If you are not redirected within 30 seconds, please click here to continue.

Samedi: 10h – 16h HAE

If you are not redirected within 30 seconds, please click here to continue.

If you are not redirected within 30 seconds, please click here to continue.

Two thirds of young homeowners in Canada considered weather-related climate risks when buying a home: survey

Table of Contents

While forest fires in western Canada are common during the wildfire season of May through September, the unusual nature and severity of this year's wildfires have left a devastating impact on life and livelihood across the country. Raging wildfires across British Columbia and Alberta in April, and those in Quebec earlier this month have displaced nearly 40,000 people. Severe rainfall and floods have also worsened the situation.

Extreme weather conditions, like large wildfires or floods, are only expected to worsen over the years. As a result of this new reality, more Canadians are factoring in the risks of extreme weather into their decision on where to purchase a home.

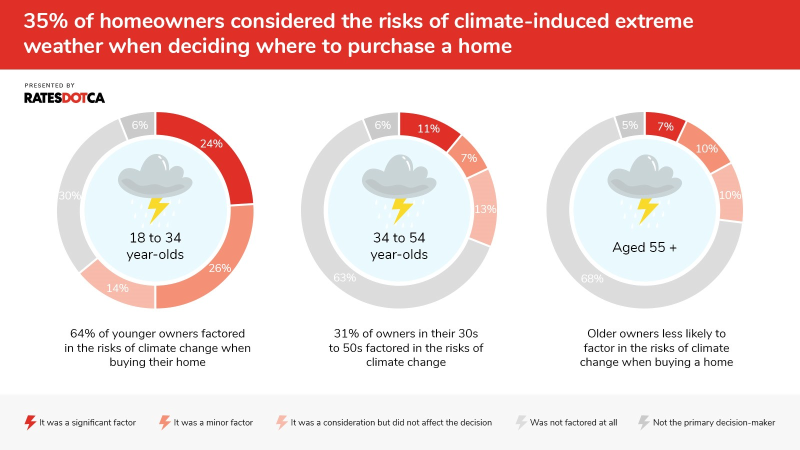

According to a recent Leger survey, conducted on behalf of BNN Bloomberg and RATESDOTCA, 35 per cent — or, over a third — of homeowners considered the potential risks of climate-induced weather patterns when buying a home.

This factor was particularly important among 60% of those who purchased a home in the last two years, compared to the 30% who bought their home more than two years ago.

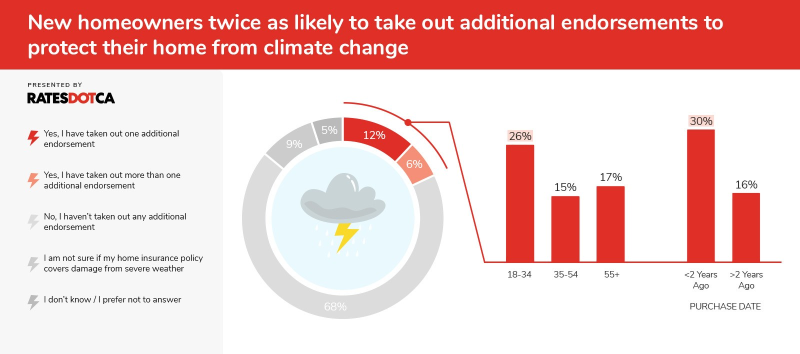

Finally, a third of homeowners who have purchased a home in the past two years took out additional endorsements to protect their home from climate change-induced extreme weather.

Young and new homeowners are more concerned about the effects of climate-induced extreme weather

Over a third of homeowners considered the risks of climate-induced extreme weather when deciding where to purchase a home. Twelve per cent of homeowners overall said that location was a significant factor in their decision, 12% said that location was a minor factor, and a further 12% said they did consider location, but it did not affect their decision.

Of the homeowners who did factor in the risks of extreme weather patterns, 64% were younger homeowners, aged 18 to 34.

Those who purchased their home less than two years ago were also twice as likely to consider the risks of climate-induced extreme weather (60%) as opposed to those (30%) who purchased a home more than two years ago.

“Canadian homeowners are paying closer attention to flood and wildfire risk when purchasing a home,” explains Dr. Blair Feltmate, head of Intact Centre on Climate Adaption at the University of Waterloo. “With the impact of [extreme weather] featuring almost nightly on newscasts, homeowners are also increasingly aware of how flooding in communities can affect a home’s value.”

