When it comes to auto insurance, customer satisfaction is more than just a buzzword — it's the foundation of success for insurers. The RATESDOTCA Annual Best Auto Insurance Study offers a comprehensive look at what matters most to policyholders by ranking insurers across several key performance categories. These categories represent a critical component of the customer experience and highlight the features that set the top insurers apart.

Here are the best auto insurance companies, according to consumers.

Annual Best Auto Insurance Study

- Winners of the Best Home and Auto Insurance Survey

- Insights from the RATESDOTCA Annual Best Auto Insurance Study

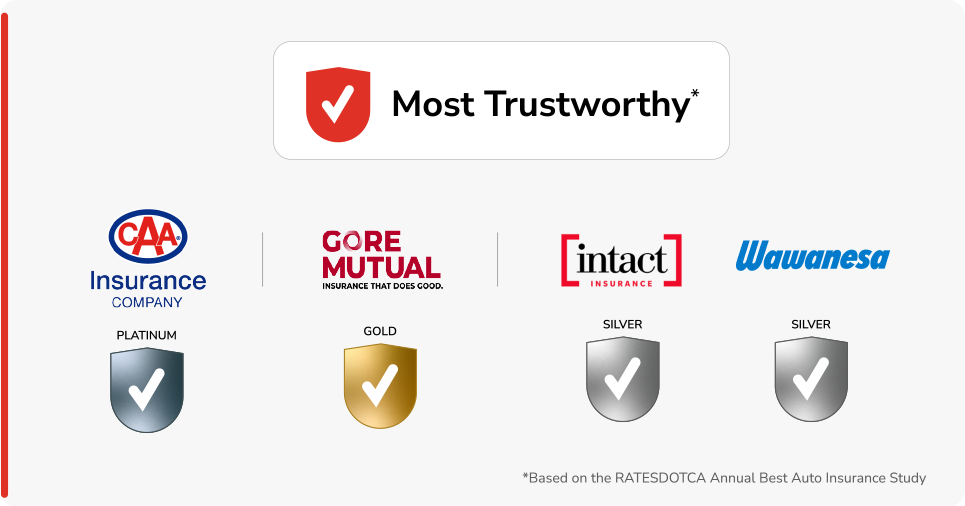

- Most Trustworthy

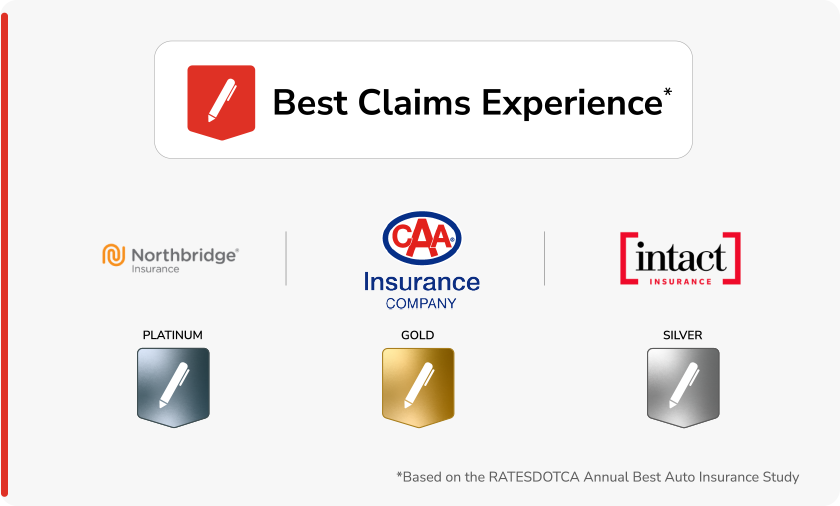

- Best Claims Experience

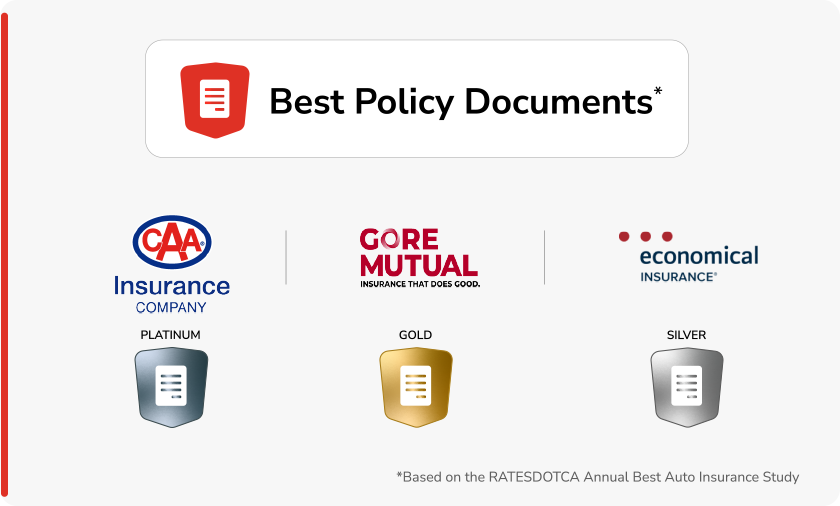

- Best Policy Documents

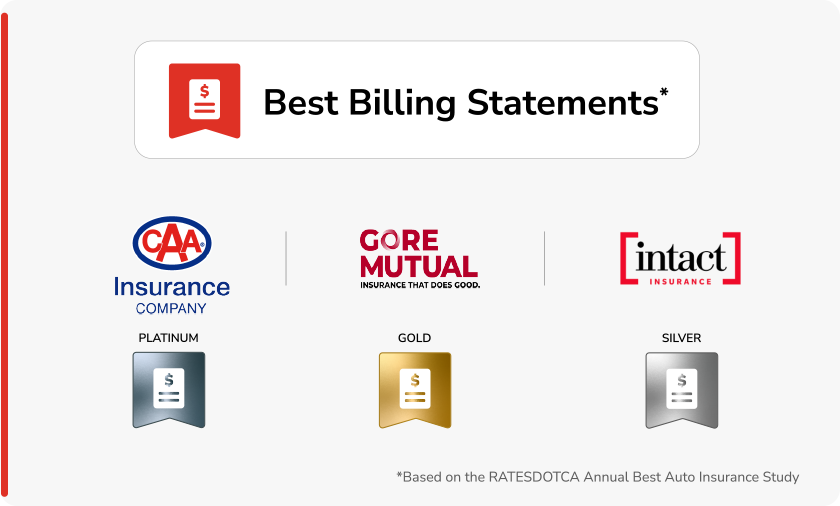

- Best Billing Statements

- Ensuring a smooth and stress-free claims experience

- Top insurance companies embrace usage-based insurance

- Methodology

Best Overall Insurance Company

These category winners showcase what’s working in Canada’s auto insurance market and set the bar for others to follow. Trustworthy brands like CAA dominate multiple areas because they understand what their customers want and execute on those expectations. Meanwhile, insurers like Northbridge lead in claims handling, proving that targeted excellence in specific areas can differentiate a brand.

Rates.ca Annual Best Auto Insurance Study 2025

Awards

CAA Insurance: WINNER

About

CAA Insurance is the best overall insurance company, say Canadian drivers surveyed by Rates.ca. It excels in trustworthiness, policy documents, and ease of claims filing.

Drivers see CAA as offering the lowest rates and best value for money. Customers also like its suite of innovative products and for having coverage that fits their needs.

It's the second year in a row that CAA has earned platinum distinctions.

Pros

- Rated highest in overall satisfaction by current customers.

- Most affordable premiums, according to customers.

- Coverage provides good value in return for premiums, customers also say.

- Rated highly for its innovative products and coverage options.

- Market leader in issuing policy documents and billing statements that are easy to understand.

