Ontario Car Insurance Calculator

Get an estimate on your car insurance rates instantly.

Compare car insurance quotes from companies across Canada

What is a car insurance calculator?

A car insurance calculator helps you find the best coverage for your car and any optional coverage you may want to add to your policy. It also lets you know about any select discounts you may be eligible to receive. The Rates.ca Car Insurance Coverage Calculator finds the best type of auto insurance coverage for you.

Please note that your auto insurance rate depends on your personal driving profile, which includes:

- Your area of residence

- How far and often you drive

- Your driving record and insurance history

- The insurance company’s claims policy

How to use our car insurance calculator?

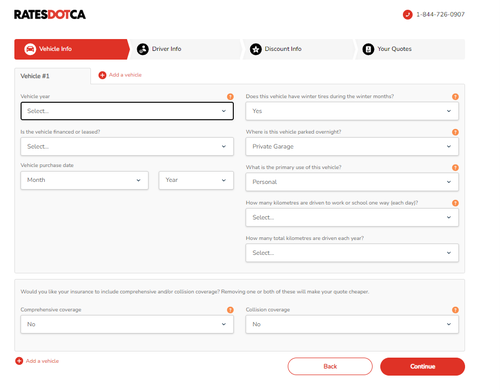

- Tell us about your car

If you want to the best insurance estimates from Rates.ca you can start by providing information about your car. First you input the model of your car, the make and year. Also add the average commute distance you drive.

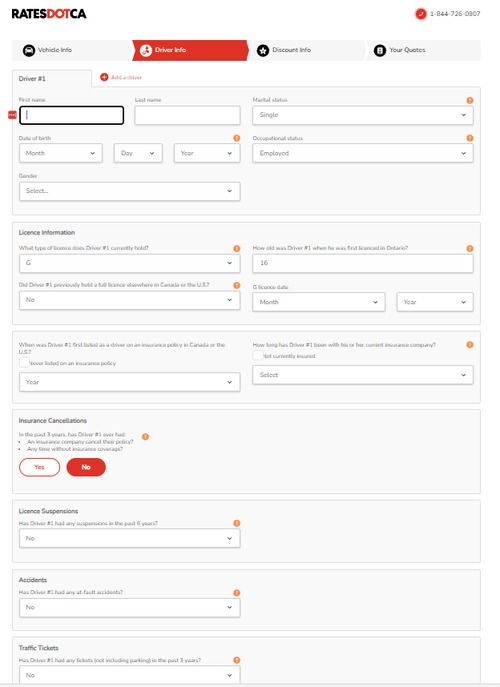

- Who are the drivers?

Then we need to know who the primary drivers of your car are. Are you the sole driver or do others us it as well. Please add their license information.

- Tell us about your driving record

Part of getting your estimate correct is understanding an accurate account of your driving history. We’ll need to know your at-fault accidents, not at-fault accidents, speeding tickets etc.

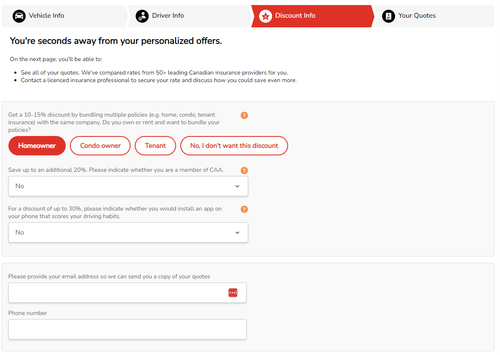

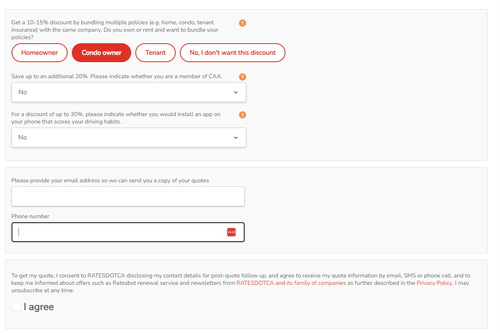

Get your car insurance discounts

The good news is that getting accurate information about you and your driving history helps us provide any eligible car insurance discounts you may qualify for. For example, bundling auto and home insurance can help save you from about 15 to 20 per cent on car insurance. Being part of a union or membership affiliation can also help you save money.

- See your rates Once all that information has been added, you will be able to see your insurance estimates and select the one that suits you best. At Rates.ca we’ll connect you with the car insurance provider and help you secure your quote instantly.

