If you are not redirected within 30 seconds, please click here to continue.

Samedi: 10h – 16h HAE

If you are not redirected within 30 seconds, please click here to continue.

If you are not redirected within 30 seconds, please click here to continue.

Damage control: How AI is transforming home insurance claims and beyond

Canada is facing serious climate issues. The country is heating up at more than double the global average, according to Natural Resources Canada, which is leading to more frequent and severe weather events.

While 2023 was a record-breaking year for wildfires, with over 6,000 fires burning more land than the size of England, flooding remains the most common and costly disaster in Canada, with two in 10 Canadian homes being at risk of flooding.

Then came the summer of 2024. Calgary got hit by hailstorms, Toronto and Montreal faced floods, and wildfires in Jasper forced over 20,000 people to evacuate. These events caused $7.7 billion in insured damages, making it the most expensive summer for weather-related insurance claims ever, according to the Insurance Bureau of Canada.

Amidst this climate chaos, homeowners are increasingly turning to their insurance providers for answers on how to protect their homes.

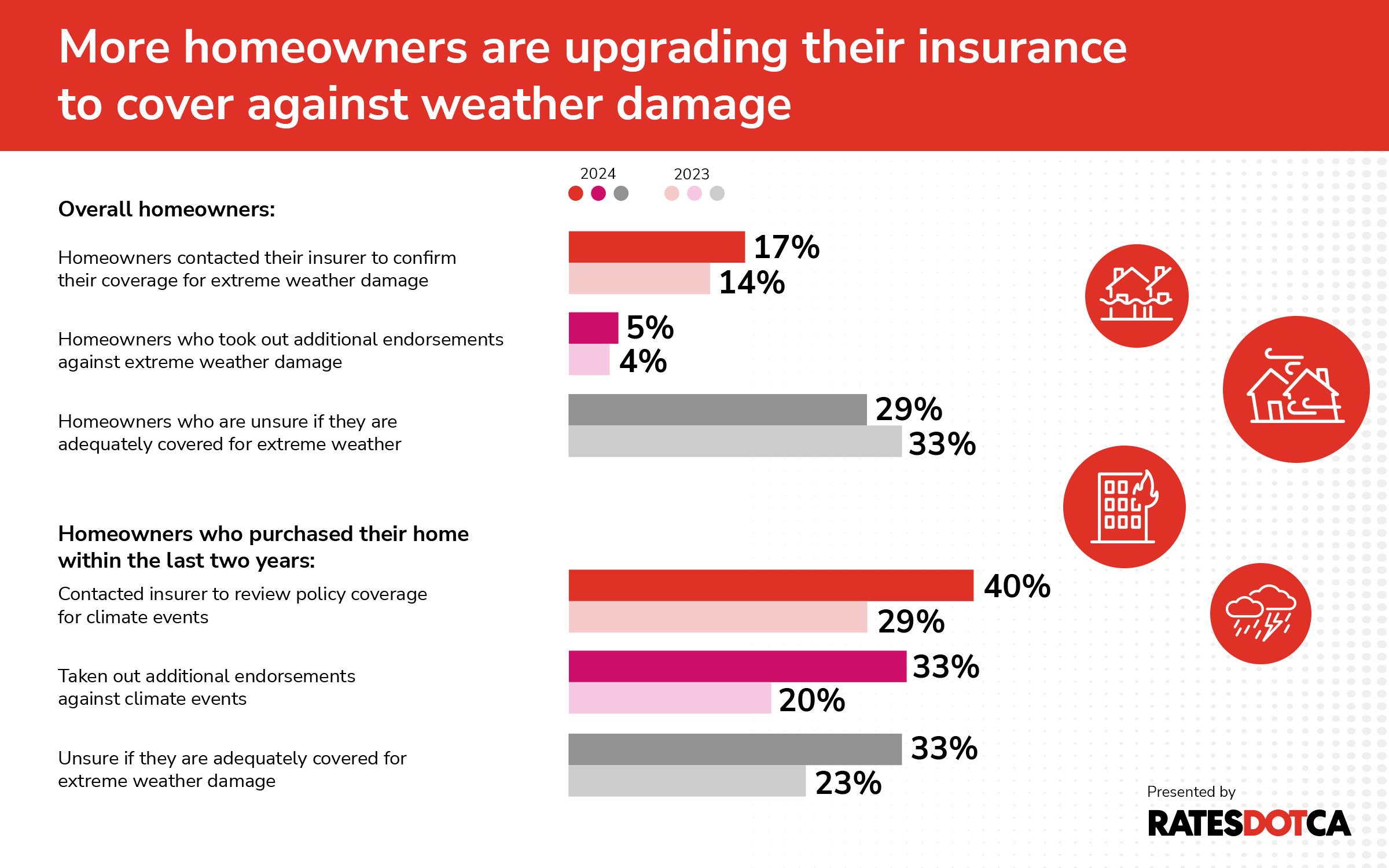

A Leger survey commissioned by RATESDOTCA found that 17% of all homeowners contacted their insurer to review their home insurance coverage in response to worsening wildfires and floods, an increase from 14% the previous year.