Awards

Gore Mutual

About

Gore Mutual has emerged as one of the study's best rated insurance companies, achieving some of the highest satisfaction ratings among Canadians surveyed.

Gore scores highly in all areas of service. Customers say that policy documents and billing statements are clear and easy to understand, and that the website is user-friendly.

Gore policyholders are more likely to file a claim online than clients of other insurance companies.

Pros

- Won Gold in trustworthiness, best policy documents, and best billing statements

- Ranks highly for innovation; customers rate Gore's website positively, and most file claims by email

- Gore excels in all areas of service and are seen to offer products that meets customers' needs

- Scores highly for quality of policy documents

Awards

Intact Insurance

About

Intact Insurance rates consistently well in all categories, placing third overall. They also placed third in categories of Most Trustworthy, Best Auto Claims Experience, and Best Billing Documents.

Customers with Intact are most likely to contact the insurance broker first to open a claim and were much more likely to use Intact's online app compared to other carriers. They were also more likely to receive policy documents electronically.

Pros

- Customers are likely to say that Intact is a trustworthy brand.

- Intact scores high for its claims service, with more customers likely to file a claim via online app than other carriers.

- Intact customers are also more likely to receive status updates on their claims by telephone; in general, customers with Intact had higher than average contact with the insurer than other companies.

Despite increasing premiums and industry challenges, consumers still trust their insurers

By Igal Mayer, CEO RATESDOTCA

The auto insurance industry has faced numerous challenges in recent years. Inflationary pricing, increasing repair costs and auto theft are all pushing claims costs higher, meaning higher premium prices for many consumers that are already being squeezed by the rising cost of living. Auto insurance premiums in Canada have risen more than 12% on average over the past year , with Ontario and Alberta posting the largest increases amongst provinces with private auto insurance markets at approximately 13% and 12%, respectively. Premium increases are likely to continue throughout 2025.

It is against this backdrop that we ran the RATESDOTCA Annual Best Auto Insurance Study with Pollara Strategic Insights, the largest survey of its kind in Canada, asking consumers in Ontario and Alberta to share their perceptions of and experiences with their insurance companies (identified by policy number). What we found may surprise some - overall satisfaction with auto insurance companies is 82%, improving by 2 percentage points YoY in 2024, with 76% reporting that they believe their insurance company is a trustworthy brand.

More than ever, maintaining consumer trust is imperative for insurance companies. The results of the study show that, on balance, the auto insurance industry is doing a good job of maintaining strong relationships with customers during very difficult times. The study also provided key insights into digital interactions, consumer communications preferences and usage-based insurance uptake.

The insurance industry lags behind comparative industries in digital interactions with consumers. When 94% of Canadians are going online for personal use and 82% of those users conducting banking online, the number of survey respondents overall reporting using digital portals to file claims is strikingly low, at 3% using online apps and 2% using digital portals. While many in the insurance industry would justifiably claim this is due to customer preference – after all there is a comfort in speaking with a live representative following what is often a very emotional event - it may also be because as a whole the industry has not invested in building digital tools that work well enough for the consumer to trust them when filing a claim.

While the majority of survey respondents overall preferred phone communications with their insurance company, the study shows an age divide between those that prefer a phone call to those that prefer digital communication. Older cohorts prefer phone calls, while younger cohorts show a preference for digital communications, such as apps and secure websites. While phone calls may be the primary preference for all age groups now, is it really so difficult to imagine a future in which this is not the case? We only have to look to the U.S., where overall customer satisfaction with home and auto insurance digital claims experience rose 17 points in 2024, and customer satisfaction scores were highest when insurer mobile apps were used to report a claim, submit photos and/or videos and receive updates from the insurer, according to J.D. Power.

