If you are not redirected within 30 seconds, please click here to continue.

Samedi: 10h – 16h HAE

If you are not redirected within 30 seconds, please click here to continue.

If you are not redirected within 30 seconds, please click here to continue.

30% of Canadians believe condos are no longer a good investment – Here's why

KEY FINDINGS

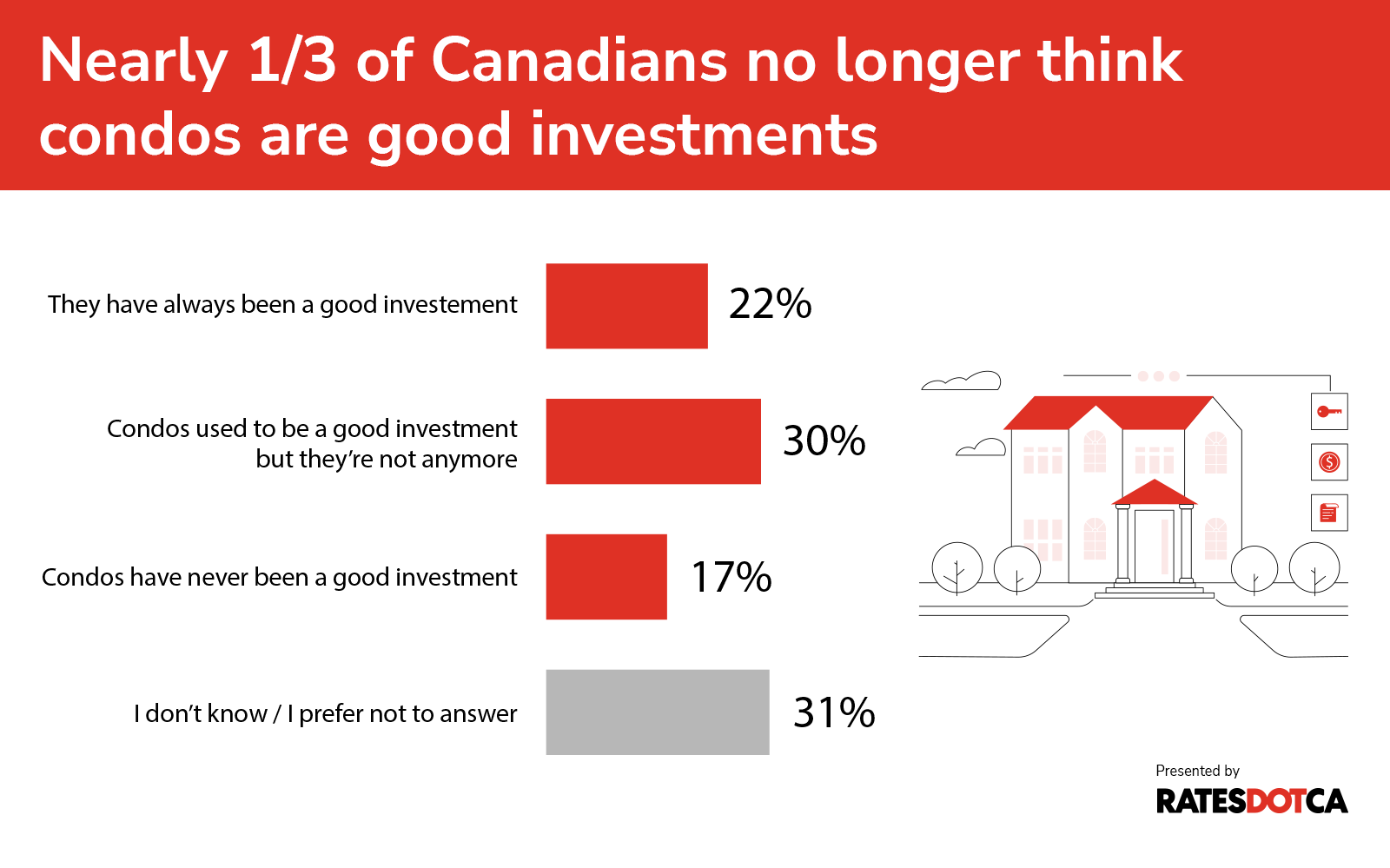

- 22% of Canadians view condos as a good investment despite rising costs and market uncertainty, but nearly one-third believe condos no longer hold investment promise.

- High inventory levels are putting downward pressure on prices, creating opportunities for buyers but challenges for sellers.