And new homeowners are more eager than ever to protect their biggest asset: One third of respondents who purchased their home within the last two years (33%) have added least one climate-related endorsement to their home insurance, an increase from only 20% the year before.

The rising cost of climate change

The Insurance Bureau of Canada (IBC) reports that severe weather in Canada now causes insured losses that regularly surpass $2 billion each year.

In contrast, from 2001 to 2010, Canadian insurers faced an average of $701 million annually in weather-related losses.

In July 2024, Toronto and nearby communities experienced severe flooding with almost 10 centimeters of rain in just three hours. Morningstar BDRS confirms in a report that it is comparable to the 2013 Toronto flood, which caused around $1 billion in insured losses.

To help with the onslaught of claims resulting from Ontario’s flash flooding, the Financial Services Regulatory Authority of Ontario (FSRA) temporarily allowed insurers to use licensed adjusters, as well as employees from affiliate firms to help with claims processing.

If this past summer was any indication of what’s to come, the industry will need faster, quicker, more permanent ways to streamline claims and anticipate future risk as severe weather events continue to worsen. That’s where artificial intelligence technology can step in.

Read more: Climate Change: How Weather-Related Incidents Impact Insurance Rates

Facing higher risks of property damage, more homeowners are turning to their insurers for answers

A home is one of the most expensive purchases one makes in their life, and it can be easily flooded by a bad storm, pelted by hail, or burnt to a crisp in a wildfire.

The RATESDOTCA survey revealed that an increasing number of homeowners in Canada are contacting their insurers to make sure they’re adequately protected from extreme weather events in response to growing climate concerns.

In the same survey from September 2023, severe weather led 14% of all insured homeowners – and 29% of people who bought homes in the last two years – to reach out to their insurance providers to check their insurance coverage. By October 2024, these numbers ticked up to 17% and 40%, respectively.

There’s a similar uptick in homeowners who’ve taken steps to protect against climate change-induced weather patterns. In autumn 2023, 11% of all homeowners and 20% of new homeowners added at least one additional climate-related endorsement. By this past October, these numbers increased to 14% and 33%, respectively.

Additionally, the 2024 survey reveals that homeowners making less than $60K/year are significantly more likely to have contacted their insurance provider to make sure they have adequate coverage for extreme weather damage at 27%, compared to 14% of those that make $60-$100K and 16% of those that make more than $100K.

To manage the increasing claims and queries, insurance companies are increasingly turning to AI for customer service support and to find new solutions.

Laivly is an AI and automation platform for contact centers for brands of all industries, from insurance to consumer-packaged goods.

Brad Stastook, a manager of the project management office at Laivly says that AI is playing a crucial role in helping brokers and agents be more efficient and accurate, leading to enhanced customers communication, particularly as more homeowners look for "better, more cost-effective coverage” and for insurers to better keep up with that growth.

Laivly’s platform, for example, automatically transcribes and summarizes client calls, which speeds up the claims process and makes sure all details are correctly recorded. This frees agents to handle more complex tasks.

The AI tool also prompts agents to ask important follow-up questions, making interactions quicker and more meaningful.

"It can remind agents and brokers to go a level deeper... so it helps move the process to be faster and more accurate,” says Stastook.

Claims process must be “fair and fast”

Insurance broker and RATESDOTCA expert, Daniel Ivans, explains that one of FSRA’s main requirements is that the claims process must be “fair and fast,” so the faster the process the better it is for consumers as it reduces wait times.

For the insurance industry, a faster process using smart technology in this way makes operations more efficient, cuts down on administrative costs, and improves customer satisfaction.

“If AI is able to assist in speeding up the claims process – and there are indications that that that could be the case – then that could be a very good tool for the industry and for consumers,” says Ivans, who has used AI to help match consumers with the right insurance policies.

This efficiency is important as more homeowners change or update their insurance policies and file more claims, especially after the extreme weather events that have become seasonal in Canada.

Related: When to file and not file a home insurance claim

Can generative AI assess – or even prevent – costly damages?

In addition to offering more personalized customer service and information to clients, generative AI is increasingly being used to assess and predict risks and set policy premiums.

Insurance companies have traditionally predicted risk by relying on historical data and statistics. They look at past events to guess what might happen in the future, using patterns and trends seen over time.

For example, insurers might assess whether a property is more prone to flooding by examining its location, historical flood data, and weather patterns. By doing so, insurers can set premiums and design policies that accurately reflect the level of risk associated with insuring a particular property or individual.

Actuaries, or risk experts, analyze factors like demographic details and past claims to assess risk. However, these methods can be slow to adapt when new data comes in and might struggle with predicting new types of risks.

“We reached an inflection point where our current models don't work anymore because of the changing climate and it no longer captures the reality of the situation we are in,” says Moustafa Naiem Abdel-Mooty, a researcher and instructor at McMaster University.

He is also the founder of Resiliō Climate Solutions, a company that provides predictive climate data risk analytics, working with insurers and other businesses.

