If you are not redirected within 30 seconds, please click here to continue.

Samedi: 10h – 16h HAE

If you are not redirected within 30 seconds, please click here to continue.

If you are not redirected within 30 seconds, please click here to continue.

Holiday cheer and financial fear: 64% of Canadians set spending limits

The holiday season is a time for giving, celebration, and connection, but it also brings financial pressures for many Canadians still grappling with debt.

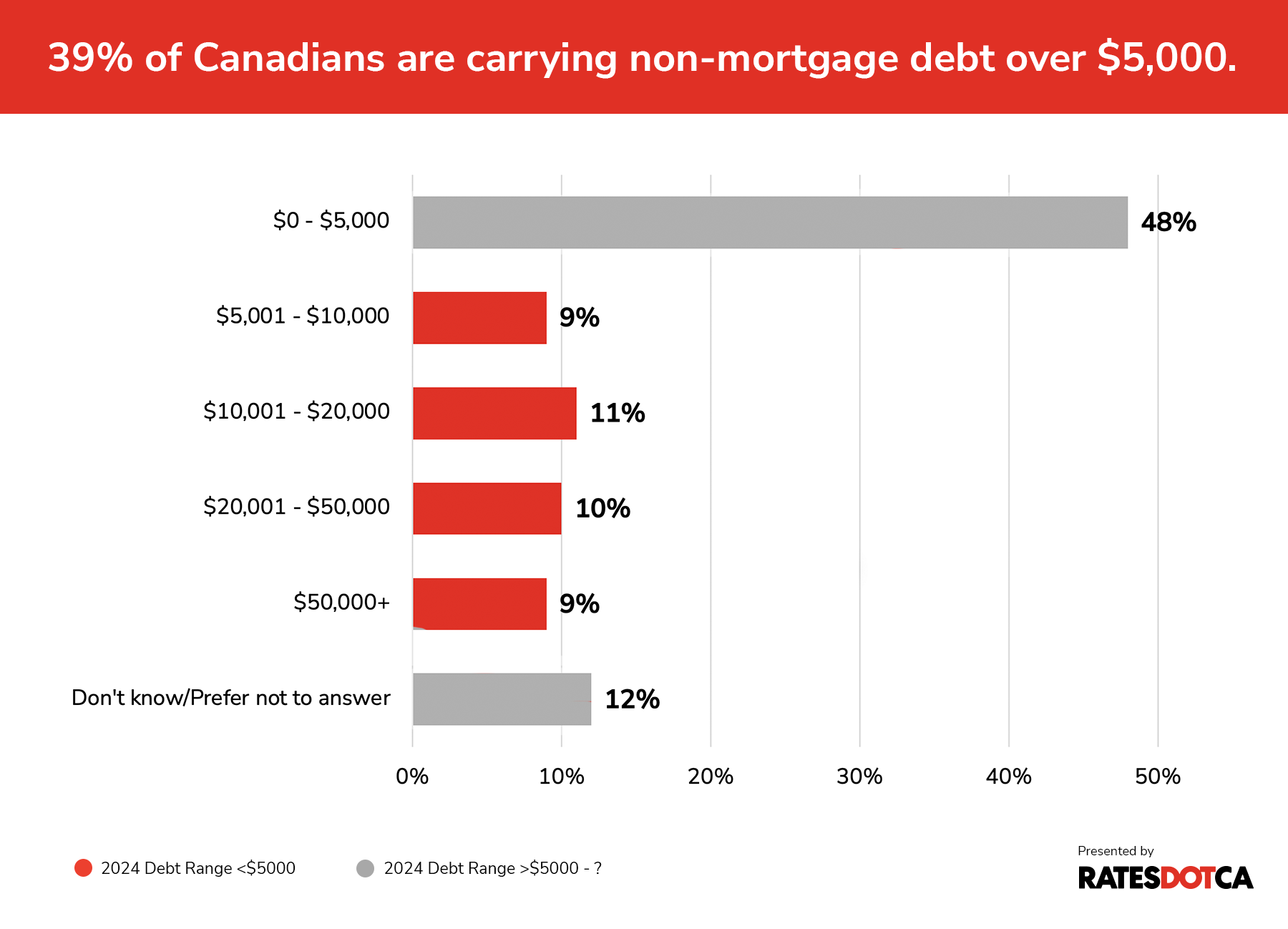

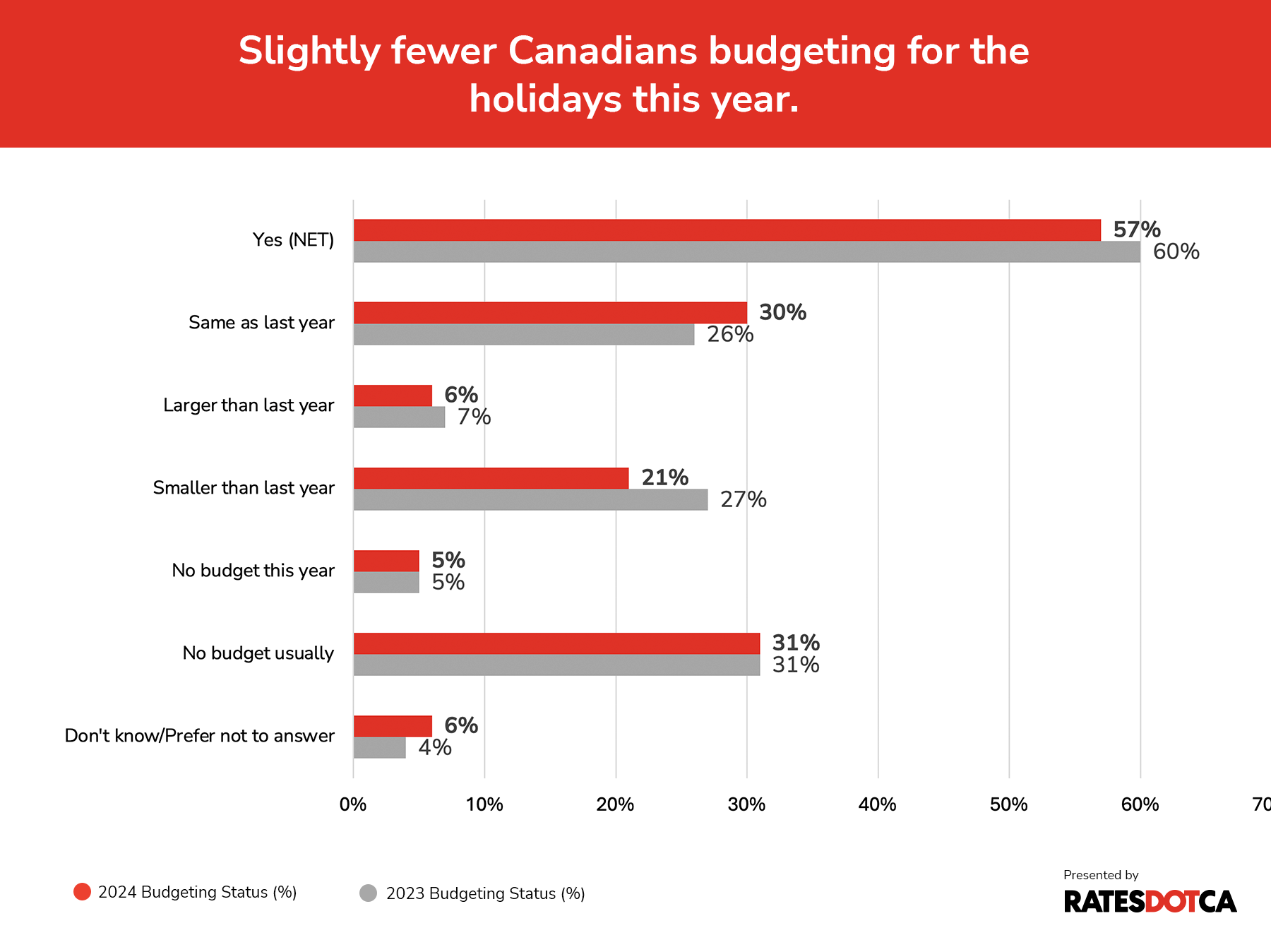

A recent survey commissioned by RATESDOTCA and conducted by Leger reveals that 39% of Canadians are carrying more than $5,000 in non-mortgage debt. This financial pressure has led nearly two-thirds (64%) of Canadians to set a maximum spending limit for the holidays. Last year, the number of Canadians with a spending limit was 63%.

