If you are not redirected within 30 seconds, please click here to continue.

Samedi: 10h – 16h HAE

If you are not redirected within 30 seconds, please click here to continue.

If you are not redirected within 30 seconds, please click here to continue.

A growing wealth gap stands between housing haves and have-nots

Table of Contents

With easing interest rates, some may be wondering if home buying might actually be attainable this fall season. However, even with lower rates, housing prices themselves remain stubbornly high, making it difficult for many Canadians to afford a home.

However, interest rates are only one part of the issue of housing affordability.

In 2024, Canada saw its income gap hit the highest level since 2008, according to Statistics Canada. In the first quarter of the year, the richest Canadians (the top 20% of the wealth distribution) accounted for just over two-thirds of the country’s net worth. Meanwhile, the bottom 40% accounted for only 2.8%.

This wealth disparity has spilled over into the real estate market, keeping the dream of owning a home out of the hands of many working Canadians. But just how bad of a problem is it, and what needs to be done to even the playing field for homebuyers?

Interest rates driving income disparities across households

High interest rates did more than make it harder for people to afford homes – they played a significant role in widening the income gap in Canada.

In the first quarter of 2024, 20% of high-income households saw a 7.7% boost in disposable income, according to a StatsCan report. Much of that boost was thanks to higher investment returns and increased yields from savings accounts.

The lowest income households saw their wages go up by 24.6%, which was just enough to cover the 20.8% increase in their interest payments. This means their disposable income improved somewhat, even with the extra debt costs.

Meanwhile, the middle 60% of households saw their income share drop by 1% because rising interest rates hit them harder. Their wage gains weren't enough to keep up with the increasing interest costs, affecting their disposable income more significantly.

This growing gap makes it challenging for both lower- and middle-income individuals to save for homes, especially as their earnings struggle to keep up with the rising cost of living, including essentials like rent and food.

Meanwhile, the wealthy have only gotten wealthier, and home prices, like all other costs, just seem to keep going up.

Read more: What is a debt-to-income ratio and how does it affect you?

How much do Canadians need to earn to afford a home now?

This fall is expected to bring a shift to the Canadian real estate market. With interest rates dropping, real estate watchers are anticipating potential buyers to re-enter the market.

A report from Re/Max Canada predicts a slight increase in average home prices in most Canadian cities by the end of the year. The report predicts prices will rise from one to six percent in around three-quarters of markets across the country, compared to early 2024.

Even though people are starting to feel more positive about the market this season, Canadians still struggle to afford homes due to insufficient supply, according to Christopher Alexander, president of RE/MAX Canada, in the report.

Even though loans are getting cheaper, this won't make housing affordable in the long term. As the market shifts and more buyers return, home prices are likely to increase.

Read more: Looking for a new home? Why you need to pre-qualify first

How much more income do you need to earn to afford a home in your city?

