If you are not redirected within 30 seconds, please click here to continue.

Samedi: 10h – 16h HAE

If you are not redirected within 30 seconds, please click here to continue.

If you are not redirected within 30 seconds, please click here to continue.

Is severe flooding making your home uninsurable?

Table of Contents

In 2022, Hurricane Fiona pummeled the town of Port aux Basques, Newfoundland, sweeping away multiple homes, and forcing the town under a mandatory evacuation order. It resulted in 25 fatalities, 13,000 displaced individuals, nearly $4 billion in damages, and an insurance bill totaling $700 million, despite most damages being uncovered.

Currently, more than 1.5 million households across the country remain highly vulnerable to flooding and lack access to flood insurance. And it’s only going to get worse. Each year, the frequency and severity of flooding in Canada continue to rise.

As climate change triggers an increase in natural disasters across Canada’s diverse landscapes, insurance claim payouts are on the rise, making covering some properties no longer affordable for the homeowner or profitable for the insurer. With worsening climate events, more and more homes are becoming uninsurable.

But if insurers won’t insure a home, where does that leave you as a homeowner?

Read more: How is climate change affecting home insurance premiums?

Which parts of Canada are most vulnerable to flooding?

A 2019 global analysis by Kulp and Strauss estimated that 320,000 to 600,000 people in Canada currently reside in areas susceptible to sea level rise and coastal flooding. Much of Atlantic Canada, particularly New Brunswick, Nova Scotia, and Prince Edward Island, will face the highest rates of sea level rise in the country by 2100.

But that’s just flooding. In 2023, Ontario, Quebec, and the Atlantic provinces experienced ice storms, while hot, dry weather across Alberta, British Columbia, and the territories led to significant forest fires.

The Bank of Canada has developed a multi-hazard exposure index to identify areas most vulnerable to natural disasters. While many regions face high exposure to at least one type of disaster, postal codes with elevated risk across multiple categories are concentrated in British Columbia, the Prairies, the Atlantic provinces, Northern Quebec, the Northwest Territories, and parts of Southern Ontario, including Toronto.

Most — if not all — standard homeowner’s and tenant’s insurance policies cover damage caused by fire (wildfire and house fires), wind damage (storms and tornados), ice and hail, and water damage (from inside the home). Mass evacuation coverage is also included to help with the cost of any additional living expenses (ALE) if the home is unhabitable.

Some – though few – households may also have the option to add on coverage for earthquakes and floods. Insurance companies, wary of substantial payouts due to frequent and severe floods, rarely offer affordable flood policies in high-risk areas. And when they do, premiums soar.

For homes considered uninsurable due to factors like frequent flooding, standard carriers may still offer coverage but exclude flood or water damage protection. However, says David Mayer, director of insurance at RATESDOTCA, it’s uncommon for all insurers to outright reject coverage for a property.

"Insurers have their own flood mapping,” says Mayer. “If a home is in a red zone, they may restrict flood coverage rather than rejecting the entire risk out right. This is why it is important to shop around as one insurer’s red zone may be acceptable for another.”

However, in certain coastal areas, no flood coverage is available.

