If you are not redirected within 30 seconds, please click here to continue.

Samedi: 10h – 16h HAE

If you are not redirected within 30 seconds, please click here to continue.

If you are not redirected within 30 seconds, please click here to continue.

For many Canadian families, the great wealth transfer can’t come soon enough

Table of Contents

Currently, many of Canada’s big cities stand as some of the most challenging arenas prospective homebuyers have ever had to enter. With property prices soaring in many parts of the country, the dream of owning a home feels increasingly out of reach for most – and nearly impossible for some without family assistance pitching in for a down payment.

Until recently, that was the case for Deirdre Tanaka, a psychotherapist in Ontario. After growing up in Japan and intermittently moving back and forth from Toronto and Tokyo for work, Tanaka returned to Toronto for good in 1986.

She raised her kids in rented houses on the east end of the city and remained a renter through the early years of her relationship with her husband, who she married 10 years ago.

Together, they had attempted to enter the real estate market in the city a few times throughout the years but remained on the sidelines.

Then, during the low-interest days of 2021, a seemingly ordinary trip to North Bay to pick up a living-room rug turned into an unexpected opportunity. The stars aligned, and they returned not just with the rug, but with an offer on a new home for $430,000.

But when asked if she could have purchased her house without an inheritance from her mother, Tanaka, a self-employed psychotherapist, says no.

She’s far from alone. Nearly one third of new homeowners are the recipients of monetary gifts from their parents.

At the core of this issue lies the daunting financial requirement of a hefty down payment, a barrier that starkly divides those with generational wealth from those without.

Putting the minimum down on a home today costs you an extra $70,000 and more over 25 years

Like many couples and individuals who can benefit from a windfall like an inheritance or a gift, Tanaka and her husband, Ted Wheeler, were able to put down 20% as a down payment for their home. Not only does being able to pay more upfront speed up the mortgage repayment process significantly, it also saves homeowners much more money in interest and other costs down the line.

The minimum down payment someone can put down on a home under $1 million is 5% on the first $500,000 and 10% on the remainder.

