If you are not redirected within 30 seconds, please click here to continue.

Samedi: 10h – 16h HAE

If you are not redirected within 30 seconds, please click here to continue.

If you are not redirected within 30 seconds, please click here to continue.

How much do you need to make to afford a used car in Ontario?

As most drivers are painfully aware, the cost of owning a car extends beyond the initial purchase or down payment. Monthly car loan payments, insurance premiums, fuel costs, and maintenance expenses all constitute the financial responsibilities that come with car ownership.

According to current StatsCan figures, one-in-three Canadians in October lived in a household that was having trouble meeting financial needs. When faced with budget constraints, individuals and households find themselves in a complex financial juggling act. Car loan payments are often one of the largest monthly expenses, and when competing with other essential costs like housing, groceries, and utilities, they can quickly become a financial breaking point.

Car ownership is a privilege that signifies freedom and opportunity, but the path to car ownership has grown more challenging — even when it comes to used cars. Amidst interest rate hikes and soaring inflation, many Canadians are struggling to keep up with ongoing car loan payments, which are also rising due to supply shortages and the persistent rise of borrowing costs.

Here’s what owning a used car looks like today across the country.

What affordability means when it comes to owning a car

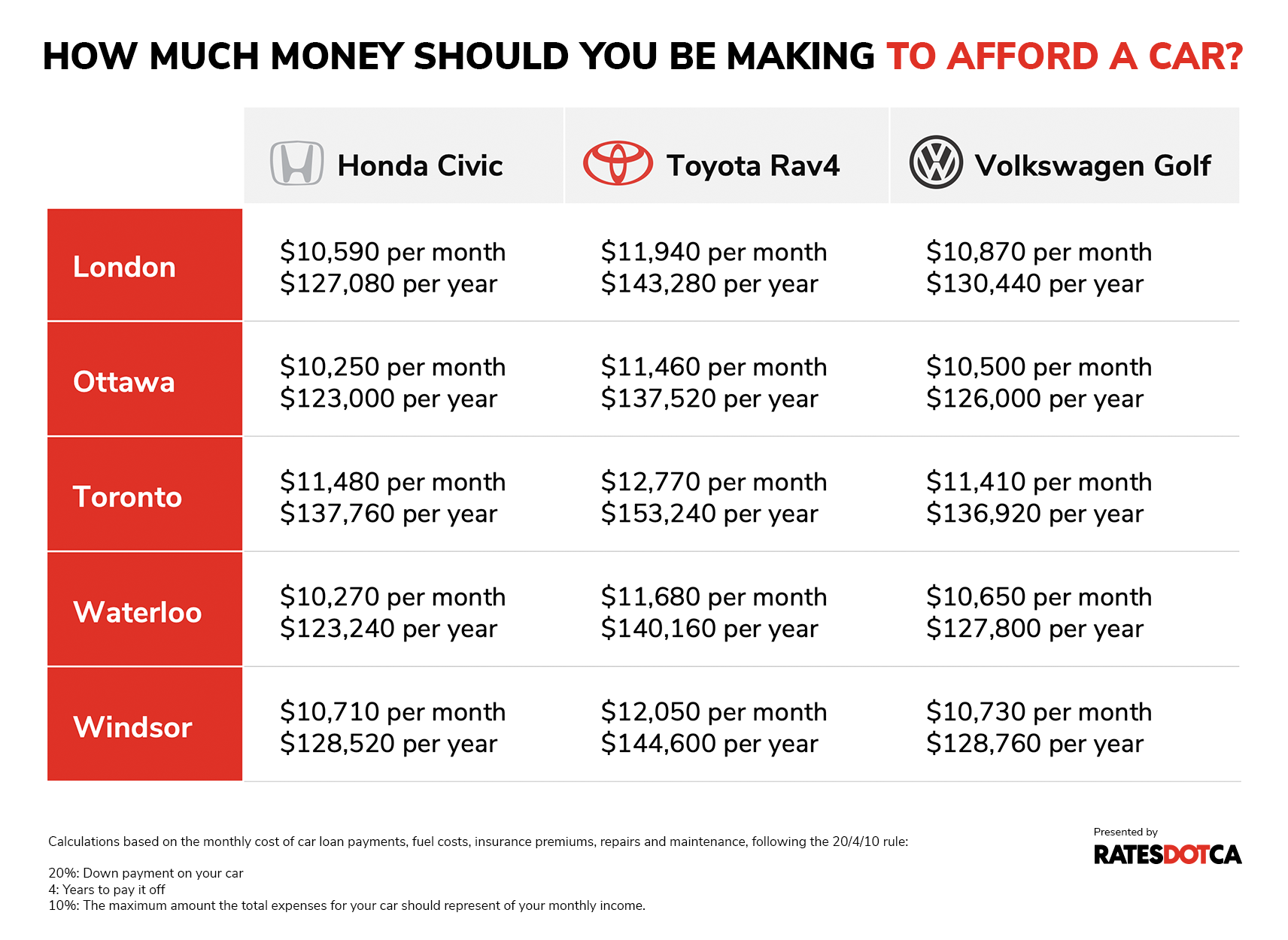

Universally, experts find that the 20/4/10 rule is a good way to not only organize your finances but understand what the right budget for purchasing your car is. The rule comprises:

20%: Down payment on your new car

4: Years to pay it off

10%: The maximum amount the expenses (car loan payments, fuel expenses, insurance premiums, repair and maintenance) per month should represent of your monthly income.

This will help ensure that you don’t overspend on your car and can afford other life expenses as well.

Related: Should you buy a car during a recession?