Inflation and relatively high interest rates have reduced spending power and increased debt loads, prompting Canadians to continue keeping a watchful eye on their holiday spending.

These ongoing difficulties, plus the pressures of holiday spending—like traveling, attending events, and shopping—further test Canadians' budgets during this busy season.

KEY FINDINGS

- Nearly two-thirds of Canadians have a holiday spending cap this year, reflecting ongoing financial caution.

- Rising costs and debt loads are prompting Canadians to watch their budgets more closely.

- 65% of families with kids and 61% of Canadians aged 18-54 created budgets, compared to less than 55% of older Canadians or those without children.

- Over half of Canadians, especially younger adults, use credit cards for holiday shopping, risking higher balances if not paid off promptly.

- Social pressures and rising living costs make it challenging for many to stay within financial limits.

65% of families with children are more likely to budget

Our survey, conducted by Leger, shows that Canadians aged 18-54, and families with children were more likely to budget than older Canadians and those without families.

Around 61% of Canadians aged 18-54 and 65% of families with children reported having a budget for holiday spending in 2024, highlighting a more proactive approach compared to older Canadians and households without children. In contrast, only 52% of older Canadians aged 55+ and 55% of those without children reported having a spending plan.

Perhaps unsurprisingly, older Canadians (55+) and those without children were consistently more likely to carry lower non-mortgage debt, while younger individuals and families with children were more likely to exceed $5,000 in debt. Experts point out that this trend is expected to worsen during the holidays, as more Canadians overspend on gifts and festivities.

When it comes to non-mortgage debt, our survey shows that 40% of those aged 18-54 carried $5K or less, 15% carried between $10K and $20K, and 10% carried more than $50K. Meanwhile, 60% of those aged 55+ carried $5K or less, 6% carried between $10K and $20K, and 7% carried more than $50K.

Additionally, 54% of those without children in the household carried $5K or less in non-mortgage debt, while 34% of those with children in the household had $5K or less.

"Young people...are the most stressed and it's because of a couple of things," says Li Zhang, director of social Impact and financial literacy leader at Chartered Professional Accountants of Canada (CPA Canada).

While wages grew by 4.1% year-over-year as of November 2024, according to a Statistics Canada report, Zhang says that younger individuals still tend to earn less than older generations. Coupled with the rising cost of living, this makes building financial stability a significant challenge for many.

Another complicating factor? Social pressure and familial responsibilities.

“Families with children obviously feel an obligation to spend more,” says David Soberman, professor of marketing and Canadian National Chair of Strategic Marketing at the University of Toronto. “There’s societal pressure, especially when kids see their friends getting gifts.”

The financial strain younger individuals face is further exacerbated by social media, which has become a primary source of financial advice for younger generations, according to FIS research, a U.S.-based study.

Platforms like Instagram and TikTok not only promote fragmented financial advice but also fuel a cycle of unrealistic comparisons. For instance, nearly half of Gen Z (48%) and 40% of Millennials report that social media pushes them to spend money they don't have, according to a study by The Harris Poll on behalf of Credit Karma.

These comparisons, Zhang says, amplify societal pressures and drive people to spend beyond their means in an attempt to "keep up," worsening financial insecurity and emotional stress.

Learn more: 6 tips to save on your holiday budget

How do Canadians approach holiday spending?

As the holiday season approaches, our survey reveals diverse financial attitudes among Canadians regarding holiday spending and consumer debt.

The survey findings reveal that 31% of respondents in both 2023 and 2024 typically do not set a holiday budget. Additionally, 18% in 2023 and 19% in 2024 reported having no fixed maximum spending limit.