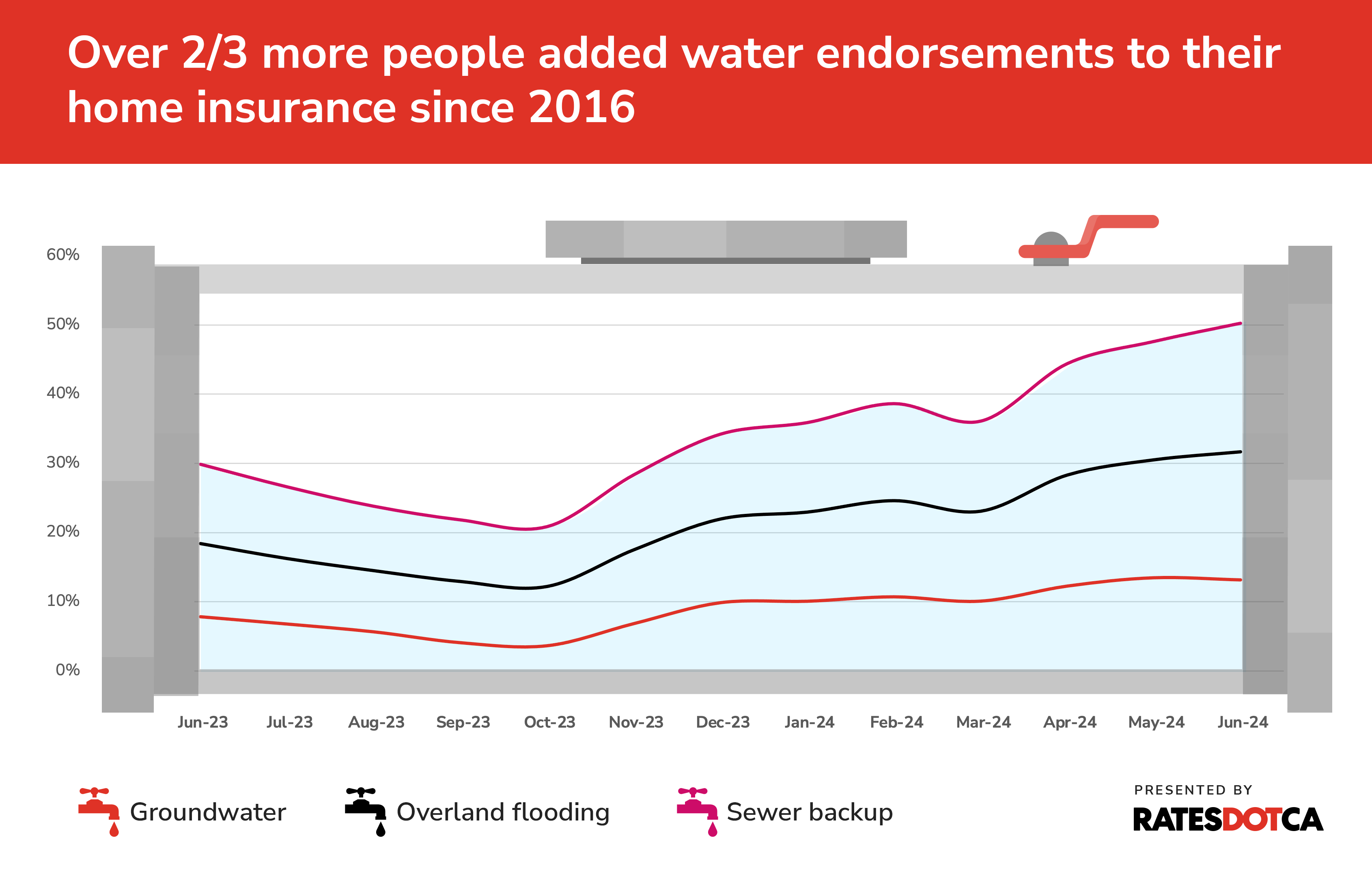

Half of home insurance buyers added water endorsements in preparation for worsening climate change

According to RATESDOTCA quoter data, in June 2024, 50% of all home insurance quotes added water endorsements, an increase of 68% from the previous year. Water insurance typically falls under the following two types:

Overland flood insurance has been available since 2015 and insures a home damaged by water that entered through windows and doors from floods caused by heavy rainfall, overflowing lakes, ponds and rivers.

Sewer back-up insurance covers the home against damage from flooding from unexpected back-up from the home’s sewers, septic pumps, and other pipes and drains.

Groundwater insurance refers to water that exists below the surface of the ground. It protects against damage caused by water that enters your home through basement walls or floors.

Overland flooding and sewer backup each account for 37% of total quotes with added water endorsements in June 2024 – making them the most popular. Ground water comprised 26% of total quotes. On average, homeowners paid $1,336 in annual premiums for overland water coverage and sewer back up each.

In any case, even with these endorsements, signs of neglect from the homeowner in the home’s maintenance may result in denied coverage.