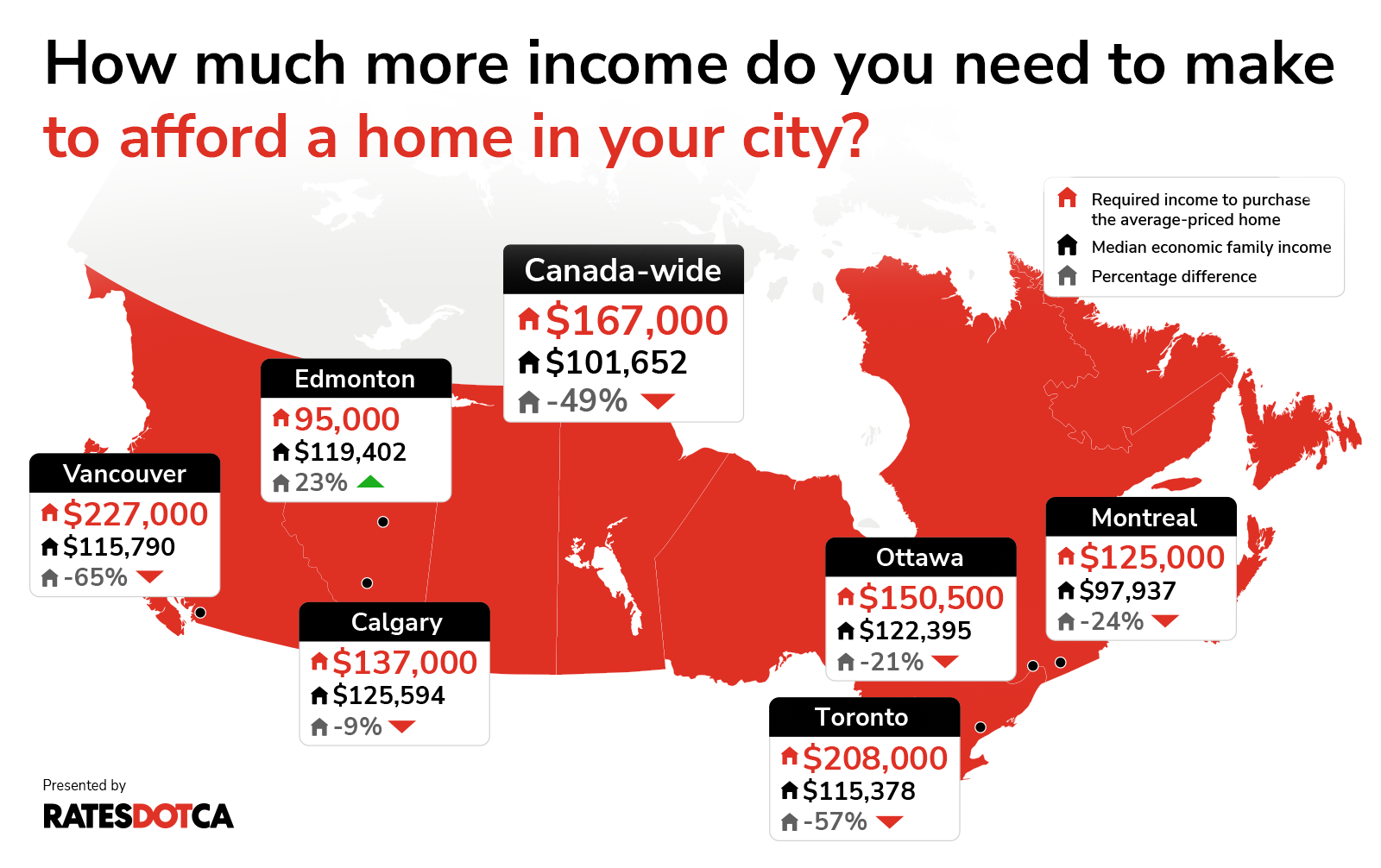

RATESDOTCA compared the median economic family income with the amount actually required to purchase a home in cities across Canada.

According to the MLS Home Price Index tool, the average home price in Canada for July was $724,800. In order to qualify for a mortgage of that amount, one would need an income of $167,000.

Meanwhile, the estimated median economic family income is $101,652 –the average family would have to scrabble together just over $65,000 more a year to qualify for a mortgage for the average-priced home.

The same story unfolded across most cities in Canada: The income needed to purchase a home was significantly higher than the income that most families were making – sometimes reaching nearly $100,000 more needed a year.

Learn more: How much mortgage can the median household income afford in these cities?

How we calculated qualifying incomes

We collected the latest available median economic family income and adjusted the earnings with an estimated annual wage growth data from Normandin-Beaudry, a consulting firm, to set our average homebuyer profile.

For most of the country, average home prices are still under $1 million, meaning our homebuyer can qualify for mortgage insurance. For these mortgages, we assumed a 5% down payment with a 5-year fixed interest rate of 4.49% — however, in order to qualify for those mortgages, buyers need to qualify at a of 6.49%, based on the current CHMC stress test guidelines.

For uninsured mortgages (i.e., on homes costing over a $1 million, which is more common in cities like Toronto and Vancouver), we assumed a 20% down payment with a 5-year fixed interest rate of 4.89%.

Try our mortgage stress test calculator to see how you qualify!

Montreal

In Montreal, the average house price is around $533,100. To buy a home, families usually need about $125,000 in income, but the median economic family income is just $97,937. That leaves a financial gap of $27,063, making it tough to afford a home in the city.

Ottawa-Gatineau

Ottawa-Gatineau is dealing with similar challenges, with average house prices hovering around $648,900. Families here need to make about $150,500 to buy a home, while the median economic family income is $122,395, resulting in a gap of $28,105.

Toronto

Toronto is still one of Canada’s toughest housing markets. The average house price in the GTA is a staggering $1,097,300, so you’ll need an income of $208,000. With a median economic family income of $115,378, that creates a shortfall of $92,622, underscoring the serious affordability issues in the city.

Calgary

Calgary, on the other hand, offers a more manageable situation with an average house price of $588,600. Families need an income of $137,000, leaving a deficit of $11,406 compared to the median economic family income of $125,594. This makes Calgary a relatively more affordable choice than some of the other major cities.

Edmonton

Edmonton stands out positively when it comes to affordability. With an average house price of $399,700, families only need an income of $95,000 to purchase a home. Meanwhile, the median economic family income of $119,402, so families have a surplus of $24,402 – imagine what else you could do with that money!

Vancouver

In sharp contrast, Vancouver remains the least affordable city in Canada. Average house prices are pegged at $1,197,700, meaning you’ll need an income of $227,000. The median economic family income of $115,790 leaves a massive shortfall of $111,210.

The housing affordability gap comes down to inventory and income

These numbers reveal some big differences in housing affordability across Canada, and the issue is the starkest in the major cities of Toronto and Vancouver.

“The typical family can no longer afford the typical home, and this is more acute in Vancouver and Toronto, so people adjust their expectations,” says Benjy Katchen, founder of the Ontario-based real estate agency Wahi.

He explains that now most people buying a place in Toronto or Vancouver, are unlikely to find themselves in a detached home – more often than not, they’re starting out in a condo or going further away from Toronto, for instance, and ending up in Burlington, Ontario just to afford your own place.