Recent Ontario auto insurance quotes

Recent auto Insurance Quote from Brantford, Ontario

Male, 28 years old

2022 TOYOTA COROLLA SE 4DR

July 25, 2025

Cheapest Quote

$ 404 / month

$ 4,848 / yearAverage Quote

$ 518 / month

$ 6,213 / yearSavings

$ 114 / month

$ 1,365 / year

22 %

Recent auto Insurance Quote from Brantford, Ontario

Male, 44 years old

2019 NISSAN PATHFINDER SL 4DR 4WD

July 25, 2025

Cheapest Quote

$ 167 / month

$ 1,998 / yearAverage Quote

$ 199 / month

$ 2,384 / yearSavings

$ 32 / month

$ 386 / year

16 %

Recent auto Insurance Quote from Brantford, Ontario

Male, 56 years old

2013 CHRYSLER TOWN & COUNTRY TOURING

July 24, 2025

Cheapest Quote

$ 78 / month

$ 938 / yearAverage Quote

$ 182 / month

$ 2,187 / yearSavings

$ 104 / month

$ 1,249 / year

57 %

Auto insurance quotes are compared from CAA, Coachman Insurance Company, Echelon Insurance, Economical Insurance, Gore Mutual, Pafco, Pembridge, SGI, Travelers, Zenith Insurance Company

How to get Ontario car insurance quotes on Rates.ca

Ready to compare quotes and save?

Tell us about your vehicle

Answer a few basic questions about your car, your driving & insurance history.

Compare your quotes

See quotes from 50+ insurance companies side by side.

Choose the right coverage

Find the right protection for your vehicle.

Secure your rate

Connect with the provider and secure your rate.

Customizing your car insurance coverage

Drivers living in Ontario are accustomed to the "no-fault" car insurance system. Simply, if you are involved in an accident, and you are injured or your car is damaged, you will have to deal with your own insurance company, no matter who is at fault for the collision. You do not have to go after the at-fault driver for compensation.

If you are legally responsible for an accident, then you are also legally responsible for all the damages. If you are uninsured, you’ll be charged with driving without insurance, and you may be fined.

Your driver's license can also be suspended until you repay the amount owing. This makes it important to ensure that you have adequate auto insurance coverage that protects you and your loved ones in the event of an accident. Compare the best car insurance quotes instantly.

The right coverage for you

While choosing your car insurance policy, be aware of the different kinds of options. Different providers may offer different you endorsements (add-ons/changes) to meet your needs.

The different types of car insurance coverage you can choose from are:

- Standard coverage: Standard car insurance has comprehensive and collision coverage, but no endorsements.

- Enhanced coverage: Enhanced coverage includes comprehensive, collision insurance and endorsements including loss of use, rental car insurance, and depreciation waiver coverage.

- Custom coverage: When you choose custom coverage, you can easily customize your car insurance policy.

Ontario’s no-fault auto insurance system

If you reside in Ontario, then you should know about the "no-fault" car insurance system, which means that if you are injured or your car suffers from damages, then you will have to deal with your own insurance company, no matter who is at fault for the collision. You do not have to go after the at-fault driver for compensation.

If you are legally responsible for an accident, then you are also legally responsible for all the damages. If you are uninsured, you’ll be charged with driving without insurance, and you may be fined.

Your driver's license can also be suspended until you repay the amount owing. This makes it important to ensure that you have adequate auto insurance coverage that protects you and your loved ones in the event of an accident. Compare the best car insurance quotes instantly.

Car insurance discounts available in Ontario

Drivers in Ontario have a variety of options to help reduce their car insurance. One of the first and best ways is to visit Rates.ca and compare rates from the top providers in your area. It’s simple to use, provides quick estimates and is free.

Beyond that there are other ways, which include:

- Bundling – By bundling other insurance products with your auto insurance (like home), you are able to receive discounts of between 15 and 20 per cent. Your insurance company appreciates the business and passes administrative savings to you.

- Winter Tires – Although Ontario has not mandated winter tires as a legal requirement (the way some provinces have), insurance companies will offer a discount for using them. They reduce risk in winter weather and can help you avoid accidents.

- Professional Group/Alumni Associations – Are you a member of a union? Did you graduate from university or college, are you a senior? Many car insurance companies in Ontario offer discounts to members of such associations or groups. Talk to your provider to see if you are eligible.

- Usage-based insurance – Participating in insurance programs that are usage-based or use telematics to monitor your driving can help you save money. Good habits are rewarded and typically offer a 10 per cent discounts when you sign up, and as much as 30 per cent at renewal time.

- Deductibles – Increasing your deductible takes risk away from your Ontario auto insurance provider. That risk reduction can help you save money.

- Drive safely – A clean driving record can help you keep rates low.

- Security – Installation of an alarm of anti-theft device will reduce the risk of your car being stole and may save you money.

- Pay upfront – Auto insurance companies in Ontario give discounts to clients that pay in full rather than in monthly or quarterly installments. The reduction is administrative costs is passed onto consumers.

Customizing your car insurance coverage

Apart from securing the coverage you require, it is always up to you to decide what additional coverage you want to add to your policy. The car insurance calculator can show you rates for your chosen coverage, helping you get the custom coverage you desire!

You can change your car insurance coverage for a variety of reasons, such as:

- When you move

- When you get married

- When you purchase a new vehicle

- When you add a new driver (spouse, G1/G2 driver)

- When you remove a driver

- When you retire

- When you change your job