If you are not redirected within 30 seconds, please click here to continue.

Samedi: 10h – 16h HAE

If you are not redirected within 30 seconds, please click here to continue.

If you are not redirected within 30 seconds, please click here to continue.

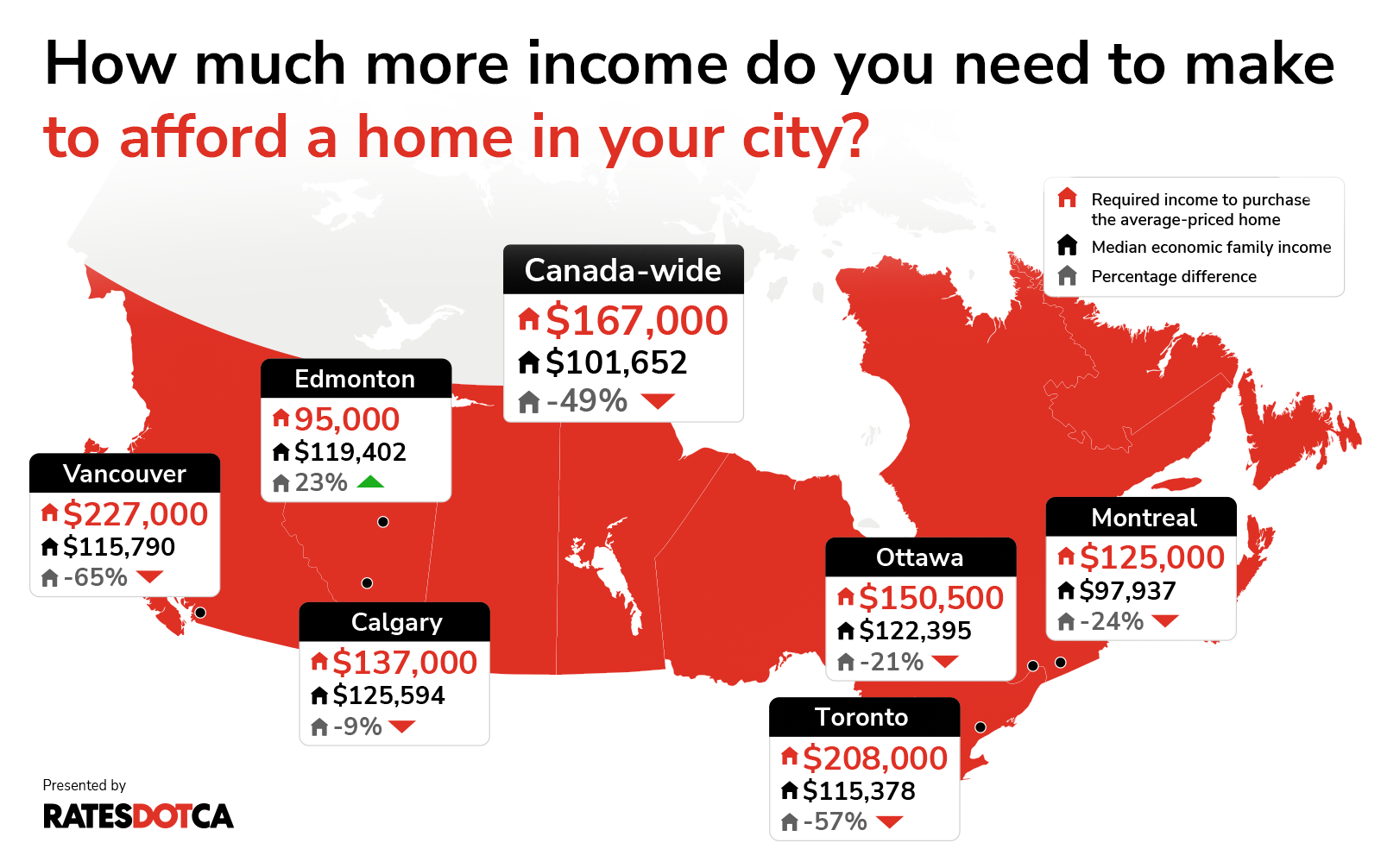

How much mortgage can the median household income afford in these cities?

High inflation and diminished purchasing power, combined with high home prices and borrowing costs, have left many Canadians wondering if the dream of homeownership will ever be within their reach.

While an ‘affordability crisis’ seems to be a growing concern for many in recent years – and with good reason – it’s worth breaking down what those words actually mean for Canadians. RATESDOTCA calculated the median after tax household income and the mortgage amount a family could qualify for and compared these figures with the average home price in each city.