However, even those spaces are becoming scarcer and scarcer in the face of surging demand.

According to a report on housing supply by TD, the number of new homes built kept pace with immigration until about 2016. But rapid population growth—over a million new residents in 2023 and another 770,000 expected in 2024—has made it harder and harder for builders to deliver the shelter that’s needed.

And with demand outpacing supply, the gap continues to widen. The Canadian Mortgage and Housing Corporation estimates we need 3.5 million more homes by 2030 to bring affordability back to early 2000s levels.

To tackle this, TD’s report says that governments are stepping in by removing taxes on rental projects and tweaking zoning laws in cities like Vancouver and Toronto, which could add about 10,000 new units each year.

“The long-term problem is the supply and that means prices won’t fall a lot,” Katchen says.

In early September, Governor Tiff Macklem said, after announcing that the Bank of Canada is lowering its key interest rate to 4.25%, that shelter price inflation remains the biggest contributor to overall inflation, accounting for 25% of the average consumer spending basket, despite some signs of easing housing costs.

“[Shelter] is a big part of what Canadians are spending on and is running over 8%, so it is going to be hard getting to 2% inflation when a quarter of your basket, a necessity, is running that high,” Macklem said.

Job trends drive a wedge between the haves and have nots

One of the reasons why the Bank of Canada was able to justify cutting the overnight interest rate from the pandemic high of 5% was due to the calming labour market, which included a rising unemployment rate that reached 6.6% in August 2024, as reported by StatCan.

This change in the economy is happening as the job market shifts. While full-time jobs still make up 82.5% of all employment, there’s a different trend emerging.

The Canadian job market shows a noticeable shift from full-time to part-time gigs. In August alone, part-time jobs increased by 66,000, while full-time roles decreased by 44,000, according to a StatCan report. This shows that part-time work is becoming more popularas businesses adjust to the uncertain economy. For workers, part-time gigs can mean less stable income and fewer benefits compared to full-time jobs.

“What we’ve seen is that the job market is slowing down,” says Benjamin Reitzes, managing director and Canadian rates and macro strategist at BMO Capital Markets.

The market slowdown is caused by an influx of new workers into the country, said Reitzes, adding that the income gap wasn’t as alarming when “wage growth was quite strong.”

And indeed, strong wage growth in recent months – average hourly wages increased by 5.0% year-over-year in August, following a 5.2% rise in July – has somewhat offset the cost of living crisis.

However, inflation has kept prices high, and the job market is cooling, Reitzes says. He pointed out the difficulties facing lower-income households as costs for goods, services, food, and particularly housing have steadily climbed.

“Job growth has not been good enough to absorb all the new people coming into the labor force,” says Reitzes. “And as that job market loosens further, it’s going to put downward pressure on wage growth.”

Will there be any improvements?

Unfortunately, in the short term, slow job growth and rising wage pressures - which occur when increased wages lead to higher prices for goods and services - will continue making it harder for Canadians to afford homes with their current incomes, says Reitzes.

“It's going to probably get more challenging in the near term and then that's really for all Canadians, at any income level,” says Reitzes. “With the labor market loosening it is challenging for workers and that will not help things going forward.”

He notes that falling interest rates could make housing more affordable. However, with housing prices rising, affordability will likely still be a challenge.

“I think on the bright side is that interest rates are coming down pretty much across the board,” Reitzes says. “The Bank of Canada are poised to continue (cutting rates). And so that that should help on the affordability side.”

Related: Then and now: How much more expensive is it to buy a home in 2024 vs. 1994?

What has the government done for home buying accessibility?

With the rising income gap making homeownership difficult, the Canadian government has rolled out measures to help make home buying more accessible.

Starting December 15, first-time homebuyers will be allowed to take out insured 30-year mortgage payment terms, up from the previous limit of 25 years, reducing monthly costs.

The insured mortgage limit is also increasing from $1 million to $1.5 million to support first-time buyers and promote new builds.

Insured mortgages require only a 5% down payment, making it easier for buyers. Uninsured mortgages, on the other hand, need a 20% down payment. By raising the insured mortgage limit to $1.5 million, people can now buy homes priced between $1 million and $1.5 million with just a 5% down payment, rather than the higher 20%.

Additionally, the Home Buyers’ Plan now allows up to $60,000 to be withdrawn from RRSPs for down payments. Coupled with the new First Home Savings Account, launched in April 2023, Canadians can save up to $100,000 tax-free for a home.

While these tools provide more options, many still depend on other sources like TFSAs or gifts for down payments.

Related: What does the federal budget for 2024 have to say about housing?

Compare Mortgage Rates

Engaging a mortgage broker before renewing can help you make a better decision. Mortgage brokers are an excellent source of information for deals specific to your area, contract terms, and their services require no out-of-pocket fees if you are well qualified.

Here at RATESDOTCA, we compare rates from the best Canadian mortgage brokers, major banks and dozens of smaller competitors.

Get money-saving tips in your inbox.

Stay on top of personal finance tips from our money experts!