Does a used car fit your budget? What you can afford across Ontario

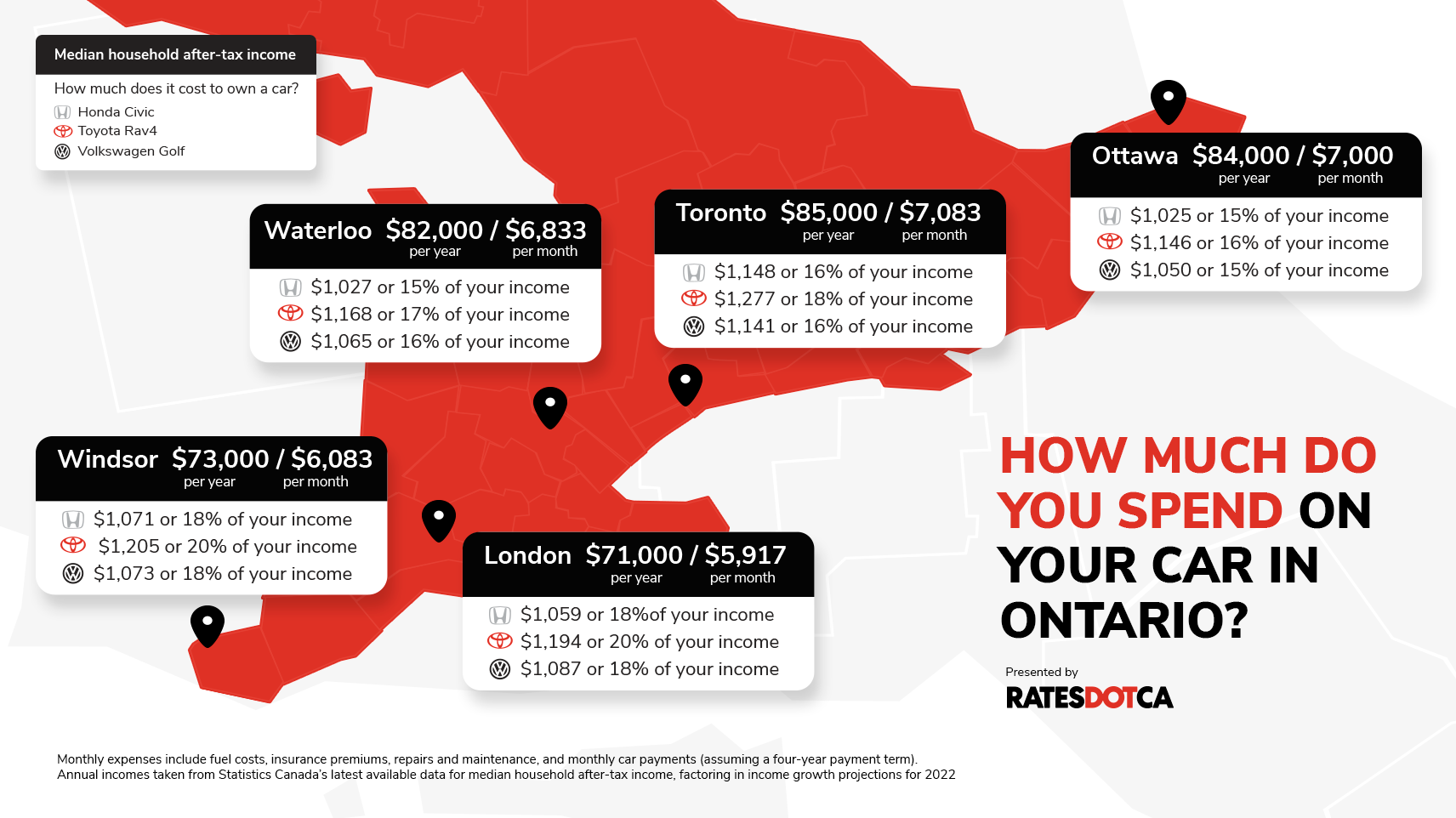

Following the 20/4/10 rule, we’ve calculated how much in monthly income a hypothetical person should spend on a car.

This calculation is based on the median after tax household income of a handful of cities across Ontario, and the average insurance premiums are based on the profile of a 35-year-old male driver with about 19 years of driving experience with no prior claims or convictions.

Keep in mind, your monthly premiums will differ based on your age, driving record, endorsements and any discounts you’re eligible for.

Toronto

Median household income after tax: $85,000 (or $7,083 monthly)

Honda Civic

A used 2019 Honda civic sedan CVT retails for an average of $24,900. Topped with a 13% sales tax, your price tag comes at $28,137. Following the 20/4/10 rule, if you put a 20% downpayment of $5,627, over a four-year loan period with an interest rate of 8.01%, your monthly payment comes to $549.64.

The average Honda Civic driver spends $143.75 monthly on fuel, and $349.33 monthly on insurance premiums. According to CAA, you can also expect to spend around $105.54 monthly on repair and maintenance. This includes routine upkeep (oil changes, tire rotations, and brake inspections) and repairs (replacing worn-out parts or engine problems).

As a result, the total monthly cost to own your car is $1,148. This means you’re spending 16% of your household income on affording one Honda Civic sedan.

To round out the 20/4/10 rule and keep your total monthly car expenses to 10% of your income, you would need to make at least $11,480 per month, or $137,760 per year.

Toyota Rav4

A used 2019 Toyota Rav4 LE AWD retails for $33,299 (after tax). Following the 20/4/10 rule, your monthly car payment comes to $650.46.

The average Toyota Rav4 driver spends $164.58 monthly on fuel, $287 on monthly insurance premiums, and $175.28 on repair and maintenance.