Regardless, our study illustrates the importance of communicating through a customer’s preferred channel. Overall satisfaction with insurance companies is 85% amongst those who communicated using their channel of choice vs. 70% for those who did not. The study also showed that consumers value 1:1 communication. Those who communicated with a live person are slightly more satisfied with their insurance company overall than those who communicated by messages via app/website or email. A multi-channel strategy is the best way to keep consumers satisfied and loyal to their insurance company.

We also saw that those with Usage Based Insurance (UBI) policies are more satisfied with their insurance companies. Those that have UBI policies report higher levels of satisfaction with their insurance companies (89% versus 81%) of those without UBI policies. We also found that although 60% of customers say they are at least somewhat familiar with UBI, very few currently have a UBI policy, and only 28% are likely to consider it for their next policy with a discount of at least 5%. Though younger cohorts are more familiar with UBI, older UBI policyholders are more likely to continue using a UBI policy.

While UBI or telematics policies can help consumers save money and insurers analyze and personalize risk more efficiently, perhaps one of the biggest benefits of widespread use of UBI and telematics is increased road safety. Safer roads are of growing concern in both rural areas and busy urban centers such as Toronto, with dozens of deaths and hundreds of injuries recorded each year. Broader promotion and uptake of UBI not only benefits insurers and consumers, it can also aid in easing some of Canada’s intensifying traffic woes.

The new year will bring with it new challenges for the auto insurance industry and consumers alike. Insurance companies have earned the trust of their consumers, and now they must continue to work to keep it.

Most Trustworthy

Trust is the bedrock of any successful relationship, and insurance is no exception. According to the study, a “trustworthy brand” emerged as the single most important driver of customer satisfaction.

But what makes a brand trustworthy? For customers, it’s about transparency, consistency, and a proven track record. Insurers that clearly communicate their policies, avoid hidden fees, and provide reliable service earn higher marks in this area.

A trustworthy brand isn’t just about what you promise—it’s about what you deliver. The perception of trust directly impacts whether a customer feels secure sticking with their chosen provider or deciding to shop around.

Category winners like CAA Insurance Company, which took the #1 spot for trustworthiness, earned this accolade by delivering a dependable and value-driven experience.

CAA Insurance’s commitment to “doing the right thing” is foundational to their approach.

"At CAA Insurance, we are committed to finding innovative and creative solutions to protect our clients effectively. As one of the most trusted brands in Canada, our business decisions are always made with the best interests of our consumers and policyholders in mind," says Matthew Turack, Group President CAA Insurance.

Best Claims Experience

Filing a claim can be one of the most stressful moments for any policyholder. This is when customers rely most on their insurer to guide them through a process that can sometimes feel overwhelming.

Among those who contacted their insurer, 92% preferred using the telephone, while 88% preferred secure messaging channels via website or app.

The top performers in the "ease of filing a claim" category excel in making this process as smooth and pain-free as possible. The survey shows that the best claims experience is judged on several critical factors:

- Ease of reporting a claim: Customers want a process that's straightforward and accessible, regardless of the situation.

- Clear communication of the claims process: Insurers that outline each step upfront reduce customer frustration and uncertainty.

- Proactive updates: Policyholders value being kept in the loop, whether through phone calls, emails, or app notifications.

- Knowledgeable representatives: Customers expect claim handlers to have the answers, resolve issues promptly, and guide them with empathy.

Gore Mutual, for instance, has seen a significant boost in its claim’s satisfaction through operational improvements.

Laura Homanchuk, director of personal lines P&L performance at Gore Mutual Insurance shared, “we now have the capability to bring in a significant amount of data in a way that allows us to make actionable changes.”

This means faster claims processes, more accurate premium management, and stronger relationships with our customers.

Best Policy Documents

For many, the fine print in an insurance policy can feel like deciphering a foreign language. But the best insurers flip the script, designing policy documents that are as clear as they are comprehensive.

The “Best Policy Documents” category evaluates insurers based on factors like:

- Clarity of coverage: Customers need to quickly understand what is and isn’t included in their policy. This transparency reduces stress and builds trust.