Among these, specific trends emerged in 2024—24% of respondents aged 55+ and 21% of households without children under 18 indicated they do not set a maximum spending limit. This shows a range of financial attitudes during the holidays, with older adults and child-free households more likely to demonstrate greater flexibility or unstructured spending habits.

For many families, however, the hangover of holiday spending can last far longer than the holiday season itself.

According to recent survey by Coast Capital, conducted among members of the Angus Reid Forum, 55% of Canadians struggle to meet financial goals due to inflation, lack of savings, and household debt.

“[People’s] views of their financial circumstance versus the holiday spending piece are not necessarily tied together because the holidays, and money in itself, is very emotional,” says ," Zhang.

Read more: Inflation: how it affects your finances

Rising use of credits cards amid the holiday season

The holiday season often sees a surge in the use of credit cards, as Canadians balance the joy of giving with financial realities.

Zhang sheds light on the driving forces behind this trend. "Credit card use has become more prevalent, especially in a cashless, very digital society," she explains.

A survey from CPA Canada and BDO Debt Solutions found that 56% of Canadians reported using credit cards for their holiday purchases, with younger generations more likely to pay with plastic - 59% of respondents aged 18 to 34 depending on credit cards, resulting in higher levels of debt.

However, while increased credit card usage among this group suggests a tendency toward higher balances, it doesn’t necessarily mean they’re carrying more debt if they regularly pay off their cards.

This reliance on credit cards puts them at greater risk of entering the new year with lingering debt if balances remain unpaid.

Soberman points out that using credit cards to finance debt is unwise because of their high interest rates. Most standard credit cards in Canada have interest rates around 19.99% to 20.99%. This means that carrying a balance can quickly lead to significant interest charges, making it harder to pay off debt.

Related: How to use credit cards to save money and tackle holiday debt

As we move further from the pandemic, insolvencies are up

Debt and insolvency are ongoing challenges for many Canadians, especially amid economic pressures like inflation and fluctuating interest rates.

The Office of the Superintendent of Bankruptcy reports that consumer insolvencies increased by 15.4% over the 12-month period ending September 30, 2024, compared to the previous year.

Zhang notes that insolvency often acts as a “lagging indicator” of financial trouble, predicting an increase in debt insolvency as COVID-era savings deplete. Individuals typically delay addressing debt problems, worsening their situation.

According to Jenifer Bartman, a business advisor, the financial habits of Canadians are still heavily influenced by the lingering effects of the pandemic.

While many reassessed their priorities during the pandemic, the recovery phase has introduced new challenges.

“We have seen interest rates and inflation rates start to come down over the past year, but we’re not quite out of the woods yet as far as financial challenges go,” she observes.

These ongoing difficulties, coupled with the pressures of holiday spending—like traveling, attending events, and shopping—further test Canadians' budgets during this busy season.

She advises Canadians to curb their spending and take a serious look at their financial situation. According to Bartman, setting a spending target and creating a detailed list can go a long way in managing holiday shopping stress. She explains that having a clear idea of what you're prepared to spend is crucial, but equally important is the practicality of using lists.

“Lists at this time of year can be really helpful," she shares. By listing items for specific family members, categorizing what can be ordered online versus what requires a trip to the store, and aligning this with your budget, you can streamline the entire process.

Not only do budgeting and lists help people stay on track financially, but they also support better organization during a demanding and hectic season.

The key takeaways are clear: setting a spending limit, creating a detailed budget, and using tools like lists can make the season both joyful and financially manageable. Small, actionable steps—like tracking expenses or prioritizing meaningful gifts over costly ones—can have a big impact on your financial well-being.

Remember, the holiday season is about connection and generosity, not overspending.

Read next: 48% of Ontarians changing moving plans due to high interest rates

Methodology

An online survey of 1,529 Canadians aged 18 and older was completed between November 15 and 18, 2024, using Leger’s online panel. No margin of error can be associated with a non-probability sample (i.e., a web panel in this case). For comparative purposes, though, a probability sample of 1,529 respondents would have a margin of error of ±2.5%, 19 times out of 20.

Get money-saving tips in your inbox.

Stay on top of personal finance tips from our money experts!