The total monthly cost to own a Rav4 comes to $1,277. That’s 18% of your monthly income on this popular SUV. To make your total monthly car expenses represent 10% of your income, you would need to make at least $12,770 per month, or $153,240 per year.

Volkswagen Golf

A used 2019 Volkswagen Golf GTI after tax retails for $31,513. Following the 20/4/10 rule, your monthly payment comes to $615.57.

The average Volkswagen Golf driver will spend $183.30 monthly on fuel, $228.75 on monthly insurance premiums, and $113.86 monthly on repair and maintenance.

Your total monthly cost to own your car comes to $1,141 — representing 16% of your household’s monthly income. To make your total monthly car expenses represent 10% of your income, you would need to make at least $11,410 per month or $136,920 per year.

Ottawa

Median household income after tax: $84,000 (or $7,000 monthly)

Honda Civic

MSRP for used 2019 model: $28,137 (with 13% sales tax)

Monthly car payment: $549.64

Fuel costs: $143.75

Insurance premiums: $226.33

Repairs and maintenance: $105.54

Cost to own: $1,025 or 15% of your monthly income

To keep your total monthly car costs under 10%, you need to make $10,250 per month, or $123,000 per year.

Toyota Rav 4

MSRP for used 2019 model: $33,299 (with 13% sales tax)

Monthly car payment: $650.46

Fuel costs: $164.58

Insurance premiums: $155.83

Repairs and maintenance: $175.28

Cost to own: $1,146 or 16% of your monthly income

To keep your total monthly car costs under 10%, you need to make $11,460 per month, or $137,520 per year.

Volkswagen Golf

MSRP for used 2019 model: $31,513 (with 13% sales tax)

Monthly car payment: $615.57

Fuel costs: $183.30

Insurance premiums: $136.83

Repairs and maintenance: $113.86

Cost to own: $1,050 or 15% of your monthly income

To keep your total monthly car costs under 10%, you need to make $10,500 per month, or $126,000 per year.

