If you are not redirected within 30 seconds, please click here to continue.

Samedi: 10h – 16h HAE

If you are not redirected within 30 seconds, please click here to continue.

If you are not redirected within 30 seconds, please click here to continue.

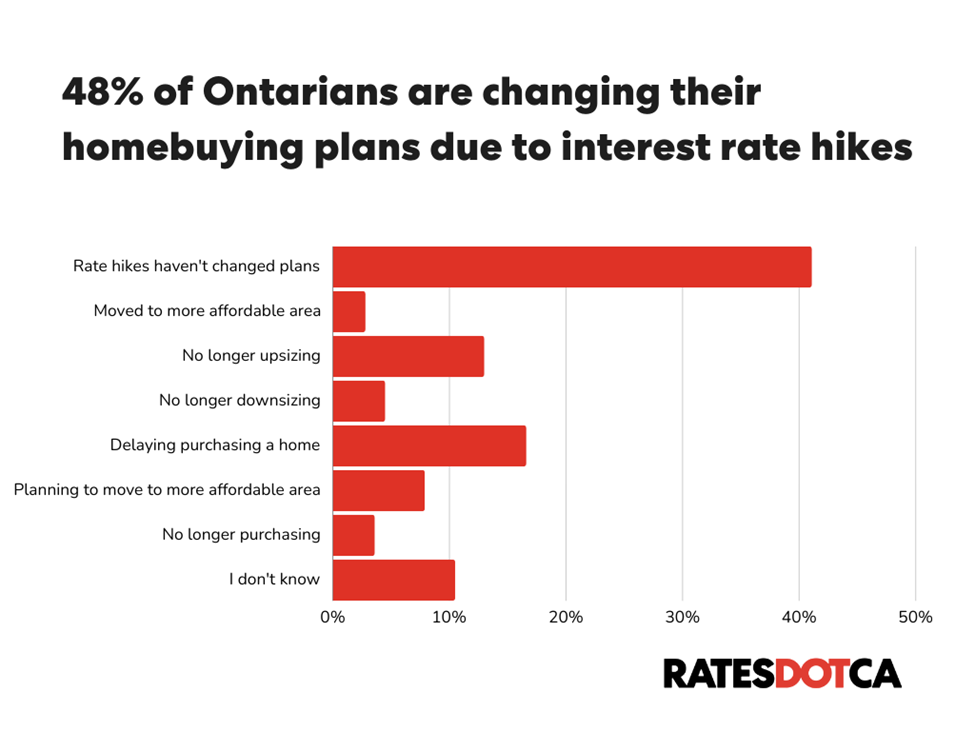

48% of Ontarians changing moving plans due to high interest rates

As 2023 comes to a close, many Canadians are — patiently or not — waiting to see what fresh financial concerns may be on the way. Over the past 12 months, variable-rate mortgage holders have seen their interest payments creep higher and higher, while fixed-rate holders are budgeting ahead for the day that their mortgage renews. The policy rate is currently sitting at five per cent. Though economists can only speculate when the first rate cut will be, it’s clear the rate will not come down soon — nor will we return to those historically low rates of three years ago for a long, long time.

According to a recent survey conducted by RATESDOTCA, 48% of Ontarians noted that rising interest rates had impacted their decision to move, upsize, downsize, or buy in some way, with 17% delaying plans to purchase.

Additionally, 17% of respondents believed that purchasing a home was a good investment before the onset of high mortgage rates, but don’t believe so anymore.

Among respondents, four per cent also stated that they regret buying their homes altogether.

What the data lays bare is that more people are deeply reconsidering the use and benefit of this particular life milestone.

Upsize, downsize – it’s a battle of, and about, the ages

Between above-target-rate inflation and high mortgage rates, two groups of prospective home buyers are locked in a tough position: Millennials and baby boomers.

“The millennial cohort is one of the largest in Canada in terms of population, and as these millennials age into the prime house-buying age, they are looking for larger space, bigger properties, or what have you,” says Shelly Kaushik, economist with BMO Economics.

Now, many millennials (adults between the ages of 27 and 42) and others eyeing an upsize might have to wait – 13% of overall respondents were planning to move to a larger home but have since decided against it.

Across the board, people are limited in their ability to move, but there are several reasons why millennials may be hedging more than most.

Higher interest rates make it harder than ever to qualify for a mortgage. Currently, the CMHC mortgage stress test still requires borrowers to meet the income levels needed to afford two per cent above the rate negotiated with the lender.

“It was challenging before, but house prices were lower,” says Jacqueline Porter, a Mississauga-based financial planner. “We’re also in a high inflation time, so the cost of everything has gone up significantly. Millennials have a lot of financial goals, like having children, or buying a home. [They may be] trying to figure out the best use of their money at this time.”

It’s leading some to give up this milestone completely – 10% of respondents do not plan on owning a home, while a further four per cent put off plans of buying a home due to high interest rates.

“I think there's a whole cohort of millennials that just don't necessarily expect to be able to buy a home anymore,” says Porter. “I talk to them, and they they're overall fairly despondent about their chances of getting into the housing market.”