- Affordability remains a hurdle for many, as interest rates and rising costs make short-term profits less likely for investors.

- Falling interest rates spark cautious optimism, making lower mortgage payments possible and drawing first-time buyers back into the market.

Today, the housing market feels like it’s holding its breath. Economic uncertainty and fluctuating housing demand have sparked a wide range of opinions on whether it’s best to buy, wait, or sell. And for the last few years, investors and would-be homeowners have been split on whether condos are still a smart investment.

Even experts are divided, describing the market as a mixed bag—one filled with challenges like high inventory and negative cash flow risks.

Yet, for the right buyer, condos still hold potential. Those who are financially stable, informed about the risks, and prepared to play the long game may find opportunities to thrive in this market.

So, is investing in condos in 2025 the right move for you?

What is the state of the current condo market?

The Canadian condo market in 2025 is navigating choppy waters, shaped by the lingering aftereffects of the pandemic, shifting immigration patterns, and the ongoing trade war with the United States. Urban hubs like Toronto and Vancouver are particularly affected, as rising inventory and affordability issues reshape the market landscape.

“There's an abundant inventory coming up,” says Kevin Wong, a mortgage agent at Swivel Mortgage Group Inc. “Although the pricing has remained steady, we're actually seeing a decline in sales in the condo market.”

Oversupply is one of the most pressing challenges for the condo market. Years of booming pre-construction sales have led to a flood of units being completed in 2025, outpacing current demand.

“We’ve overproduced condos,” says Frank Clayton, co-founder and senior researcher at Toronto Metropolitan University (TMU)’s Centre for Urban Research and Land Development. “Since the late 90s, we’ve been producing thousands of condominiums across the country.”

Previously, he says, developers needed to pre-sell at least 80% of units before getting financing for construction. This caused a span of time of three to four years between sales and completion.

However, a lot can happen in three to four years. Namely, higher interest rates and immigration policy changes. As of last year, for example, Canada decided to reduce permanent resident admissions. According to the Government of Canada, the targets were reduced from 500,000 permanent residents to 395,000 in 2025, from 500,000 to 380,000 in 2026, and now set at 365,000 for 2027.

While this policy addresses infrastructure and labor market challenges, it has also led to softer housing demand.

So, as of now, it’s expected that “prices are likely to go down before they go up,” Clayton adds, highlighting the continued downward pressure on the market.

How much do condos cost across Canada?

Condos remain a more affordable alternative to detached homes, but their affordability varies significantly by region.

Wondering how much more income you need to make to afford a house? Read our mortgage report here.

National average

- Average condo price: $520,100

- Required income: $125,500

- Median family income: $124,672

- Income gap: -$828

On average, Canadians face a modest shortfall of $828 when trying to afford a typical condo, but regional differences tell a very different story.

Vancouver

- Average condo price: $768,200

- Required income: $182,000

- Median family income: $133,947

- Income gap: -$48,053

Vancouver residents face steep income shortfalls for condos, driven by high demand and limited supply.

Toronto

- Average condo price: $662,200

- Required income: $158,000

- Median family income: $136,535

- Income gap: -$21,465

Toronto continues to see sharp disparities, with condo prices consistently surpassing income growth. According to Clayton and Wong, buyers often face delays in purchasing or look for smaller, more affordable units further from the city core.

Halifax

- Average condo price: $466,000

- Required income: $113,000

- Median family income: $117,877

- Income gap: +$4,877

Halifax offers a small surplus, providing more accessibility for its residents. However, migration-driven demand and limited development resources still challenge the market.

Montreal

- Average condo price: $420,600

- Required income: $102,500

- Median family income: $122,946

- Income gap: +$20,446

Montreal is one of the few major cities where incomes significantly surpass what's needed to afford a condo. However, rising property taxes and unforeseen costs can still pose challenges.

Calgary

- Average condo price: $344,900

- Required income: $84,500

- Median family income: $147,643

- Income gap: +$63,143

Calgary leads among cities with income surpluses. Affordable prices and strong economic diversity make it an attractive location for first-time buyers and investors alike.

Edmonton

- Average condo price: $197,800

- Required income: $49,700

- Median family income: $141,604

- Income gap: +$91,904

Edmonton offers the largest surplus, with condos widely accessible for residents. Consistent inventory and affordable construction costs keep the market stable and welcoming.

Wong observes, "urban cores like Toronto have hit pricing points where entry seems out-of-reach for many buyers.” He views Alberta, with its lower-priced properties and “landlord-friendly regulations,” as a standout for investors.