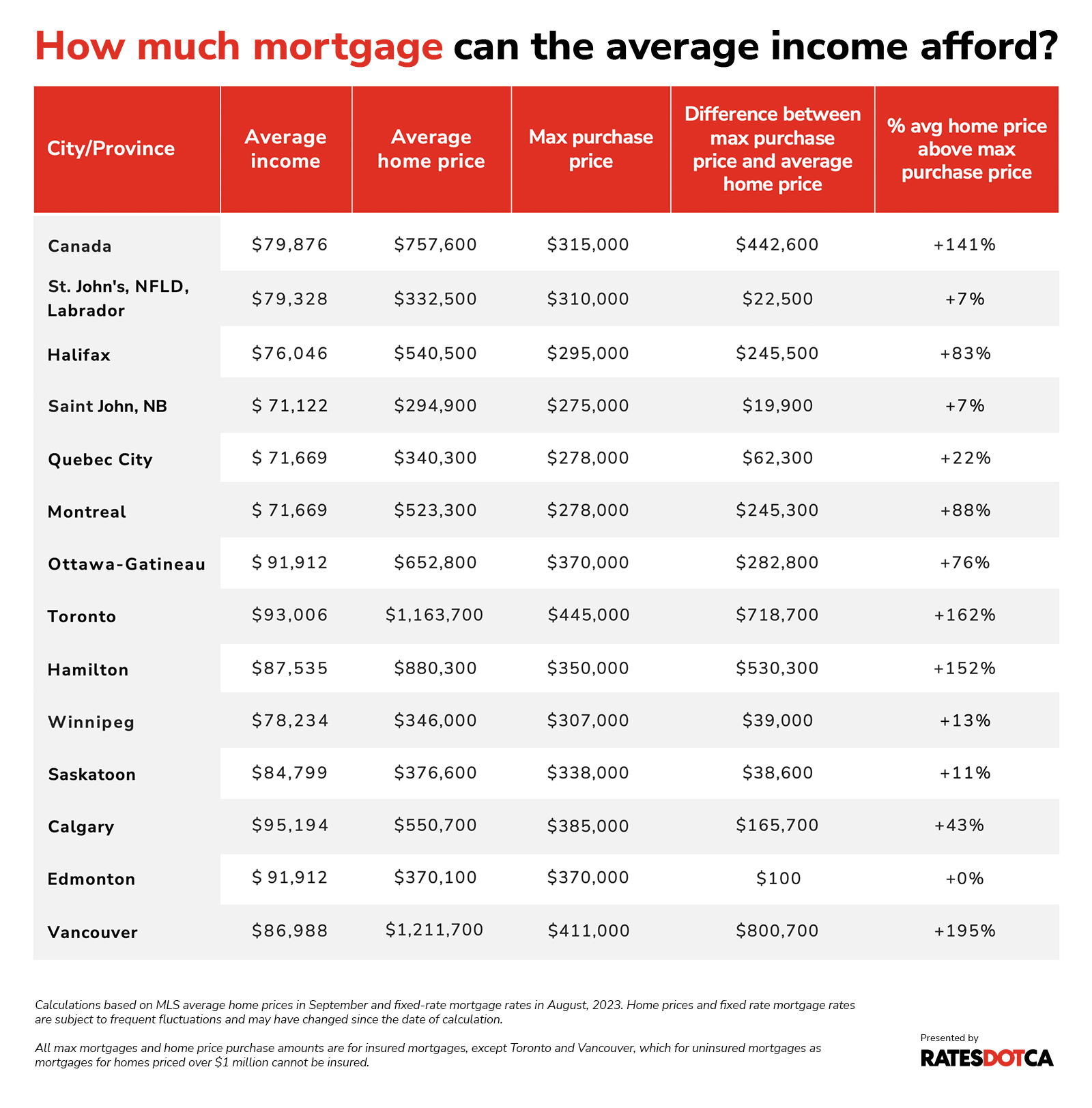

Nationwide, a Canadian household making the median income of $79,876, for instance, can afford a home of $315,000 with a maximum insured mortgage of $299,500. However, the average home price across Canada is $757,600. That means that the average home costs 141% more than what this family can afford — otherwise known as the maximum purchase amount.

Breaking it down by major cities, it turns out that homeownership is not only beyond reach, but in Vancouver and Toronto, it's nearly 250% and 210% more than what the average family can afford on a median income.

Here's how Canadian cities rank based on most to least affordable.

Edmonton

Median household income: $91,912

Maximum insured mortgage: $351,500

Maximum insured purchase price: $370,000

Average home price: $370,100

The average home price is just enough for someone to afford a home in Edmonton. Taylor Pardy, an economist with Canadian Mortgage and Housing Corporation (CMHC) highlights a few factors that have contributed to more accessible housing in Edmonton. Namely, new construction has been more responsive to changes in demand, home builders are able to keep up with demand, and lastly, slowed economic activity over the past few years.

“Following the significant decline in oil and gas prices in 2015-2019, economic activity in Edmonton (and Calgary) moderated a fair bit,” Pardy says. “This has allowed housing supply to catch up and maintain that ample supply for much of the past decade, leading to flat or even declining prices in certain segments of the housing market.”

Calgary

Median household income: $95,194

Maximum insured mortgage: $365,750

Maximum insured purchase price: $385,000

Average home price: $550,700

Just 300 kilometres south of Edmonton, the average home price in Calgary is 43% more than what the average household can afford.

While Alberta overall is generally considered more affordable than Ontario and British Columbia, Stampede City has seen heavier interprovincial and international migration in the past few months, resulting in a rise in the cost of housing.