Waterloo

Median household income after tax: $82,000 (or $6,833 monthly)

Honda Civic

MSRP for used 2019 model: $28,137 (with 13% sales tax)

Monthly car payment: $549.64

Fuel costs: $143.75

Insurance premiums: $228.50

Repairs and maintenance: $105.54

Cost to own: $1,027 or 15% of your monthly income

To keep your total monthly car costs under 10%, you need to make $10,270 per month, or $123,240 per year.

Toyota Rav 4

MSRP for used 2019 model: $33,299 (with 13% sales tax)

Monthly car payment: $650.46

Fuel costs: $164.58

Insurance premiums: $178

Repairs and maintenance: $175.28

Cost to own: $1,168 or 17% of your monthly income

To keep your total monthly car costs under 10%, you need to make $11,680 per month, or $140,160 per year.

Volkswagen Golf

MSRP for used 2019 model: $31,513 (with 13% sales tax)

Monthly car payment: $615.57

Fuel costs: $183.30

Insurance premiums: $151.92

Repairs and maintenance: $113.86

Cost to own: $1,065 or 16% of your monthly income

To keep your total monthly car costs under 10%, you need to be making $10,650 per month, or $127,800 per year.

Windsor

Median household income after tax: $73,000 (or $6,083 monthly)

Honda Civic

MSRP for used 2019 model: $28,137 (with 13% sales tax)

Monthly car payment: $549.64

Fuel costs: $143.75

Insurance premiums: $272.17

Repairs and maintenance: $105.54

Cost to own: $1,071 or 18% of your monthly income

To keep your total monthly car costs under 10%, you need to be making $10,710 per month, or $128,520 per year.

Toyota Rav 4

MSRP for used 2019 model: $33,299 (with 13% sales tax)

Monthly car payment: $650.46

Fuel costs: $164.58

Insurance premiums: $214.67

Repairs and maintenance: $175.28

Cost to own: $1,205 or 20% of your monthly income

To keep your total monthly car costs under 10%, you need to be making $12,050 per month, or $144,600 per year.

Volkswagen Golf

MSRP for used 2019 model: $31,513 (with 13% sales tax)

Monthly car payment: $615.57

Fuel costs: $183.30

Insurance premiums: $160.58

Repairs and maintenance: $113.86

Cost to own: $1,073 or 18% of your monthly income

To keep your total monthly car costs under 10%, you need to be making $10,730 per month, or $128,760 per year.

London

Median household income after tax: $71,000 (or $5,917 monthly)

Honda Civic

MSRP for used 2019 model: $28,137 (with 13% sales tax)

Monthly car payment: $549.64

Fuel costs: $143.75

Insurance premiums: $260.25

Repairs and maintenance: $105.54

Cost to own: $1,059 or 18% of your monthly income

To keep your total monthly car costs under 10%, you need to be making $10,590 per month, or $127,080 per year.

Toyota Rav 4

MSRP for used 2019 model: $33,299 (with 13% sales tax)

Monthly car payment: $650.46

Fuel costs: $164.58

Insurance premiums: $203.67

Repairs and maintenance: $175.28

Cost to own: $1,194 or 20% of your monthly income

To keep your total monthly car costs under 10%, you need to be making $11,940 per month, or $143,280 per year.

Volkswagen Golf

MSRP for used 2019 model: $31,513 (with 13% sales tax)

Monthly car payment: $615.57

Fuel costs: $183.30

Insurance premiums: $174.58

Repairs and maintenance: $113.86

Cost to own: $1,087 or 18% of your monthly income

To keep your total monthly car costs under 10%, you need to be making $10,870 per month, or $130,440 per year.

The takeaway? Car upkeep is up. Looking at the city breakdown, following the 20/4/10 rule, you’re spending way more than you should be on maintaining just one car in the household. In an ideal world, your total cost including car loan payments, insurance premiums, fuel costs, repairs and maintenance should take up to 10% or less than your monthly take home income — these days, that means you should be earning upwards of $120,000 a year just to comfortably afford one of these popular models.

Costs are different, but no better, out west

Just to mix things up, we took a look at what it would cost to own the same cars in Calgary.

A few things set Alberta apart from Ontario. There’s also no provincial sales tax for car purchases there which significantly lowers car monthly payments for Calgarians.

While we’ve used a standard price model to factor in repairs and maintenance costs, urban areas generally have higher traffic, which can lead to increased wear and tear on vehicles and higher accident rates. Considering Alberta has lower population density or different traffic patterns than some Ontarian cities like Toronto, it could contribute to lower maintenance and repair costs. Let’s take a deeper look.