“AI, in its essence, is a way for us to predict what is going to happen and drive insights from it,” he adds.

Instead, platforms like Resiliō can quickly process large amounts of data and offer more accurate predictions. Unlike traditional methods, smart technology keeps learning and updating, helping insurance companies adjust to changes and better manage risks.

Brad Stastook at Laivly says that large insurance companies in Canada are already integrating generative AI into their risk models.

“Predicting risk is aided by AI because of its ability to digest large data sets,” he says, adding that AI is already in use for analyzing profile of vast number of properties and weather patterns to quantify risk effectively.

Even as weather patterns become increasingly unpredictable, Stastook notes that this unpredictability is now part of the risk assessment, capturing the current reality we are in.

"You still need all that historical data (not just new data) to feed into your unpredictability for the future,” he says. Current models and their past data remain very valuable and necessary.

By connecting these data points, including assumptions about storm frequency and intensity, companies can create advanced models that effectively manage future uncertainties.

Rising flood risks and insurance challenges

Floods are happening more often and getting worse, which makes home insurance expensive for people living in risky areas.

In Canada, more than 1.5 million homes are at high risk of flooding, and the households that are at highest risk of flooding either can't afford or don't have access to home insurance.

According to data provided by the RATESDOTCA home insurance quoter, in June 2024, 50% of all home insurance quotes added water endorsements, an increase of 68% from the previous year.

In June 2024, overland flooding and sewer backup were the most common water endorsements, each making up 37% of total quotes. Groundwater made up 26% of quotes.

However, even with these endorsements, homeowners might still be unable to get coverage due to high flood risks. It's reported by the IBC that about 10% of Canadians are uninsurable for flooding.

To tackle this, the Canadian government has proposed a national flood insurance program. This program, expected to be up and running in April of 2025, aims to provide affordable coverage for homes in high-risk areas.

But being able to provide coverage for all hinges on its ability to insure the highest risk homeowners – and relying on historical flood mapping is no longer cutting it.

Related: Is severe flooding making your home uninsurable?

Cities can avoid flooding altogether by relying on digital twin technology

It’s not just insurers that are relying on AI to assess risk. Cities across the world have are using AI to monitor and evaluate climate risk, and in some cases, even prevent it all together.

In Lisbon, where urbanization and rising sea levels have ramped up flooding risks, drones and censors across the municipality capture real-time spatial data to create a “digital twin” virtual model of the city.

This digital twin is a hyper-precise 3D model of the city, including buildings and existing infrastructure. It is on this model that data scientists and urban planners test out different flood mitigation plans and develop and new drainage model to mitigate future flooding risk.

Financially, it is estimated to avoid 20 floods over the next hundred years and save around EUR100 million by protecting buildings and infrastructure from damage, according to a report by Geospatial world.

Other companies are finding innovative ways to apply AI to flood mitigation.

Abdel-Mooty’s Resilio solution offers data-driven technologies like digital twin technology, which creates virtual replicas of physical objects and systems to track and prepare for damage caused by severe weather-related events, like flooding.

In the US, companies like Floodbase have developed their own advanced AI-based flood monitoring system that is 11% more accurate than current methods. The system uses deep learning and satellite data to create detailed, real-time flood maps. It covers large areas, providing hourly updates, which helps insurers better assess flood risks and offer more affordable policies.

And UK-based Fluvialycs is a consumer-facing platform that gives early warnings to homeowners of any floods coming their way. Their system is trained with decades of recorded hydrological data and integrates real-time information from multiple rainfall and river level stations. The company states that it can predict floods up to three days in advance with 85% to 95% accuracy.

Around the world, private companies are racing to apply AI solutions to both track the pace of climate change and provide solutions that help slow it down. Currently, AI is being used to monitor the pace of iceberg melt, improve waste management, and even help speed up reforestation in Brazil.

Looking ahead

However, when it comes to solving our current crises, Canada’s insurance companies are still fighting their own unique battles. Currently, in Canada in particular, Abdel-Mooty says insurance companies are developing data-driven models separately, each working on their own without sharing or collaborating. This means there's no standardized method of determining risk.

Much like climate change itself, new AI technologies are "like a train, it's moving, and it will never stop," says Abdel-Mooty. “It's happening whether we like it or not to get the most out of it depends on how smart and how efficient we are.”

“People are starting to see that it's actually going to benefit everyone, not just the Insurance companies, but the people that they insure,” he adds.

Learn more: Rebates for climate-friendly changes to your home

Methodology

An online survey of 1,555 Canadians was completed between October 11 and 13, 2024, using Leger’s online panel. For comparative purposes, a probability sample of 1555 respondents yields a margin of error no greater than ±2.5%, (19 times out of 20). Results were weighted by gender, age, region, area, income, employment status, children in household, education, mother tongue, and ethnicity.

Don't waste time calling around for home insurance

Use RATESDOTCA to shop around and compare multiple quotes at the same time.

Finding the best home insurance coverage has never been so easy!

Get money-saving tips in your inbox.

Stay on top of personal finance tips from our money experts!