If you are not redirected within 30 seconds, please click here to continue.

Samedi: 10h – 16h HAE

If you are not redirected within 30 seconds, please click here to continue.

If you are not redirected within 30 seconds, please click here to continue.

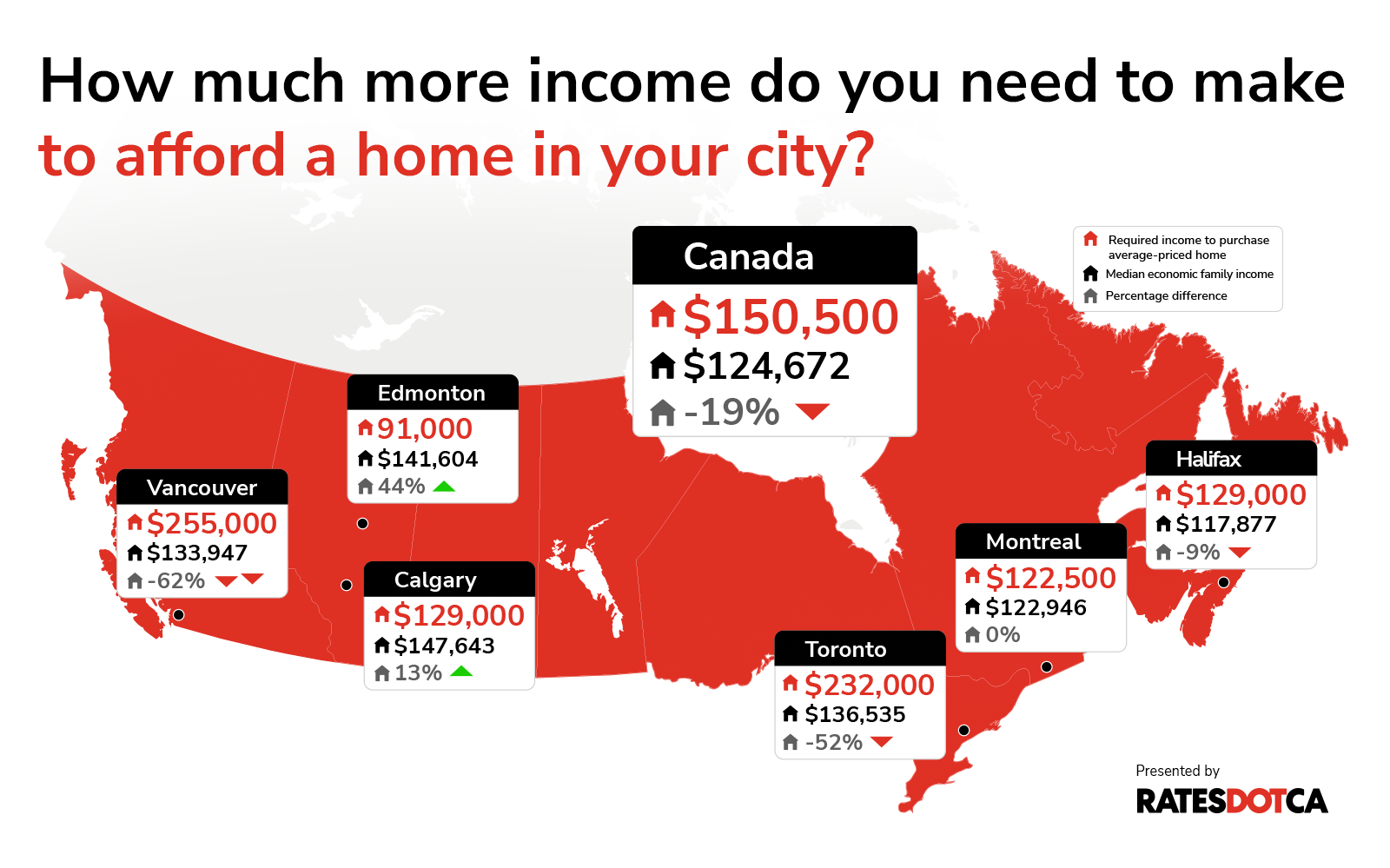

How much more money do you need to make to buy a home in Canada?

Table of Contents

KEY FINDINGS

- Canadians in major cities like Vancouver and Toronto face large affordability gaps, with families in Vancouver short by $121,053 and Toronto by $95,465 to afford an average-priced home.

- Housing in Alberta remains more accessible, with Calgary offering an $18,643 income surplus and Edmonton leading with a $50,604 surplus.

- The composite benchmark home price in Vancouver and Toronto has exceeded $1 million, creating significant barriers for potential homeowners.

- Condos provide a more affordable option, but cities like Toronto still show an income shortfall of $21,465, while Edmonton condos offer an impressive surplus of $91,904.