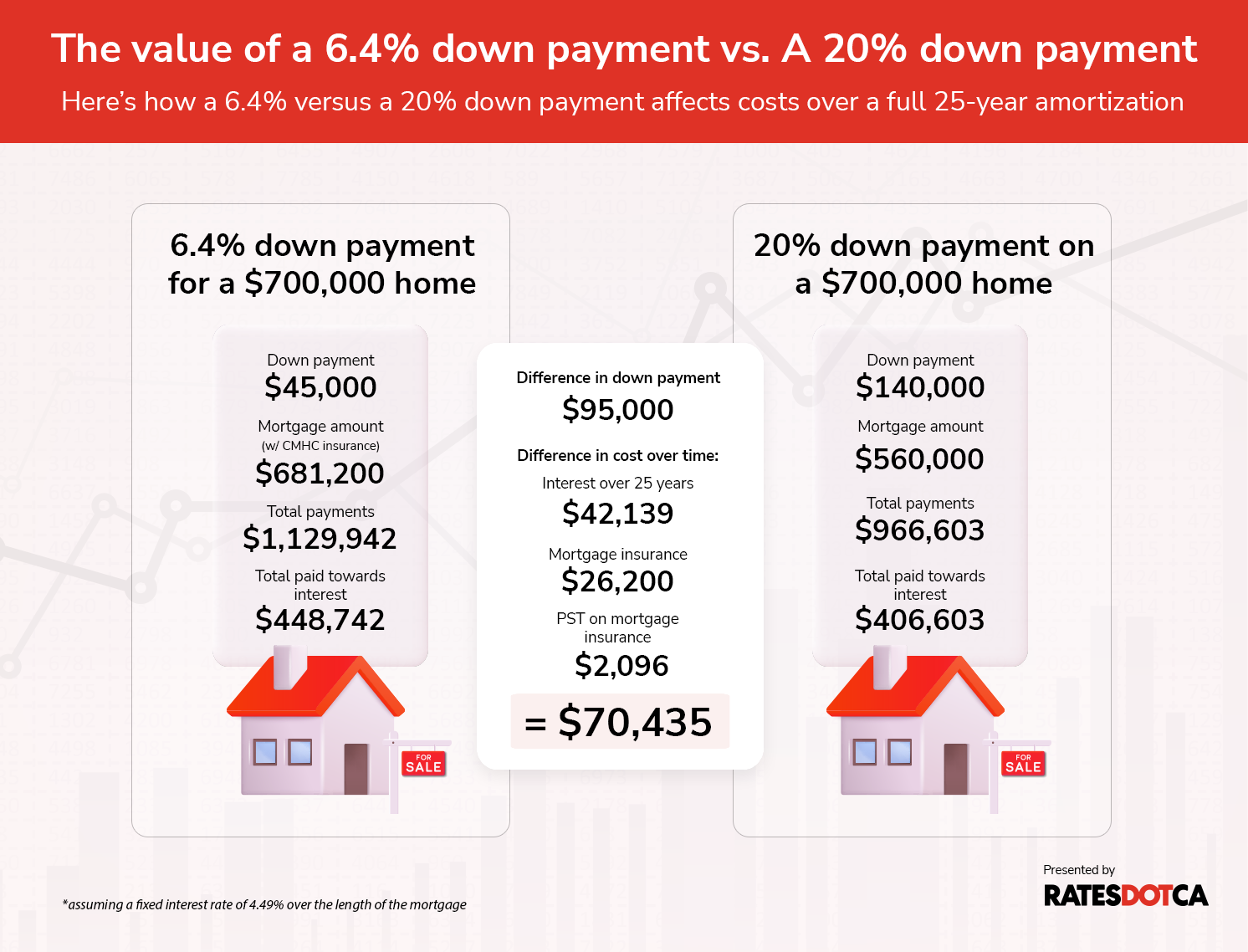

We compared cost differences between someone putting a minimum 6.4% down payment for a $700,000 home (the approximate average home price in Canada), and another paying a 20% down payment on the same home, assuming a fixed-rate mortgage with an interest rate of 4.49%.

A 20% down payment on this home is $140,000, while the 6.4% down payment comes to $45,000.

But being able to put down $95,000 more up-front actually saved the homeowner over $70,000 over the course of a 25-year amortization term, assuming their interest rate stays the same.

In Canada, buying a home priced under $1 million with less than a 20% down payment generally requires mortgage insurance through the Canada Mortgage and Housing Corporation (CMHC). This insurance provides security to lenders but adds significant costs to homeowners over time.

The monthly mortgage payments for an insured mortgage are $544 higher than those for an uninsured mortgage (with the 20% down payment).

By the end of a five-year term, the homeowner with the insured mortgage will have paid approximately $14,657 more in interest than someone with an uninsured mortgage.

And by the end of the 25-year amortization period, assuming a continual 4.49% interest rate, the homeowner who put down a smaller down payment will have paid $42,000 more in interest, plus $28,000 in mortgage insurance and accompanying Ontario provincial sales tax of 8% on the insurance premium.

As a result, the minimum down payment option, though initially accessible, costs homebuyers an additional $70,435 in mortgage insurance and increased interest payments over a 25-year mortgage.

Related: Then and now: How much more expensive is it to buy a home in 2024 vs. 1994?

The great wealth transfer can’t come soon enough

While headlines often tout the promise of baby boomers passing down their fortunes to Gen X and millennial heirs – an estimated sum of $1 trillion in the next few years alone – for many Canadians, the notion of a "great wealth transfer" remains more myth than reality.

The reality is that the great wealth transfer is still a long way off, says Joshua Harris, a licensed insolvency trustee, CEO and partner at Harris & Partners Inc. That’s because boomers are living longer than previous generations and millennials haven’t quite hit their highest earning stage yet.

“The so-called ‘great wealth transfer’ likely is still ten to twenty years away at least, and is for now just a click-bait headline,” he adds.

Tanaka, now a first-time homeowner at 67, represents a significant segment of Canadians who find themselves only now coming into money from the previous generation.

“Ted and I didn't have much when we met, but I received an inheritance when my mother passed away, and we used around $100,000 for our house,” says Tanaka.

Despite years of hard work and attempts to secure a home in Toronto, it wasn’t until this unexpected endowment that she and Wheeler could finally cross the threshold of their own home.