- Contact information: Knowing who to call or where to go next—whether it’s for a claim, policy change, or general inquiry—is essential.

- Billing and payment details: Accurate, simplified information about premiums and payment schedules makes customers feel more in control.

Outstanding policy documents aren’t just about checking a box—they empower policyholders to make informed decisions without the headaches of ambiguity. Winning insurers understand that clarity equals confidence, and it’s reflected in their scores.

Best Billing Statements

While it may not seem as dramatic as claims or trustworthiness, billing is a crucial touchpoint for insurers. It’s often the only time policyholders actively interact with their insurer outside of filing a claim. The “Best Billing Statements” category measures how well insurers make this routine — but important — process transparent and manageable.

Flexible payment options, clear statements, and timely notifications strengthen an insurer’s reputation for professionalism and customer care.

Digital transformation is a key enabler of success for CAA Insurance in this area — policyholders can now access billing information and options in the format they prefer, whether online, over the phone, or in person.

Gore Mutual’s commitment to digital communication also resonated with its policyholders, who reported a preference for managing information electronically via email or portals.

There's a lot you can't control in auto insurance. One thing you can is your claims process

A smooth and stress-free insurance claims process can make all the difference in retaining customers – especially as the auto insurance industry navigates challenges like the auto theft crisis, increasing cost of repairs, and inflation, leading premiums to rise significantly in recent years.

Key steps like easy reporting, maintaining quick and clear communication, and expediting claim payouts can offer significant peace of mind to consumers. This is particularly important given that the MNP Consumer Debt Index shows 50% of Canadians feel they are $200 or less away from being unable to cover all their monthly bills and debt payments.

According to the RATESDOTCA Annual Best Auto Insurance Study, overall satisfaction with insurance companies is 85% amongst those who communicated using their channel of choice vs. 70% for those who did not.

The study results support the importance of 1:1 live communication and that a multi-channel strategy is the best way to keep consumers satisfied and loyal to their insurance company.

In addition to maintaining customer satisfaction, having an efficient claims process in place helps insurers manage costs by reducing administrative expenses and streamlining claim resolutions to assist more customers at once.

What makes a successful insurance claims experience?

A successful insurance claims experience is characterized by straightforward claim submission, timely resolution, and exceptional customer service. Customers value a process that is straightforward and stress-free, with clear communication and support at every step.

In the Annual Best Auto Insurance Study, Northbridge Insurance led the rankings on all aspects of claims service and placed first in the Best Claims Experience category. Here’s how they excel.

Quick claims handling

Respondents note in the Annual Best Auto Insurance Study that filing a claim with Northbridge is simple and straightforward, with many choosing to call in their First Notice of Loss (FNOL).

This ease of making claims helps Northbridge stand out for quickly resolving claims, with many customers saying their claims were handled quickly.

“Our first notice of loss team answer calls within 20 seconds of the first ring,” says Jon Medel, vice president of claims & underwriting experience and quality at Northbridge Insurance, adding that 94% of the time, adjusters contact customers within three business hours of the initial report.

Using technology to speed up the process

Technology plays a role in streamlining the process for reporting and resolving a claim. The study’s second ranked overall insurance company, Gore Mutual Insurance, uses advanced data systems like Business Intelligence (BI) and analytics platforms to expediate their claims management process and get agile in that process.

"We now have the capability to bring in a significant amount of data in a way that we can make actionable changes to processes,” says Laura Homanchuk, director of personal lines P&L performance at Gore Mutual Insurance explains.

These changes help ensure proactive communication, reduce waiting times for updates, and make the overall experience more efficient.

Northbridge has also introduced the “Express Claim” program, an online appraisal tool for auto insurance claims to “dramatically” reduce the time and effort involved in the claims process.

“With a half-day turnaround on appraisals, losses can be processed quickly, and you can receive your payment sooner. The appraisal process is completely digital, so it makes things easier for everyone involved,” Medel explains.