- Rising housing costs have driven migration trends, with Toronto losing 100,000 residents and Vancouver and Montreal experiencing similar declines as residents move to more affordable areas.

This article originally included calculations for the average home price in Kelowna which were based on the average single-family home price, not the composite benchmark average home price. As the composite benchmark home price is not available for Kelowna, we have removed the calculations. We sincerely regret the error.

For many Canadians, owning a home has long symbolized stability and achievement. But as housing costs rise and wages lag, families in some regions face income shortfalls of tens of thousands of dollars.

When it comes to how much an average income* can afford, there’s a big difference between thriving areas like certain cities in Alberta and struggling ones like southern Ontario.

In Toronto, you now need a yearly income of $232,000 to afford a $1,061,900 home (the average price of a home in the city). However, the typical Toronto family only qualifies for a maximum mortgage of $574,000. This leaves most families with scrambling to make up an income shortfall of up to $100,000 if they want to buy a house.

The $1 million barrier - homeownership’s new frontier

Toronto and Vancouver are at the center of Canada’s housing crisis. The composite benchmark home price in these cities has surpassed $1 million.

- Toronto: $1,061,900

- Vancouver: $1,171,500

According to Leon Turkin, a financial expert and mortgage broker at Turkin Mortgage, there’s less demand for homes due to the higher interest rates we’ve seen since the pandemic.

“However, they've also made mortgage payments cost so much more.” he says.

For the homes in our calculations, buyers can get insured mortgage rates with a minimum down payment if the home costs $1.5 million or less. More details below.

Related: For many Canadian families, the great wealth transfer can’t come soon enough

How much you make vs. How much you need to make to afford a home in these cities

Whether you can afford a home or not depends less on your income and more on where you live. To illustrate, this is a city-by-city comparison showing how much mortgage the median economic family income can afford compared to the income needed to afford a mortgage on an average-priced home.

National average

- Average home price: $676,640

- Required income: $150,500

- Median family income: $124,672

- Difference: -$25,828

On average, Canadians face a $25,828 shortfall between the income they earn and what’s required to afford a typical home.

Vancouver

- Average home price: $1,171,500

- Required income: $255,000

- Median economic family income: $133,947

- Difference: -$121,053

Vancouver leads first place in income shortfalls, with households trailing by $121,053 on average. Restrictive zoning laws, high demand and limited construction worsen the situation. As a result, families have few options: They can either rent or relocate to other regions.

Toronto

- Average home price: $1,061,900

- Required income: $232,000

- Median family income: $136,535

- Difference: -$95,465

Toronto prices have consistently outpaced incomes over the years. The average house price has risen by 205% since 1994, compared to just a 32% increase in household incomes.

This has many Torontonians buying homes later in life or seeking other living arrangements.

“There might increasingly be a trend away from single-generational households and into more multi-generational living or further into the rental market,” says Turkin.

Halifax

- Average home price: $533,500

- Required income: $129,000

- Median family income: $117,877

- Difference: -$11,123

Halifax has a small gap of $11,123. Halifax faces increasing pressure from migration and limited new development. Though its gap is small, growing demand is stretching many household budgets.

Montreal

- Average home price: $542,900

- Required income: $122,500

- Median family income: $122,946

- Difference: +$446

Montreal’s housing market sits on a tightrope, with household earnings barely covering housing requirements. The city is one of a few of Canada’s major hubs where the median family income surpasses the income required to buy a home, but even a small, unexpected expense could push some families to their breaking point.

Calgary

- Average home price: $572,400

- Required income: $129,000

- Median family income: $147,643

- Difference: +$18,643

Calgary provides a rare surplus of income over housing costs. This comes from land availability and concerted efforts to diversify the city’s economy beyond oil and gas.

Kevin Wong, a realtor and mortgage agent at Swivel Mortgage Group, explains that cities like Calgary, which were historically more affordable, are now experiencing a surge in demand that might drive prices up over time.

“Calgary is attracting strong interprovincial migration and investors looking for alternative housing options to Toronto and Vancouver,” he says. “With rental supply being tight in these smaller cities, more people may turn to homeownership instead, increasing the demand for housing even further,” he adds.

Edmonton

- Average home price: $397,400

- Required income: $91,000

- Median family income: $141,604

- Difference: +$50,604

Edmonton, with the biggest income surplus, attracts first-time buyers looking for stability. This is because the city is bolstered by consistent inventory and lower-than-average construction costs.

Learn more: Will the Bank of Canada’s jumbo cut add fuel to the warming house market?

How we calculated qualifying incomes

We started with the average median economic family income for each city, using 2022 data from Statistics Canada and adjusting for annual wage growth percentages based on estimates from Normandin-Beaudry. This gives us an updated profile of today’s Canadian homebuyer.

We based home prices on the composite benchmark home prices listed in the MLS® Home Price Index as of December, 2024.

We followed insured mortgage guidelines, including a minimum down payment of 5% on the first $500,000 and 10% on amounts above that.

