Alberta Car Insurance Calculator

Get an estimate on your car insurance rates instantly.

Compare Alberta insurance quotes from top providers

What is a car insurance calculator?

Your monthly car insurance bill is a recurring expense that deserves as much attention as gas prices and car loan interest rates.

However, it’s hard to estimate a car insurance premium on your own because insurers don’t offer flat-rate coverage.

Car insurance calculators can help you estimate your insurance premium (the amount you pay for coverage), so that you:

- Have a clear picture of what the market can offer and,

- Don't pick an insurer that overcharges you.

RATESDOTCA’s car insurance calculator shows quotes from 50+ car insurance providers, so you can see which offers your lowest and highest quotes.

Our Alberta car insurance calculator also helps you find savings as you can apply discounts to your quote.

The car insurance calculator will ask for specifics about insurance rating factors to generate your estimate. These include:

- Your address

- How far and often you drive

- Your driving record and insurance history

- The insurance company’s claims policy

- Whether someone else in your household plans on driving the car

How to use our Alberta car insurance calculator

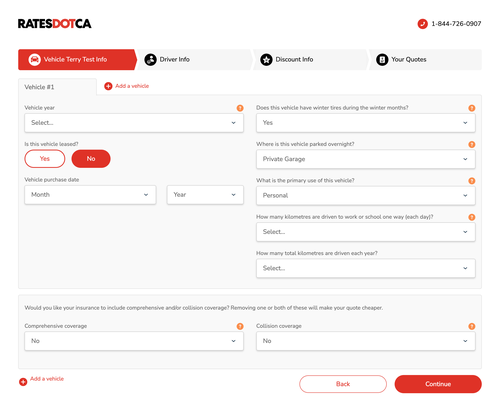

1) Tell us about your car

Before we can give you an estimate, we need to know a few details about the car you drive.

- Be ready with your car's model, make, and year.

- We’ll also need to know where you park your car overnight (like in a private garage, driveway, shared garage, or the street).

- We also need an estimate of how many kilometres you drive each day. Our quoter will automatically estimate how many kilometres you drive each year.

- Lastly, let us know if you want comprehensive or collision added to your policy.

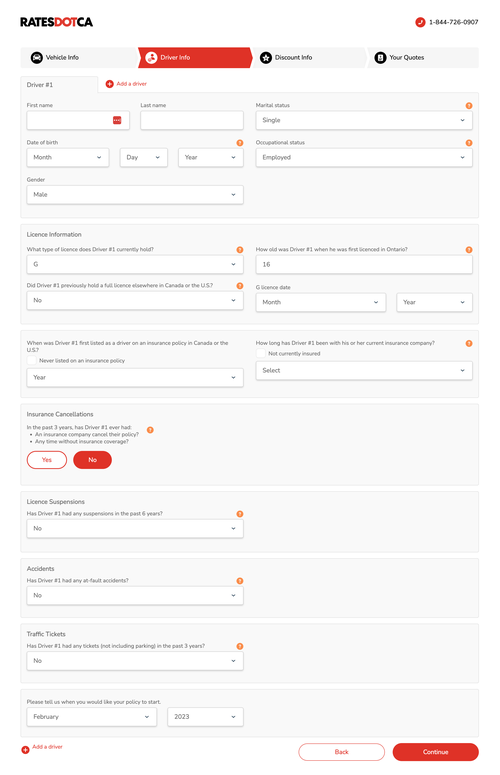

2) Tell us who’ll be driving the car

Next, we need to ask about who will be driving the car.

- You can also add additional people who are going to be driving.

- Be ready with birth dates if you're adding more than one driver.

- You’ll also need to provide information about your licence (what class you currently hold, when you were first licensed)

- Lastly, we need to know your insurance history (whether you've had any cancellations, suspensions, or convictions).

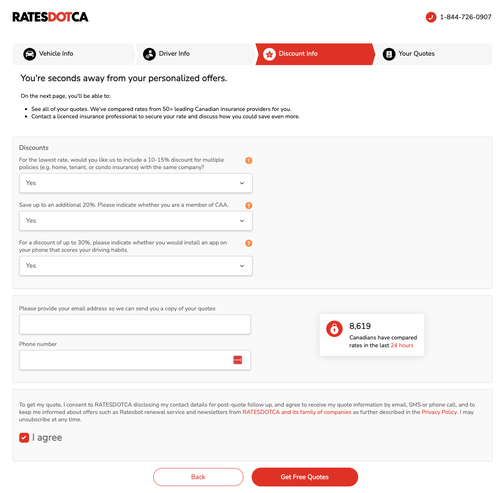

3) Apply for discounts

We can talk discounts now that we have key information about the driver(s) and the car. It’s your chance to indicate whether you’re interested in the following:

- Bundling car and home insurance.

- Using a telematics device.

AMA members can save an additional 20%.

4) See your quotes

Explore car insurance rates and choose the one that fits your needs. We’ll connect you with the car insurance provider and help you secure your quote.