Read more: How to protect your home from spring flooding

Catastrophic floods leave homeowners high and dry: The costly aftermath

In Abbotsford, British Columbia, the Mulder family faced a heart-wrenching reality: their one-story home, once a sanctuary, now lays in ruins after being swallowed by floodwaters.

The high cost of rebuilding along with a lack of government support, left the Mulders in limbo. The family, who did not have flood insurance, adapted by living in the makeshift shed while one of their children lived in an RV parked inside.

“Without flood insurance, homeowners face out-of-pocket expenses to restore their homes promptly,” says Dr. Blair Feltmate, head of the Intact Centre on climate adaptation and a professor at the University of Waterloo’s faculty of environment.

According to Feltmate, the average cost to repair a flooded basement in Canada is around $54,000. Often, these incidents involve sewer water and basement damage, rendering the house uninhabitable."

The Bank of Canada conducted an analysis to explore the connection between severe weather events (such as floods) and the financial vulnerability of Canadian households. This ‘vulnerability’ considers two factors:

- Depreciation of assets: When homes that are not fully insured are destroyed, their value depreciates significantly.

- Loss of income: If employees can’t reach their workplace or businesses face disruptions due to natural disasters, it affects household income.

Their findings revealed that households with high indebtedness — specifically, borrowers with mortgages and a high loan-to-income ratio — hold approximately 39% of Canadian household debt. These households are concentrated in British Columbia and Ontario, where home prices are already above the national average.

If a home is destroyed due to natural disasters, it not only results in the loss of the property itself but also erodes any accumulated equity within that home.

Furthermore, for these households, the BoC posits a double vulnerability: their existing debt burden and the lack of insurance coverage. If a natural disaster strikes and destroys their home, they won’t have the financial resources to restore or rebuild their homes.

Similarly, homes in the Prairies and Atlantic provinces, which are vulnerable to disasters, account for 17% of Canada’s household debt.

Read more: Rural Ontario residents hit hardest by increasing costs of home insurance

High-risk homes create a domino effect for the insurance industry

In the property insurance market, there are standard and non-standard insurance companies. Standard carriers offer policies to most homeowners, while non-standard carriers specialize in higher-risk properties.

“If you’ve had two or three property claims (such as flood, fire, theft, or burglary), you might be directed to the residual market for property insurance,” says Mayer.

The residual market includes non-standard carriers. Premiums with these carriers may be higher, and coverage restrictions could apply.

Related: Flood warnings may prevent insurance coverage even for high-rise condos

A single natural event has the potential to cause tens of billions of dollars in damage and could result in insurer bankruptcy or withdrawal. For example, on July 23, 2023, an overflooded river in Nova Scotia resulted in insured damages exceeding $170 million.

The ‘combined ratio’ assesses an insurer’s financial health. A ratio below 100% means the company is earning more from premiums than it’s paying out in claims and expenses.

It combines two key components:

Loss ratio: This represents the proportion of claims payouts (losses) relative to the premiums collected. A high loss ratio indicates that claims are eating into the company’s revenue.

Expense ratio: This includes all other operating expenses (such as administrative costs and commissions) as a percentage of premiums earned.

Ideally, insurers aim for a combined ratio below 95% to maintain a healthy profit margin (5%).

In the aftermath of Hurricane Fiona in 2022, Prince Edward Island faced an extraordinary claims ratio of nearly 400%, resulting in a substantial loss (300%). Much of the loss was exacerbated by contractor shortages and supply-chain challenges.

Related: What will my car and home insurance policies cover when it comes to storm damage?

Reinsurance rates impacted by extreme weather claims

When insurance companies can no longer pay out the damages from a climate event, they turn to their own insurer.

“Reinsurance is insurance for insurance companies,” says Mayer. The homeowner’s insurer allocates a portion of their portfolios to reinsure, transferring risk to another party (reinsurer).

Reinsurers use advanced climate modeling to predict risk and set rates. When actual catastrophes happen (e.g., one-in-10-year or one-in-100-year events), reinsurers adjust their rates. These rate increases ripple down to policyholders, affecting premiums.