Both consider a qualifying 6.7% stress test rate. For condos, property taxes, heating, and condo fees are also included. Assumptions consider a credit score of 680+, no debts, and 25- or 30-year mortgage terms.

Calculations are also based on a qualifying stress test rate of 6.7%, assuming an average five-year fixed mortgage rate of 4.7%, plus an additional 2% for the qualifying rate. For condos, property taxes, heating, and condo fees are factored in. Other factors include a credit score of 680+, no debts, and a 25-year mortgage term.

Curious about what you qualify for? Try the mortgage stress test calculator and see how your numbers compare.

Condos and co-buying as alternatives

With single-family homes out of reach, many Canadians are turning to condos and shared ownership structures.

“Buyers are getting creative,” says Wong. “More people are choosing to co-purchase homes with family or friends or prioritizing properties with rental income potential to offset mortgage costs.”

The numbers on condos:

Though condos provide a stepping stone for some, family budgets are still being squeezed by “rising maintenance fees, property taxes, and insurance costs continue to squeeze family budgets” says Turkin.

Additionally, a significant challenge for families is that many condos are one-bedrooms or studios, which may not suit the needs of a household.

| City | Average condo price | Income gap |

|---|---|---|

| Vancouver | $768,200 | -$48,053 |

| Toronto | $662,200 | -$21,465 |

| National Avg | $520,100 | -$828 |

| Halifax | $466,000 | +$4,877 |

| Montreal | $420,600 | +$20,446 |

| Calgary | $344,900 | +$63,143 |

| Edmonton | $197,800 | +$91,904 |

According to Wong, between 2020 and 2022, Toronto’s pre-construction condo prices hit $1,689 per square foot at their peak between the years of 2020 and 2022, primarily due local investor demand. While prices are now cooling, investors remain a big influence on trends.

The urban exodus: Are smaller cities the answer to your homeownership dreams?

Provincially, Alberta stands out as a beacon of cost-effective housing. But housing costs are rising in mid-sized cities like Halifax and Calgary too.

“In Halifax, populations have risen with the arrival of remote workers,” says Turkin. “Home prices are rising at unprecedented rates due to demand and are fast becoming luxuries, thanks to the migration of Ontarians and British Columbians.”

Turkin questions whether earnings will keep up with the rapid rise in housing prices. If not, these cities could face a housing crunch similar to larger metropolitan areas.

What’s driving home prices higher today?

Several key factors continue to fuel rising costs in the housing market:

- Development delays: Long approval times, municipal fees, and rising material costs (like steel and concrete) are slowing construction. It’s also adding tens of thousands to home prices. Labor shortages make it worse.

- Economic pressures: Inflation and U.S. tariffs on Canadian exports are raising costs for builders and buyers. Higher mortgage renewal rates are also straining families.

Turkin notes, “Over the years, prices for material such as lumber, steel, and concrete took a hike because of global supply dislocation effects and the consequences increased costs for homebuilders.”

Related: Ask the expert: Steve Garganis on how the US impacts Canadian mortgage rates

High housing costs are keeping new talent away from promising markets

Many are leaving the expensive cities entirely. Even a 1% increase in house prices in a destination city can lead to a more than 1% decline in the number of people moving there.

This trend is worrying because it makes it harder for people to find good jobs and learn new skills, which are important for the economy.

Young workers, especially, can’t afford to live in cities where they could gain experience. This leads to fewer opportunities and slower growth in Canada’s biggest cities.

Cities like Toronto and Vancouver have seen thousands of residents relocate to smaller communities where housing is more affordable. Between 2021 and 2022, for instance, Toronto lost nearly 100,000 residents to other regions. Montreal lost 35,000 residents, and 14,000 left Vancouver.

The future of Canadian home ownership: Challenges and opportunities ahead

Cities like Toronto and Vancouver continue to grapple with affordability challenges, while Calgary and Edmonton maintain relatively accessibility for homebuyers. This raises critical questions about the future of homeownership and where Canadians can realistically plant roots.

The ongoing tension between demand and supply, urban density, and rising costs will likely shape the market for years to come. Aspirations of homeownership are shifting, no longer tied solely to location but to broader considerations like lifestyle, stability, and long-term potential.

For many, the question is no longer just "Can I afford a home?" but "Is this the right place to build my future?"

What unfolds in the coming years will determine if housing remains a foundation of opportunity for Canadians or becomes an increasingly exclusive privilege.

Find a mortgage broker

Engaging a mortgage broker before renewing can help you make a better decision. Mortgage brokers are an excellent source of information for deals specific to your area, contract terms, and their services require no out-of-pocket fees if you are well qualified.

Here at Rates.ca, we compare rates from the best Canadian mortgage brokers, major banks and dozens of smaller competitors.

Get money-saving tips in your inbox.

Stay on top of personal finance tips from our money experts!