"Alberta markets aren't as dependent on investors, unlike places with heavy foreign buying interest," he added. This results in accessibility for local buyers and stronger rental yields in Calgary and Edmonton.

While condos remain a more affordable option, especially in provinces like Alberta, the question of whether they still hold their value as an investment is a growing concern among Canadians.

How we calculated qualifying incomes for condos

We started with the average median economic family income for each city, using 2022 data from Statistics Canada and adjusting for annual wage growth percentages based on estimates from Normandin-Beaudry. This provides an updated profile of today’s Canadian condo buyer.

We based condo prices on the average condo prices listed in the MLS® Home Price Index as of December 2024.

We followed insured mortgage guidelines, including a minimum down payment of 5% on the first $500,000 and 10% on amounts above that.

Calculations are based on a qualifying stress test rate of 6.7%, assuming an average five-year fixed mortgage rate of 4.7%, plus an additional 2% for the qualifying rate. For condos, property taxes, heating, and condo fees are also factored in. Other assumptions include a credit score of 680+, no debts, and a 25-year mortgage term.

Curious about what you qualify for? Try the mortgage stress test calculator and see how your numbers compare.

30% of Canadians no longer believe condos are a good investment

According to a recent survey by Leger for RATESDOTCA, about 30% of Canadians say condos were once a good investment but no longer hold the same appeal. Only 11% said they would buy a condo as an investment, while 57% stated they would not buy a condo for any reason. This tracks with what Wong has been seeing on the ground.

For him, there are two distinct types of investment buyers in the current condo market: The first is investor buyers, who purchase condos to generate returns. These buyers have grown more cautious.

“Investor confidence has definitely softened,” he explains, citing high borrowing costs and an oversupply of units as key factors, especially in the GTA. “Some of my investor clients are selling properties and reallocating their funds to other investments, like the stock market or high-growth regions like Alberta.”

The second type of buyer is a small group of seasoned investors who see condos as a long-term hold, betting on future market recovery.

Younger Canadians still view condos as a good investment

According to the study, 22% of Canadians believe that condos have always been a good investment.

Younger Canadians aged 18-34 (28%), homeowners (26%), and those living in urban (24%) and suburban areas (23%) more likely to believe that condos are a good investment.

For end user buyers, especially younger first-time buyers aged 18 to 34, the appeal of condos remains steady. Wong notes that condos remain one of the most affordable ways for this group to enter the housing market.

“Condos are the lowest point of entry for many people,” he says.

Condos are losing money for investors

While condos are still an achievable entry point into the housing market for younger Canadians, the financial landscape has shifted for investors. High interest rates, lower rental returns, and falling resale values have put significant pressure on investment opportunities in the condo sector. Here are the factors at play:

High interest rates

During the COVID-19 pandemic, many first-time investors in Canada started buying properties because prices were lower and borrowing was cheap, Wong notes. Interest rates were very low, making it easy to get loans.

Later, the overnight rate increased to 5%, making it harder for these investors to keep up with the cost of their properties. Now, rates have dropped to 2.75%, but they are still higher than when the condos were first purchased, reducing their profits.

As Davelle Morrison, a Toronto-based real estate broker, explains, investors might have previously managed monthly losses of $100 to $200, confident they could recoup these through long-term appreciation. Today, however, monthly financial strain has escalated significantly, with carrying costs ranging from $500 to $700 in many cases.

Lowering rents

On top of this problem is the slowing rental market. After significant rent price increases during the pandemic, rent growth started to slow down. According to data from Statistics Canada, while rent prices remain high, the rate of increase has moderated, reflecting a cooling in the rental market.

For example, according to the April2025 Rentals.ca Rent Report, “average asking rents in Canada decreased 2.8% from a year ago to $2,119 in March, marking the sixth consecutive month that rents decreased on an annual basis.”

“The math for investors doesn't make sense the way it used to,” says Morrison, adding that carrying costs like property taxes, maintenance, and repairs keep increasing. Combined with stagnant or lowering rental incomes, investors can no longer justify holding onto these properties.

Lower resale value giving less bang for their buck

Resale trends paint an equally challenging picture. Morrison notes that condos that used to sell quickly within two or three weeks are now lingering on the market for 45 to 60 days.

Sellers, in many cases, are simply breaking even or even taking financial hits when selling their units. The long-standing belief that property appreciation would offset monthly losses is now being challenged, as property values are no longer climbing at the rates investors once relied upon, Morrison explains.