For many middle-class families, inheritances often arrive when individuals are between the ages of 46 and 74, well past the traditional age for purchasing a starter home. However, homebuying gets more complicated the later in life you start the process.

“The average Canadian Gen X and Baby Boomer today may be faced with carrying a mortgage into their retirement, likely at much higher rates than they would have in the past,” says Jackie Porter, a certified financial planner and financial advisor.

That comes with the extra pressure of potentially paying off a mortgage, riding fluctuating interest rates well into your golden years, as well as waiting longer to be able to tap into your home equity.

An early gift is the one that keeps on giving

In today's Canadian housing market, the traditional notion of waiting for an inheritance to secure homeownership is rapidly evolving.

Increasingly, individuals of homebuying age are relying on early financial gifts from their parents to afford a home. These gifts now average as high as $115,000, enabling families to put down a 20% down payment while giving them a bit more budget flexibility in their home search. As mentioned earlier, it also speeds up mortgage repayment, significantly reduces costs and potentially allows the homeowner to retire more securely.

Research shows that first-time homebuyers with a parent co-signing often secure an uninsured mortgage, which leads to a lower loan-to-value (LTV) ratio. They typically choose mortgages with terms longer than 25 years, an option available only for low-LTV uninsured loans.

With a 20% down payment, homebuyers can also avoid the additional costs associated with mortgage insurance, Provincial Sales Tax (PST), and higher interest payments that come with a smaller down payment.

However, those without this support may only be able to put down the minimum 5% down payment required for an insured mortgage, which significantly increases long-term costs.

Although interest rates remain similar whether parents co-sign or not, these buyers face higher monthly payments due to larger loan amounts, even with extended amortization periods.

Less debt = More wealth

A potential homebuyer who puts down 5% as a downpayment not only faces higher monthly payments but also misses out on potential savings or investments. This ongoing cash outflow can limit the ability to generate wealth over time.

If one were to consider the potential compound interest of investing the $70,000 difference at a 5% or even a 10% return over 25 years, the opportunity cost becomes clear.

If you invest $70,000 at a 5% return, it could grow to approximately $237,020 (or about $144,000 adjusted for inflation) over 25 years. At a 10% return, it could grow to approximately $758,380 (or about $462,000 in today’s dollars).

Related: The snowball effect of compound interest when saving

In some markets, help from parents is no longer just a nice-to-have, but a need-to-have

Homebuyers relying on the bank of mom and dad in order to purchase a home is becoming the norm in Canada, particularly in cities like Toronto and Vancouver.

Given extremely high home prices in Canada, and specifically in our major urban centres, purchasing a home is out of reach for many aspiring first-time buyers, says Amin Kanji, the executive director of family enterprise advising at CIBC private wealth.

“Families that are fortunate to have additional resources available often wish to assist their adult children given the challenges surrounding this life milestone,” he adds.

A report from CIBC shows the percentage of first-time homebuyers receiving financial assistance from family members has climbed to 31%, a notable increase from 20% in 2015.

The gift amounts themselves have also escalated significantly. In Canada, as mentioned, they now average $115,000 —73% higher than the average gift in 2019.

Families who can provide financial assistance allow their children to bypass years of scrimping and saving, fast-tracking their path to homeownership. Meanwhile, individuals without this advantage are left to contend with the full weight of current economic pressures, often delaying their entrance into the housing market, influencing who can enter the market, who remains on the bench and potentially who can retire with more security.

Related: A growing wealth gap stands between housing haves and have-nots

You don’t have to come from billionaires to benefit from generational wealth

You don’t need to be a Rockefeller – or a Thomson – to pass on generational wealth.

With home prices vastly outpacing income growth, more parents are digging deeper into their pockets to help their children with a down payment.

A poll from the Ontario Real Estate Association (OREA) found that a significant 44% of parents draw from their general savings, and 15% tap into retirement funds or investments.

Some parents also use home equity lines of credit (HELOCs) or reverse mortgages to fund these contributions, which can pressure their retirement plans and increase debt risks.

While the average gift size in Ontario clocks in at $73,605, parents who lend money for a down payment provide an average of $40,878 according to the OREA poll.