Once a claim is reported, the insurance company provides immediate help, such as arranging a tow truck or offering a rental car.

Customer service representatives who stand out

The expertise and responsiveness of customer service representatives are key to a smooth claims process. They can provide clear guidance, quickly address concerns, and keep customers informed, enhancing overall customer satisfaction.

According to the Annual Best Auto Insurance Study, customers say that Northbridge representatives were knowledgeable and easy to reach.

Medel highlights Northbridge’s approach, stating that, "our dedicated team of claims adjusters are committed to supporting each and every customer through challenging times with friendly, professional, and helpful claims service. Providing our customers with clarity as to what to expect, including timelines and delivering on our commitments, are key ingredients to our success.”

Similarly, Gore Mutual places a strong emphasis on customer service. Homanchuk says that the company has worked to improve the quality of those who work on their teams so that their customers can get the best service.

Communicating on the customer’s terms

By equipping brokers with advanced data insights and tailored information, Gore Mutual makes sure each customer receives fast, personalized guidance in multiple formats.

Across insurance companies in the RATESDOTCA Annual Best Auto Insurance Study, only 3% of claimants report receiving updates from their insurer through an online app and 2% through a secure website.

In overall communications with insurance companies, the study shows higher preference for digital forms of communication in the younger demographic, pointing to a potential future in which digital communications may play a more important role.

“We know that the changes in consumer behavior are more driven towards technology, so consumers expect to be able to reach either their broker partners or their insurers very quickly,” Homanchuk explains. “So having legacy systems or even legacy processes, those won’t support the speed to response expected in today’s market. Carriers needs to invest in updated technology to meet the service level agreements (SLAs) that that consumers are expecting of us."

Northbridge also collects customer feedback to continuously improve their services.

Medel states, "we continuously refine our claims processes by asking for feedback on completed claims. While we celebrate the positive feedback our customers often provide, we also embrace feedback outlining how we can improve. This drives our continuous improvement model and ensures we stay at the front of the pack.”

Navigating today’s auto insurance landscape requires focusing on what customers need through the collection of feedback, direct communication and trends.

A smooth claims process, with clear communication, quick resolutions, and caring service, can greatly reduce customer stress. These practices build trust and loyalty, making sure that customers feel valued and supported.

Top insurance companies embrace usage-based insurance

As auto insurance premiums increase, more Canadian insurers are innovating products and special coverages to help mitigate the rising cost of insurance to consumers.

The RATESDOTCA Annual Best Auto Insurance Study identified one underrepresented area to deliver more control over pricing to policyholders while offering rich customer data to insurers: usage-based insurance (UBI).

UBI and telematics programs measure a customer’s driving habits, or the kilometres driven, through a phone app or a telematics device in their car and sets discounts accordingly.

Low uptake in UBI programs, but higher satisfaction

The number of telematics policies in North America is forecasted to hit 26.3 million policies by 2028, up from 17.9 policies at the end of 2023, according to the market research firm Market and Research.

However, Canada is slightly behind trend: The study found that while 60% of customers say they are at least somewhat familiar with UBI, very few currently have a UBI policy, and only 28% are likely to consider it for their next policy with a discount of at least 5%.

However, those that have UBI policies report higher levels of satisfaction with their insurance companies (89% versus 81%) of those without UBI policies.

Almost 20 years of telematics in Canada

Since Aviva Canada launched Autograph in 2005, becoming the very first UBI program in Canada to track and reward driving habits of consumers, the field has only grown.

Desjardin Insurance debuted its Ajusto mobile app, the first of its kind in Canada, in 2015; soon followed by CAA Insurance Company’s MyPace in 2018 —the first pay-as-you-go auto insurance program of its kind in Canada designed for people who drive less than 12,000 kilometers per year.

CAA MyPace bills drivers by 1000-kilometre-increments, measured with a telematics device installed in their car and a mobile app.