Choosing the right car insurance coverage in Alberta

In Alberta, everyone must buy a standard car insurance policy. You can add a range of optional coverages to customize your policy.

A standard insurance policy includes the following:

- Third-party liability insurance (TPL): Provides financial aid when you're at fault for an accident. The minimum you're required to carry is $200,000. TPL pays for bodily injury, property damage, and any legal expenses you may incur.

- Direct property compensation damage (DCPD): Pays to repair or replace your car if it's damaged in an accident you didn't cause.

- Accident benefits: Pays non-Medicare medical costs and also covers lost wages.

These coverages are automatically included in your premium estimates.

In addition to the mandatory coverages, common optional coverages include:

- Collision: Pays to repair or replace your car if it’s damaged in an accident with another car that you also are responsible for.

- Comprehensive: Pays to repair or replace your car if it’s damaged by something other than a car collision (falling objects, vandalism, theft, fire, or severe weather, for example).

- Specified perils: You request coverage against specific perils. If it's not in your policy, you're not covered against it. Specified perils doesn't cover vandalism or glass breakage.

- All-perils coverage: Combines collision/upset and comprehensive coverage.

When you unlock your quotes, the insurance provider offering the lowest one will contact you. You can ask the insurance professional whether adding optional coverages is a good idea.

Sometimes more coverage isn't better; if you’re driving a car older than three years, it’s often cheaper to pay for the repair yourself than to file a claim. Plus, your insurance premium will go up after you file a claim on some of these coverages (with the exception of the perils covered under comprehensive insurance).

Recent Alberta car insurance quotes

Recent auto Insurance Quote from Clairmont, Alberta

Female, 18 years old

2020 FORD ECOSPORT SE 4DR 4WD

July 18, 2025

Cheapest Quote

$ 408 / month

$ 4,898 / yearAverage Quote

$ 851 / month

$ 10,208 / yearSavings

$ 443 / month

$ 5,310 / year

52 %

Recent auto Insurance Quote from Calgary, Alberta

Male, 29 years old

2011 TOYOTA SIENNA CE V6

July 18, 2025

Cheapest Quote

$ 221 / month

$ 2,653 / yearAverage Quote

$ 274 / month

$ 3,292 / yearSavings

$ 53 / month

$ 639 / year

19 %

Recent auto Insurance Quote from Edmonton, Alberta

Male, 25 years old

2004 ACURA TSX 4DR

July 18, 2025

Cheapest Quote

$ 292 / month

$ 3,499 / yearAverage Quote

$ 414 / month

$ 4,973 / yearSavings

$ 123 / month

$ 1,474 / year

30 %

Auto insurance quotes are compared from CAA, Coachman Insurance Company, Echelon Insurance, Economical Insurance, Gore Mutual, Pafco, Pembridge, SGI, Travelers, Zenith Insurance Company

Frequently asked questions about car insurance in Alberta

Here we answer any lingering questions you may have about car insurance in Alberta

How can I find the cheapest car insurance in Alberta?

Compare quotes: The Alberta car insurance regulator recommends getting quotes from multiple insurance companies before committing to one.

Don’t overbuy insurance: Believe it or not, buying too much insurance is possible. Talk to an insurance professional about whether you need comprehensive or collision insurance. However, buying above the mandatory liability and accident insurance limits is often a good idea.

Drive less: Substitute some trips with other modes of transportation and try car-pooling or ride-shares. According to insurance actuaries, the less time you spend on the road, the less likely you’ll need to file a claim.

Increase your deductible: By volunteering to pay a larger deductible, your insurance company will likely offer an insurance discount in return. You’re taking on more risk, which makes you appear more reliable in the eyes of your insurer.

Bundle home and auto insurance: Buying home and auto insurance with the same company is known as bundling. It will reduce your annual insurance costs by up to 15%.

Try telematics: This is a technology that monitors your driving habits. If you opt into a telematics program, your insurance company will install a device in your onboard diagnostic port. The device measures your speed, how hard you brake, what time of day you drive, and how many kilometres you drive. If it shows you’re a good driver, you could lower your premium by 25% at renewal.

Research discounts: Insurance companies offer a range of discounts. Some examples include seniors’, winter tires, and bundling discounts. There are also discounts for being an alumnus of a post-secondary institution, guild, or union member. Some insurers even extend discounts to current high school or post-secondary students for maintaining a solid grade point average.

Which company has the cheapest car insurance in Alberta?

When you use our Alberta car insurance calculator, one thing will become clear: every insurance company will quote a different price. Sometimes the difference is slight; other times, the gulf between premiums is hundreds of dollars.

Why is this the case? No insurance company can offer a flat-rate premium because insurance is based on the risk each driver represents. That means your friends and family might find a cheaper rate with company A, while company B can offer you a better rate.

The best way to determine which car insurance company you should use is to compare quotes from multiple providers.