This trend is making an impact on the real estate market. According to Feltmate, over the past 10 years, catastrophic flooding in communities across Canada led to an 8.2% drop in selling prices of homes in flood-prone areas. Feltmate also notes that approximately 10% of homes (1.5 million residences) across Canada are deemed “high flood risk,” which makes them ineligible for coverage in case the basement floods.

Related: What to know about wildfire season and insurance

“Insurance companies like State Farm are no longer offering new fire insurance coverage for homes in California, and Canadians living in the wildland urban interface are beginning to wonder if a similar rule might apply to Canada,” he says. That possibility is unlikely — in fact, the Insurance Bureau of Canada is actively working with the government to institute a national flood insurance program that ensures coverage for all homeowners living in flood-prone areas.

However, occasionally, insurance companies will place a freeze on writing new policies on homes facing imminent risks, such as during extreme wildfire events.

“Canadian homeowners are on alert relative to climate-driven extreme weather risks,” he adds.

However, 59% of the survey respondents that own a home did not consider climate-induced extreme weather when choosing where to purchase a house. Homeowners in the age groups of 35 to 54, and 55 and older were more likely to not consider risks posed by extreme weather, at 63% and 68% respectively.

A third of new homeowners have taken out additional endorsements to protect their homes

Among respondents who bought and insured a home in the last two years, 30% have taken out additional endorsements to protect their home from damage by climate-induced extreme weather.

This group of homeowners were twice as likely to take out additional endorsements than those who purchased more than two years ago (16%).

Just as they are more likely to factor climate change into their decision to buy a home, younger homeowners are also more likely to take out additional endorsements on their homes – 26% of those in the age group of 18 to 34 versus 15% and 17% in the age groups of 35 to 54 and 55 and older.

In general, those who considered the potential risks of climate-induced extreme weather when purchasing a home are three times more likely to take out an additional endorsement to protect their home (32% versus 11% of those who didn’t consider it.)

Does home insurance cover damage from extreme weather conditions? One-in-ten people don’t know

Nine per cent of homeowners in this survey are unsure if their home insurance policy covers damage from severe weather. Damage from wind, hail, snow or rain is typically covered by most home insurance policies, as is damage from fire.

Daniel Ivans, a RATESDOTCA insurance expert explains that all risks, comprehensive, fire, and extended coverage insurance packages will cover fire damage, which also includes damage from wildfires

However, home insurance policies may not cover unexpected extreme weather events like earthquakes, tornadoes or floods.

“Consumers will want to double-check their policy limits for water claims,” Ivans adds. “Some companies will often limit these coverages, which might leave a consumer vulnerable in the face of a devastating or total loss.”

Coverage for water damage can vary by insurance company, and homeowners should ensure that they’re getting the proper insurance coverage to protect themselves in the event of a water claim. One example is the overland water endorsement, which provides coverage for damage caused by rising or overflow of any body of water, such as a flood.

Insurance can be expensive, but it’s often worth the price

While these endorsements can cost a bit extra, proactively insuring your home against the effects of extreme weather can save your finances if disaster strikes.

Ivans explains that damage caused by windstorms, water, and fire claims can lead to some of the most financially devastating losses.

“When a consumer has a fire claim or a water damage claim, belongings need to be replaced and rooms — in some cases, entire dwellings — need to be rebuilt and furnished,” he says.

“As a general rule of thumb, the more losses that are paid out in a particular area, the more expensive insurance is. Canadians are growing more alert to the risks posed by their surroundings.”

However, with inflation and extreme weather conditions, home insurance premiums are expected to increase across the country.

The best way to make sure you are covered for all unanticipated and extreme weather conditions – be it floods or wildfires – is to check the specific wording on your home insurance policy or speak with an insurance broker about your coverage requirements.

Methodology

An online survey of 1,525 Canadians aged 18+ was completed between June 2 and 5, 2023 using Leger’s online panel. For comparative purposes, though, a probability sample of 1,525 respondents would have a margin of error of ± 2.5 %, 19 times out of 20.

Don't waste time calling around for home insurance

Use RATESDOTCA to shop around and compare multiple quotes at the same time.

Finding the best home insurance coverage has never been so easy!

Get money-saving tips in your inbox.

Stay on top of personal finance tips from our money experts!