Another reason for the rapidly heating housing market? Calgary’s emerging reputation as a high-tech hub, which has attracted a post-pandemic bump of new residents.

However, that could change soon, as more skilled professionals consider making the move to the greener – or rather, less expensive – pastures of Edmonton.

“Edmonton has generally maintained a higher inventory of homes for sale in existing and new home markets,” says Pardy. “Consequently, market conditions are not as tight as Calgary and buyers have more choice when shopping for a home or a unit to rent.”

Halifax

Median household income: $76,046

Maximum insured mortgage: $280,250

Maximum insured purchase price: $295,000

Average home price: $540,500

In Halifax, the average home price is 83% more than what the average household can afford.

Kelvin Ndoro, economist at CMHC states that there is a supply-chain imbalance in Halifax that has continuously pushed home prices and rents up.

“Demand for housing in the last few years has grown due to higher-than-normal population growth,” he says. “However, the supply of new housing units has not kept pace with demand, and some factors that can affect supply of housing can be construction costs, land prices, land-use regulations, and interest rates.”

Toronto

Median household income: $93,006

Maximum insured mortgage: $356,250

Maximum insured purchase price: $375,000

Maximum uninsured mortgage: $356,000

Maximum uninsured purchase price: $445,000

Average home price: $1,163,700

For anyone reading the news, it will come as no surprise that Canada’s largest city is becoming woefully unaffordable for many of its residents. Indeed, the average home costs a whopping $1,163,700, according to the MLS. That is a difference of $788,700, or 210%, more than what a regular household can afford – potentially the entire cost of a condo or home.

However, there’s another factor to consider. Mortgage insurers won’t insure a home of over $1 million, which increases interest rates and the required down payment, and decreases the amount a borrower can qualify for. In this scenario, the home price factored in the uninsured mortgage will be 162% more than what an average household can afford.

Read more: Looking for a new home? Why you need to pre-qualify first

Amidst the skyrocketing cost of living and dearth of affordable housing, Canada’s most expensive city has seen an exodus of young professionals moving out to the Maritimes and the Prairies. In fact, last year alone, the Conference Board of Canada recorded 24,000 people leaving the city for other parts of the country.

Aled ab Iorwerth, deputy chief economist at the CMHC, explains that over the past decade, factors of population growth, increased income, and low interest rates had drawn many professionals to major cities of Toronto, Vancouver, and Montreal. “But now, as demand is going up, these cities are quite slow in increasing their housing supply,” he says.

As immigration levels continue to rise, housing supply is failing to keep up with demand, which in turn is pushing home prices up.

Vancouver

Median household income: $86,988

Maximum insured mortgage: $329,650

Maximum insured purchase price: $347,000

Maximum uninsured mortgage: $328,800

Maximum uninsured purchase price: $411,000

Average house price: $1,211,700

The average home price is 249% more than what the average household can afford. And since the average home price is over $1 million, we included the uninsured mortgage amount, which is 195% more than what the average household can afford.

Faced with a housing crunch, young professionals have also started migrating out of Vancouver to Atlantic cities.

Some small hope in big cities

While demand and housing supply drives unaffordability, Iorwerth notes that all over Canada, increasing the supply of homes is a challenge as construction financing will be more difficult due to higher interest rates.

To cool the market across major cities of Toronto, Vancouver, Calgary, and Halifax, Iorwerth calls for an “all-hands on-deck approach” that involves all government and private parties working together to restore the housing market.

Some initiatives are already underway. For example, the Government of Ontario has introduced new housing reforms and pledges to increase construction. Meanwhile, the City recently committed $8 billion to speed up development processes and the use of government-owned land, which would open 7,500 new affordable homes and add 40,000 affordable rental units to the city.

The Federal government has also pledged $4 billion towards a Housing Accelerator Fund to help tackle the issue of lack of housing.

In the meantime, if you're considering an interprovincial move, our mortgage affordability calculator can help weigh in on your decision.

How did we calculate how much a household can afford?

We looked at Statistics Canada’s latest available data for median household after-tax income and factored in income growth projections for 2022. For average home prices, we turned to the Canadian Real Estate Association’s MLS composite index.

Mortgage calculations for insured mortgages are based on the following:

- 5-year insured fixed mortgage rate of 5.29% (The rate at the time of researching in August)

- With a qualifying rate of 7.29% 25-year amortization period

- 5% downpayment

- $3,000 per year in property taxes

- $100 per month for heating

- No condo fees

- No monthly liabilities

- And an Equifax credit score of above 680

- Mortgage amounts do not include the default insurance premium.

Similar calculations were also made for uninsured mortgages (but factor in a 20% down payment).

Fixed-rate mortgage amounts fluctuate regularly, and exact mortgage amounts may vary according to individual mortgage-holder's individual circumstances.

Compare Mortgage Rates

Engaging a mortgage broker before renewing can help you make a better decision. Mortgage brokers are an excellent source of information for deals specific to your area, contract terms, and their services require no out-of-pocket fees if you are well qualified.

Here at RATESDOTCA, we compare rates from the best Canadian mortgage brokers, major banks and dozens of smaller competitors.

Get money-saving tips in your inbox.

Stay on top of personal finance tips from our money experts!