“Higher reinsurance rates lead to increased costs for insurers,” explains Mayer. “Property insurance premiums have risen. Previously, most were under $1,000; now, the average is closer to $2,000. Factors like climate change contribute to more frequent natural disasters, driving up reinsurance costs.”

For example, hurricanes in Atlantic Canada or flooding in British Columbia impacted both reinsurance rates and direct policyholders.

Do high-risk disaster areas have a harder time selling homes?

A Leger survey commissioned by RATESDOTCA and BNN Bloomberg in June 2023 showed that two thirds of all young homeowners in Canada considered weather-related climate risks when buying a home.

Another survey conducted by the Intact Centre on the impact of flooding on home prices found that flooding directly impacted home prices.

They compared the sold prices of homes six months after a flood to six months before. The results showed that in flooded communities, home prices increased by 2%, while in non-flooded areas, prices rose by 10%. The 8% difference was directly attributed to the flooding.

"The house itself doesn’t have to have a history of flooding, it just has to be located in a flood impacted community in order to be influenced,” says Dr. Feltmate.

The study also found after flooding, there was a 44% decrease in the number of houses listed for sale within six months. Homeowners seemed to wait for the stigma of flooding to subside before selling their homes. When homes were eventually listed, they took 20% longer to sell compared to non-flooded properties.

Your house might be on a floodplain but nobody’s obliged to tell you

There’s no requirement for disclosing future flood risk in Canada. For many homeowners, the risk of potential flooding isn’t a point made when purchasing homes.

In an undercover test, the CBC sent fake homebuyers around properties within the Greater Toronto Area situated in floodplains. These floodplains are areas designated on publicly available maps by the Toronto and Region Conservation Authority (TRCA). Agents selling two out of the four properties denied that these homes were at risk of potential flooding.

A 2020 survey by a climate resiliency network at the University of Waterloo revealed only 6% of Canadians living in designated flood-risk areas knew about their risk status. And just a quarter of respondents said their insurance company had discussed flood coverage options with them.

Looking ahead, however, property listings may include a crucial new detail.

“Imagine a flood readiness score on a home listing, like a walking score, indicating whether a home is flood-ready or not. This score could highlight features like being on a floodplain or having a backwater valve,” notes Dr. Feltmate.

Six to eight years ago, he says, home inspectors historically received minimal to no training in flood risk assessment. However, recent efforts are underway to address this gap.

Collaborations between institutions like the Intact Centre and colleges and universities aim to equip home inspectors with the necessary expertise to evaluate flood risks accurately during training.

Read more: Oakville homeowners sue city over flood risk

Next moves for the Canadian government where insurers fall short

According to the IBC, insured losses from natural disasters now surpass $30 million per flood event. Up to 10% of all Canadian homes currently face the specter of being uninsurable.

“Since 2009, there’s been a significant escalation in claims. For 14 out of the last 15 years, catastrophic loss claims have exceeded a billion dollars annually, with an average cost of $2.1 billion per year,” says Dr. Feltmate.

Private insurers can no longer provide affordable coverage to everyone without payouts exceeding premiums.

In response, the IBC is working with federal and provincial governments to launch the first Canadian national flood insurance program in April 2025.

It aims to provide affordable flood insurance to over 1.5 million homeowners at high risk of flooding and subsidize premiums for homeowners in high-risk areas. But while the program sounds great in theory, some critics worry that it has the potential to do more harm than good.

“By making insurance accessible in high flood risk zones, we might inadvertently encourage risky behavior,” says Dr. Feltmate. “It’s akin to enabling someone to stay in a situation where they shouldn’t be.”

But ultimately, Mayer notes, it’s at least some relief for people who are struggling without insurance options.

“If you're in a coastal area, or if you're in an area where the private market can’t provide flood insurance, only then would you turn to the government program,” he says.

It may just be the difference between hope and despair for many homeowners.

Don't waste time calling around for home insurance

Use RATESDOTCA to shop around and compare multiple quotes at the same time.

Finding the best home insurance coverage has never been so easy!

Get money-saving tips in your inbox.

Stay on top of personal finance tips from our money experts!