In the back half of 2024, Gore Mutual Insurance Company launched Drive Good, a “pay how you drive” program which rewards drivers on their driving behaviours with discounts of up to 20% and gift cards to popular retailers and restaurants in Ontario.

“It is becoming a pretty standard offering that most carriers do offer,” says Laura Homanchuk, the director of personal lines P&L performance for Gore Mutual Insurance Company. “Gore wanted to ensure we had a product option for technology focused consumers that wanted to improve their driving behaviour and who wanted to have more control of their rates.”

The one-size-fits-all solution isn't working

This year, both CAA Insurance Company and Gore Mutual ranked as the top two best overall insurance companies in the study. Both companies also ranked highest in offering products that met customer’s needs.

“Our research shows that a one-size-fits-all insurance solution for our customers isn't working. What they want are products like pay-as-you-go,” says Matthew Turack, Group President of CAA Insurance.

Not only do these programs reward good drivers through premium discounts (and, in the case of Gore, gift cards), they’re also able to deliver personalized feedback to their customers and more by analyzing the data that the app collects.

“Gore is on our next horizon journey and our focus has been on becoming a data-driven insurer,” says Homanchuk. “UBI provides the insurer with a lot of data allowing us to get to know our clients better. With this information, where privacy and data protection are integral to the process, we're able to better manage premiums, product offerings, and even potentially how we market to consumers. This is all possible because the data allows us to measure who they are at a functional driver level.”

Better data + better drivers = safer streets

The results benefit drivers as well as insurers. A recent poll of telematics customers by Desjardin Group found that 50% of drivers reported that they became safer drivers after installing a telematics device, leading to an average 12% discount from their standard rate.

The results mirror those experienced by CAA MyPace’s pay-as-you-go customers.

“Our model predicted that people who drive less get into fewer collisions, and our data shows that those predictions were accurate,” says Turack. “On average, our pay-as-you-go policyholders save 50 per cent on auto insurance costs over a traditional policy.”

No matter how you dice it, fewer collisions – whether through less driving or better driving behaviour – results in lower premiums for drivers and safer roads.

“The benefits of UBI are not just premium-based discounts; the program allows us to give this data back to the consumer so that they can improve their driving behaviour, which supports driving improvement our roads,” adds Homanchuk. “We do not hold consumer data for any reason.”

How we came up with the RATESDOTCA Annual Best Auto Insurance Study

RATESDOTCA Annual Best Auto Insurance Study

The RATESDOTCA Annual Best Auto Insurance Study is a survey of customers from nine insurance brokerages in Ontario and Alberta – the two largest markets for private auto insurance in Canada.

Conducted by Pollara Strategic Insights, the survey was completed from September 16 to October 8, 2024, using an online survey methodology, surveying a total of n=12,600 auto insurance customers who take part in decisions regarding insurance for their household and is the largest survey of auto insurance customers in Canada.

This is a survey dedicated solely to satisfaction with auto insurance, with questions focused on the entirety of experience with one insurance company to understand and measure what drives customer satisfaction.

Underwriting carriers were identified by policy, not customer recall, ensuring accuracy in carrier identification. The study includes brands which are not typically reported in surveys of the general population of insurance consumers due to their relatively small market share.

About Pollara Strategic Insights

Founded in 1985, Pollara Strategic Insights is a Canadian public opinion and market research firm that provides custom quantitative and qualitative research as well as a suite of proprietary research models and syndicated studies. Pollara Strategic Insights is a founding, accredited Gold Seal member of the Canadian Research Insights Council (CRIC).

They are in full compliance with the CRIC Canadian Code of Market, Opinion, and Social Research and Data Analytics, the CRIC Public Opinion Research Standards and Disclosure Requirements, the CRIC Pledge to Canadians and ISO 20252:2019.

Methodology

For media inquiries, please contact:

Laura Fitch

Director of Editorial and PR

RATESDOTCA

For inquiries about methodology, please contact:

Craig Worden

President & Chief Innovation Officer

Pollara Strategic Insights