For many, the return on investment has diminished to the point where selling feels more like damage control than profit-making.

45% of non-homeowners planning to buy are considering condos

According to the survey, nearly half (45%) of non-homeowners who are planning to buy are considering condos.

In addition to younger buyers, higher-income households earning $100K or more annually tend to view condos more favorably. Regionally, those outside Quebec and current homeowners show a stronger inclination to purchase or invest in condos.

According to Wong, one of the reasons why first-time homebuyers are considering condos is location. Urban hubs and areas with strong transit links continue to attract interest, even as the overall enthusiasm for condos has cooled. Increased supply and various government incentives to support first-time buyers are also making condos an attractive option for this segment.

So, while some view the condo market with skepticism, others continue to see value depending on their needs and goals.

Condos, especially in urban areas, often cater to individuals or couples prioritizing affordability and location over space. Clayton highlights this trend, noting, “the condominiums we’ve been building across Canada have been very small, and to make them more affordable, even got smaller. But for renting that’s not a terrible thing because that’s what’s affordable to renters.”

However, the shift toward investor-targeted, smaller units has created a noticeable disconnect between what the market offers and what many buyers now prefer. First-time homebuyers may start with condos, but as their needs evolve, they often seek larger and more family-friendly spaces. Clayton adds, “they’re not going to go buy a very small one-bedroom condo that some investor had.”

Ultimately, many condos are designed with short-term rentals in mind, which makes it harder to create stable, owner-resident communities and leaves fewer options for those looking for permanent homes.

The decline of preconstruction condos

A rise in unsold units has made it harder for developers to secure the funding needed for launching new projects. As a result, the Canada Mortgage and Housing Corporation (CMHC) expects housing starts, including new condos, to decline.

This trend is especially apparent in Ontario, where preconstruction condos—which often rely on investor buying power—are struggling, according to The Globe and Mail report.

The report notes that rents are often insufficient to cover investors’ mortgage payments, maintenance fees, and taxes, leading to a 15% drop in preconstruction condo prices in Toronto at the end of 2024.

Meanwhile, British Columbia’s slowdown has been milder, thanks to a strong resale market and less dependency on investors. Alberta appears even more insulated, as more condo buyers there are residents, not investors.

These regional differences may shape how the condo market evolves across the country, but the overarching trend is clear, while condos offer an important entry point for young buyers and renters, the market’s focus on small, investor-driven designs is limiting their broader appeal.

Looking ahead

The Canadian condo market in 2025 is at a crucial moment. Experts say that while prices might drop in the short term, there is careful hope for recovery in the future if certain conditions are met.

Wong highlights key factors shaping the market. “If all remains the same – meaning elevated inventory levels, flat interest rates, and ongoing uncertainty persist – I anticipate condo prices to either remain flat or trend slightly downward in the near term,” he explains.

Wong suggests that as these pressures ease, condo values might start to recover, probably in the second half of the next five years.

In the meantime, Wong advises buyers to focus on choosing the right location and type of property to get the best long-term value.

“If you’re purchasing a condo to live in and not focusing on short-term profits, you’re likely to build equity and gain value over time,” he adds.

Clayton also advises caution for investment-focused buyers in the current market. “It’s not a good time to look at buying a condominium as an investment right now because there’s just an oversupply and prices are likely to go down before they go up,” he says.

Clayton predicts prices will continue to decline over the next two to three years before stabilizing. He anticipates that as fewer new condos are built, prices could begin to rise again in four to five years.

Short-term volatility and oversupply challenge the market today, but longer-term trends like population growth and reduced development suggest potential for recovery.

If you're planning for your next big purchase, like financing a home, make sure to compare mortgage rates and find the option for your needs.

Methodology

An online survey of 1,568 Canadians was completed between March 14 and 16, 2025, using Leger’s LEO panel. For comparative purposes, a probability sample of this size yields a margin of error of ±2.5% (19 times out of 20). Results were weighted by gender, age, region, education, and language based on Statistics Canada data.

Find a mortgage broker

Engaging a mortgage broker before renewing can help you make a better decision. Mortgage brokers are an excellent source of information for deals specific to your area, contract terms, and their services require no out-of-pocket fees if you are well qualified.

Here at RATESDOTCA, we compare rates from the best Canadian mortgage brokers, major banks and dozens of smaller competitors.

Get money-saving tips in your inbox.

Stay on top of personal finance tips from our money experts!