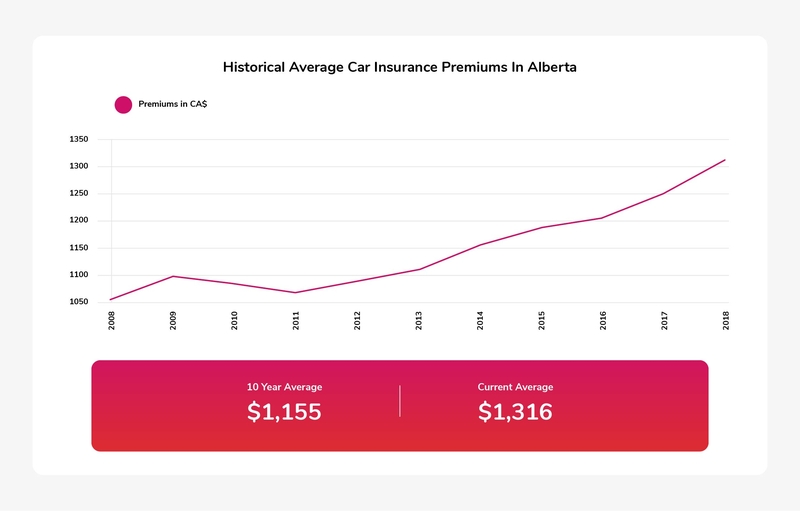

Historical average car insurance premiums in Alberta

Here are the average premiums paid by Albertan drivers for auto insurance, every year since 2008.

Data source: Insurance Bureau of Canada.

| Year | Average Annual Premium | Average Monthly Premium | Year Over Year Change |

|---|---|---|---|

| 2008 | $1,057.00 | $88.08 | -0.30% |

| 2009 | $1,095.00 | $91.25 | +3.60% |

| 2010 | $1,081.00 | $90.08 | -1.28% |

| 2011 | $1,070.00 | $89.17 | -1.02% |

| 2012 | $1,087.00 | $90.58 | +1.59% |

| 2013 | $1,113.00 | $92.75 | +2.39% |

| 2014 | $1,153.00 | $96.08 | +5.59% |

| 2015 | $1,179.00 | $98.25 | +2.25% |

| 2016 | $1,206.00 | $100.50 | +2.29% |

| 2017 | $1,251.00 | $104.25 | +3.73% |

| 2018 | $1,316.00 | $109.67 | +5.20% |

Find the best Alberta car insurance on RATESDOTCA

The cost for auto insurance in Alberta has increased a lot over the last few years, and it continues to rise.

If you automatically renew your auto policy or rely on a traditional brokerage with a limited number of insurance partners, you'll almost certainly see your car insurance premiums go up.

Fortunately, you can beat this trend by comparison shopping for the best available rates. Answer some basic questions about your driving history, and well compare quotes from Canadas best insurance providers.

Our service is free and there are no strings attached. If you don't like what you see, there is no obligation to buy. If you choose to purchase a policy, you'll be connected directly with that insurance provider.