Calgary

Median household income after tax: $87,000 (or $7,250 monthly)

Honda Civic

For a used 2019 Honda Civic in Calgary, the retail price is $24,900. The price tag comes to $26,145 with the 5% GST. Consequently, your monthly car payment is $510.72, fuel costs amount to $143.75, and insurance premiums are $307.42. Additionally, repairs and maintenance contribute $105.54.

Despite lower car prices, the total cost to own a Honda Civic is $1,067, clocking in at 15% of your monthly income. To ensure your total monthly car costs stay under 10% of your income, you would need to earn $10,670 per month, or $128,040 annually.

Toyota Rav 4

A used 2019 Toyota Rav4 LE AWD retails for $30,941 (with GST). Following the 20/4/10 rule, your monthly car payment comes to $575.62.

The average Toyota Rav4 driver spends $164.58 monthly on fuel, $266.25 on monthly insurance premiums, and $175.28 on repair and maintenance.

The total monthly cost to own a Rav4 comes to $1,182. That’s 16% of your monthly income. To make your total monthly car expenses represent 10% of your income, you would need to make at least $11,820 per month, or $141,840 per year.

Volkswagen Golf

MSRP for used 2019 model: $29,282

Monthly car payment: $572.01

Fuel costs: $183.30

Insurance premiums: $266.92

Repairs and maintenance: $113.86

Cost to own: $1,136 or over 16% of your monthly income

To keep your total monthly car costs under 10%, you need to make $11,360 per month, or $136,320 per year.

Higher interest rates mean people are paying more for longer, even for cars

Looking at the data above, you might be tempted to wonder: Has the 20/4/10 rule ever been a reasonable expectation for car owners to follow?

The fact is, like seemingly everything else, car payment prices have increased dramatically over the past few years.

“In October 2023, average used car monthly payments were $652,” says Baris Akyurek, Vice President of Insights and Intelligence at Autotrader. “[Back in] 2019, it was $471. There’s a 38.8% increase for October over October of 2019 versus 2023.”

As of August 2023, car loan interest rates have reached 8.01 percent, a notable jump from the 6.79 percent recorded during the same month the previous year. This substantial increase in interest rates has implications for both new car buyers and those seeking financing for used vehicles – not just on their payments, but also on their loan terms.

“Back in 2020, the average loan term was around 67 months and in 2023, it's almost 72 months,” Akyurek says. “Consumers are paying more and for longer for their cars.”

That’s because as the cost of living rises, lenders often adjust their rates to account for increased lending risks and to maintain profitability.

Furthermore, the impact of global financial events and shifts in monetary policy cannot be discounted. Central banks' decisions to adjust their interest rates in response to economic conditions can have a cascading effect on lending rates, including those for auto loans. The economic uncertainty and adjustments brought about by these larger financial forces have rippled into the auto lending market, pushing rates upward.

More inventory, more demand, but higher prices

The choice between new and used cars in Canada has become increasingly intricate due to supply chain disruptions and shifting market dynamics. These factors have significantly impacted the conventional wisdom that used cars provide a more budget-friendly alternative.

Still chipping away at post-pandemic supply distress

The semiconductor chip shortage, a persistent challenge that has plagued the auto sector since 2020, continues to impact the supply of vehicles.

This shortage, along with “disruptions brought on by the pandemic created an imbalance between supply and demand in the automotive sector,” says John Fanjoy, Economist at Scotiabank.

“Constrained vehicle production amid parts shortages and shipping delays resulted in inventory levels being drawn down, and in the face of pent-up demand this added upward pressure to vehicle prices,” he adds.

Naturally, with the pandemic, with workplaces closed and more people staying home during the early closures, there was a big dip in car demand. However, this didn’t remain the case for too long. “Consumers were interested in buying vehicles because of public safety,” says Akyurek. “They didn’t want to take public transportation or use ride sharing services as health precautions. So, overall demand for private vehicles had gone up.”

“If supply is low, demand is high. What happens to the prices? Prices start to go up.”

Akyurek notes that in March of 2020, the average price of a new car was almost $47,000. Now? It’s $67,555, which is a 43.8 per cent increase.

Soaring prices are giving used cars a run for their money

As of March 2022, used vehicle purchases surged by 24.5%, outpacing the 7.2% increase in new car purchases.

“A used vehicle today costs as much as a new vehicle did in 2019,” Fanjoy notes.

This sharp contrast has made used cars a popular choice in light of the affordability challenges posed by the current market.