The subset of parents assisting their children in buying homes are typically financially well-off, enabling them to provide support without compromising their own financial well-being.

However, Equifax data shows that an estimated 5.5% of parents who provided financial assistance with their children’s down payments went into debt to assist with home purchases in 2020.

CIBC’s Amin Kanji, himself hasn’t been directly aware of a situation where a parent’s best intentions have resulted in additional burdens for the family - given the client segment he personally serves has access to significant resources to support multiple family generations.

Related: What is a debt-to-income ratio and how does it affect you?

Down payments aren’t the only type of gift

Nobody said that the ‘great wealth transfer’ from Baby Boomers to Millennials, Gen X, and Gen Z would come in the form of a single windfall.

As high home prices and interest rates create significant barriers for all generations, “the ways parents support their children can vary,” says Kanji.

Many parents are stepping in not just with down payments, but also "co-signing on mortgages to assist their children in obtaining the necessary financing needed," he adds. This allows first-time buyers to leverage their parents' income, easing the passage through stringent mortgage stress tests and securing potentially better rates.

Beyond co-signing, parents may also offer to be loan guarantors. While this role makes them liable for mortgage payments without ownership rights, it underscores their commitment to supporting their children.

Furthermore, there's a growing trend of parents contributing directly to mortgage installments, providing an additional financial cushion. This is echoed by findings from an RBC poll, which reveals that 21% of grandparents are supporting at least one adult child aged 25+, and 30% are providing financial assistance to grandchildren.

In addition to helping out with the home purchase, parents and grandparents may also cover grandchildren's tuition or college fees, or facilitating multi-generational housing arrangements, where grandparents may move in with adult children and help with housing costs and childcare.

While Statistics Canada reports a decline in homeownership among older Canadians, this may not necessarily limit their ability to provide financial support. Many older Canadians view their homes as retirement assets, opting to sell for liquidity that can then be used to support their children financially, as well.

These intergenerational support systems remain crucial, but it's vital for families to weigh the long-term financial implications.

As Kanji warns, it's one thing to help qualify for a mortgage, and another to service the debt and associated costs of the property. If parents are hoping to provide temporary support until their children are financially independent, they should assess whether it’s feasible for their children to manage homeownership costs alongside other expenses young families face today.

Related: Looking for a new home? Why you need to pre-qualify first

Thanks to her inheritance, Deirdre Tanaka and her husband finally have a home of their own. However, the delay of homeownership came with its own set of challenges — juggling the demands of frequently moving while trying to provide stability for her children and pushing off their retirement beyond their initial plans.

But with their feet firmly in their front door, they plan to pay off the rest of their mortgage within the next two years.

Reflecting on her early adult years in Japan during the 1980s, Deirdre recalls, "Buying a house there meant a lifetime of payments, with no expectation of ever fully paying it off or retiring."

She adds, "That was just how it was, and purchasing property wasn't something I considered while living there. But when I returned to Toronto in 1986, it initially seemed more doable."

Young people in Canada’s biggest cities today share the same pessimism that Tanaka felt in the 1980s in Japan—sky-high prices and fierce competition that make it tough for many to get a foot in the door. Once inside, the challenge of managing a mortgage alongside the high cost of living in Canada remains. Here, the timing and size of financial gifts can make all the difference in sustaining home ownership

A well-timed gift can serve as a financial safety net, providing the peace of mind needed to navigate life's uncertainties without compromising your home.

Larger financial gifts can offer a substantial buffer against economic fluctuations, protecting families from potential downturns or interest rate hikes. On the other hand, smaller, strategically timed contributions can help manage ongoing costs, like property taxes or home improvements, sustaining your family’s financial health over the long term.

This way you can not only achieve home ownership but also not lose sight of its sustainable needs.

Read next: Mortgage rates are creeping closer to 4% after the latest inflation news

Compare Mortgage Rates

Engaging a mortgage broker before renewing can help you make a better decision. Mortgage brokers are an excellent source of information for deals specific to your area, contract terms, and their services require no out-of-pocket fees if you are well qualified.

Here at RATESDOTCA, we compare rates from the best Canadian mortgage brokers, major banks and dozens of smaller competitors.

Get money-saving tips in your inbox.

Stay on top of personal finance tips from our money experts!