Plus, boomers approaching, or at, retirement age, may also be finding their own finances at a standstill while, at the same time, trying to support the next generation.

Options are narrowing for retirement-age folks

Porter predominantly works with Canadians aged 45 to 70. Her clients often grapple with both navigating their own housing woes while also supporting their adult-aged children.

“I see so many of my clients who are trying to figure out how they can afford to help them,” says Porter. “But then there’s the quandary of, well, if I help one, and I have more than one child, can I help two? Can I help all three and still be okay financially as well?”

Furthermore, she adds, is it sustainable?

“The thing you also don't want to do is put your children in a scenario where their financial circumstances are unstable and sustainable,” she says. “So, you helped them get into the house but as interest rates go up and costs go up, can you continue to help them?”

Downsizing has been a traditional money-saving move to keep older homeowners comfortable through their golden years. However, selling off the family home might not be as tempting, now that the mortgage rate you might be paying on your next home will likely put a damper on much of your potential gain. The survey found that five per cent of respondents had halted any plans to move to a smaller home.

“When banks started raising rates, we definitely saw a cooling off in momentum and it’s something we expect to continue,” says BMO Economics’ Shelly Kaushik. “But we haven’t seen prices fall to the degree that would offset those higher rates from an individual affordability perspective.”

Excess demand is deciding whether people move – and where

Typically, with higher inflation rates, there’s a reasonable expectation that list prices may go down. And while that’s beginning to happen with condos and smaller units, the prices of single-family homes in the Toronto area have not returned to pre-pandemic levels. The fact is, there’s still record-high demand for housing.

“Because immigration targets have been ramping up year after year, that brings in more people into the country, more people who need houses,” says Kaushik. “On the supply side, we do have near record high levels of home building in Canada, which should bring additional supply to market. It just takes time, so right now, demand is just so much stronger than supply right now.”

As a result, list prices in major cities remain stubbornly high, and smaller cities in Ontario have also seen prices increase. Indeed, in our survey, three per cent of respondents said they had moved to more affordable areas than they had intended to. A further eight per cent stated that higher interest rates were pushing their plans out to more affordable areas.

Porter has seen inter-provincial moves among her clients. And while it may give them more financial flexibility, it sheds light on a completely new set of challenges.

“The financial costs are definitely a driving force for people to decide that they want to downsize,” says Porter. “It just needs to make sense from, you know, end of the day. Will you be happy in that area? Do you have social connections in that area? Do you have healthcare in that area? Is it going to be practical as your forever home? Because if it's your forever home, will it be easy for your family and friends to get to?”

Related: How much mortgage can the median household income afford in these cities?

When a house is just a home (and not a stream of future income)

For much of modern history, buying one’s first home has always been seen as a major life milestone; the soundest financial decision a family could make.

Now, that attitude is shifting for Ontarians, given higher interest rates and the intense competition for housing. In the survey, 30% of people believe that real estate is a good investment if you can afford it, and 17% of respondents believe that homes were a good investment before the rate hikes, but do not anymore. Forty-five per cent still think it’s a good investment.

However, an opinion is one thing, and practice is another. With the high cost of housing now, Porter has seen this traditional nest egg evolve into something closer to a piggy bank than an investment, says Porter.

“For every dollar Canadians have, their debt is $1.85,” says Porter. “Maybe it's because interest rates were so low, and real wages haven't gone up, but Canadians have largely relied on their loans to finance all the things that they need.”

As a result, she says, many people – even if they have homes – cannot afford to retire without tapping into the equity in their homes.

“If you’re seeing your home as an investment, you're trying to pay it off,” she says. “You're not leveraging it the way that we have been, where, at the end of the day, I don't know how much better off we are because we don't have the savings.”

We’re all holding on as long as possible

It’s worth noting that, ultimately, the purpose of raising these rates is to combat inflation. As economic uncertainty looms over the country, Ontarians are not just playing it safe with their home-buying plans, but with everything else, including other goods and services.

However, Kaushik and her colleagues have faith in a more affordable future. Economists, including those at BMO, have called for rate cuts to start in mid-2024. Meanwhile, the construction industry continues to work at capacity, despite an ongoing labour shortage and lingering supply chain issues. Homes are getting built, and people who have to move – well, they have to move.

“If you have a growing family or relatives moving to Canada from other countries, there’s only so long that you can wait before you need that extra space,” says Kaushik. “A lot of this is just, wait and see to a certain point. And if rates do, in line with our expectations, start coming down in the middle of next year, it is just a temporary phenomenon that we’re seeing.”

*Survey conducted by RATESDOTCA, polling 1,751 Ontarians between November 4 and 5, 2023 who used RATESDOTCA’s mortgage quoter.

Compare Mortgage Rates

Engaging a mortgage broker before renewing can help you make a better decision. Mortgage brokers are an excellent source of information for deals specific to your area, contract terms, and their services require no out-of-pocket fees if you are well qualified.

Here at RATESDOTCA, we compare rates from the best Canadian mortgage brokers, major banks and dozens of smaller competitors.

Get money-saving tips in your inbox.

Stay on top of personal finance tips from our money experts!