The price disparity between new and used vehicles has also grown more pronounced. In June 2023, the average price of a used vehicle held steady compared to May, marking a 4.1% year-over-year rise, while new vehicle prices reached a record high, with a substantial 21.3% year-over-year increase.

Higher prices speeding up the sale of small cars

According to Akyurek, the average price of a new car in Ontario $66,477. In Alberta, the cost of a new car is $70,771.

“One of the reasons behind this is because out West, people tend to drive trucks and bigger cars compared to eastern Canada,” he says. “The composition of the inventory is a bit different and therefore, the prices are a bit higher.”

Akyurek says sedans are less desirable in North America than in Europe or Asia; we like our cars bigger. Our cities’ wider streets and grid-like roads accommodate larger vehicles, as well. However, given tighter budgets, there’s been more interest in cheaper vehicles. His team has noticed a shift in demand from larger vehicles to smaller vehicles, with cars priced below $40,000 selling at a much faster rate than those priced $40,000 and above.

“Is it because consumers want to drive a smaller car?” he asks. “Probably not. It's because it’s what the budget allows.”

Higher gas prices pushing up demand for EVs

The average price of gas was around $1.41 per litre before the war between Russia and Ukraine started. Right after, it went up just over $2.00 per litre. This was almost a 50% increase on a per litre basis.

"The war started, and we saw this unexpected increase in total number of leads sent to dealerships. We saw 567% more leads sent in for electric vehicles,” notes Akyurek. “Consequently, during that time, there was an 89% increase in EV searches on a year-over-year basis. There's a strong correlation between gas prices and what cars consumers are wanting to buy.”

Related: Most and least expensive cars to insure by fuel type in 2023

Drivers are paying more for insurance

As vehicle costs and MSRPs increase year-over-year, insurance premiums rise, especially considering theft ratings, which in turn, impacts comprehensive premiums. According to recent RATESDOTCA data, insurance premiums in Ontario have jumped 12% between 2021 and 2023. “We are starting to see increased insurance shopping activity as Canadians feel the crunch of inflation on their household budgets,” says David Mayer, Director of Insurance at RATESDOTCA.

The higher the technology content is in modern cars, the more repair costs have increased over the past decade, which drives up overall premiums.

“We’re also seeing increased deductible requirements with many insurance carriers when the vehicle MSRP is higher than $150,000,” observes Mayer. “In many cases, the insurance company may require a deductible amount of $5,000 or $10,000 for some of these vehicle types.”

Newer vehicles tend to have higher premiums than older vehicles because of 'rate groups’. Insurance companies look at various aspects when determining rate groups, such as safety ratings, thefts, costs of repairs, and other factors.

However, new and used vehicles of the same year, make, model, will typically have identical or very similar premiums. Some insurers use the purchase date of the vehicle as rating criteria, however, it’s not as influential to the premium.

The road ahead: What to anticipate and how to act

Sadly, the continued technological advancement of newer vehicles will keep pushing up insurance premiums. This is mainly due to the rising costs of repairing more sophisticated vehicles.

“We may see some relief in prices as supply gradually returns to pre-pandemic levels, however it’s important to note that it is unlikely to have a complete return to pre-pandemic price levels,” concludes Fanjoy.

But while supply shortages and interest rate hikes are out of most drivers’ control, the car you buy is not. Whether opting for the reliability of a new vehicle or the cost savings of a used one, staying informed can still empower you to navigate these uncertain market conditions.

“Once you find the car that you like, pull the trigger right away, because if you’re looking for a specific car, it might not be there the next time you look,” suggests Akyurek.

Canadians can reduce the risk of their vehicle being stolen — and thus, the risk of their insurance rates going up, or, worse, having to buy a whole new car — by installing anti-theft devices such as the Tag System or a steering wheel lock.

Many insurers offer discounts or waive theft surcharges when these protections are in place for drivers of high-theft vehicles. Consumers may also choose not to buy these more commonly stolen vehicles (like newer models of the Honda Civic and the Toyota Rav4) to keep their premiums low.

Lastly, it pays to shop around – at least on insurance.

“This helps Canadians scan the marketplace and make better decisions which could lead to material savings on their insurance,” advises Mayer. “Comparing policies is always the best way to ensure you are getting the best deal.”

Read more: Thefts drive up insurance premiums by 25% on most stolen vehicles

Don't waste time calling around for auto insurance

Use RATESDOTCA to shop around, and compare multiple quotes at the same time.

Get money-saving tips in your inbox.

Stay on top of personal finance tips from our money experts!