If you are not redirected within 30 seconds, please click here to continue.

Samedi: 10h – 16h HAE

If you are not redirected within 30 seconds, please click here to continue.

If you are not redirected within 30 seconds, please click here to continue.

81% of drivers in Ontario have witnessed road rage, only 6% admit to engaging in it: survey

As the temperature soars, so do tempers.

Scorching weather, combined with frustration over ongoing construction and detours, slow-moving traffic and road congestion seem like a perfect cocktail to trigger road rage. It's no surprise then, that Canadians are witnessing more incidents of road rage.

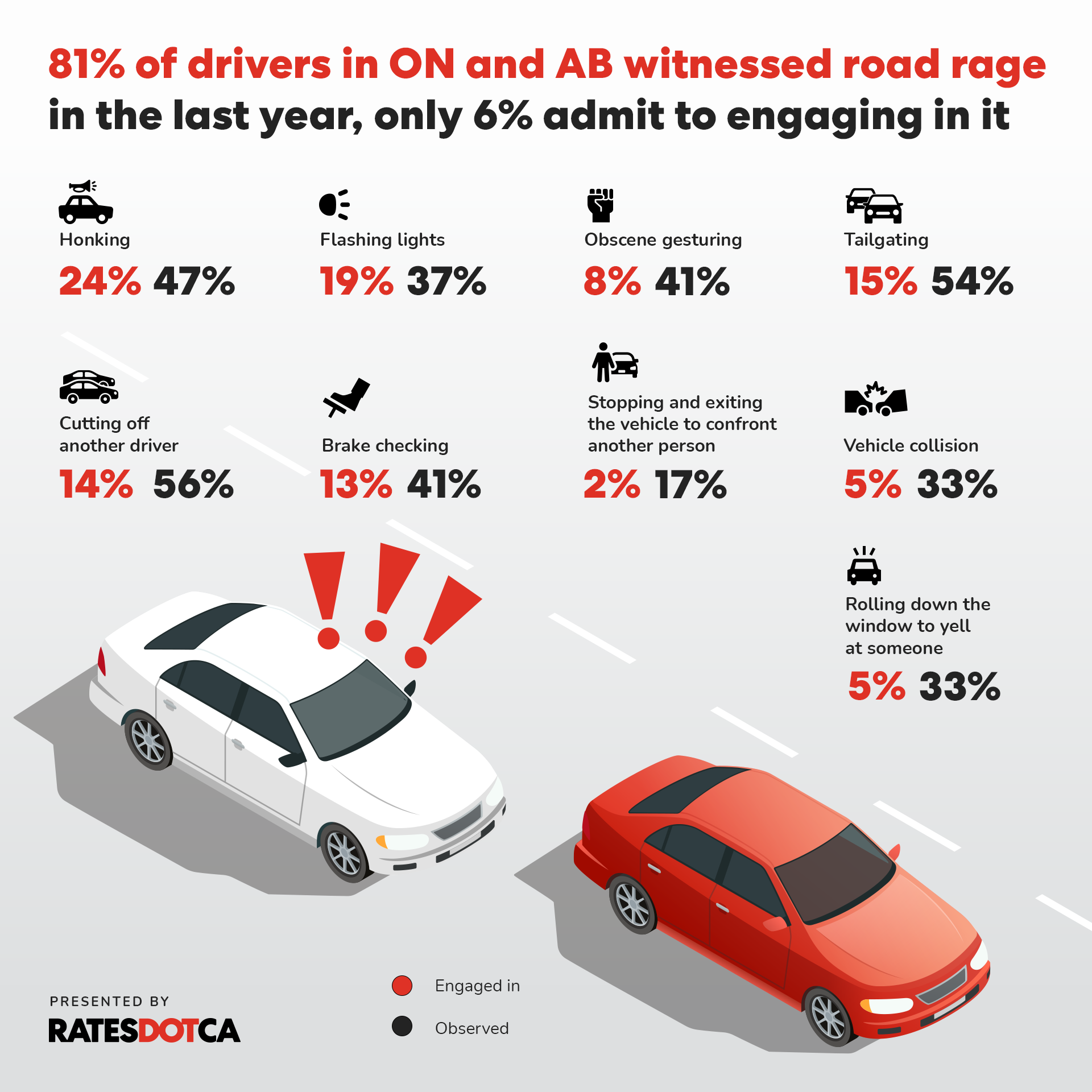

According to a RATEDOTCA survey conducted in Ontario and Alberta, 81% of drivers witnessed road rage, while only 6% admit to engaging it in.

Many more drivers seem to have observed road rage, yet few admit engaging in it

Road rage means displaying aggressive behaviour on the road. It can take on various forms, including honking, flashing lights, obscene gesturing, tailgating, slamming brakes, colliding into another vehicle intentionally, rolling down the window to yell at or cutting off other drivers, cyclists, or pedestrians, or getting out of your vehicle to confront others.

The data demonstrates that an overwhelming number of drivers claim to witness road rage, yet very few admit to engaging in it. Women in these provinces are slightly more likely to self-report themselves engaging in road rage behaviours than men (7% compared to 5%) and young people in the age group of 18 to 54 are just as likely (3%) to engage in road rage behaviours than those who are older than 55.

Road rage in Ontario

It's getting toasty in the Big Smoke, with 81% of Ontario drivers having witnessed road rage, and 6% admit to having done it.

Of the respondents in Ontario, 5% of drivers have rolled down their window to yell at someone, while 35% drivers have only witnessed it. Similarly, 8% of drivers have used obscene gestures on the road, while 41% claim they have observed it from other drivers.

Perhaps the most concerning road rage behaviour is that of colliding against another driver’s vehicle. Thirty-four per cent of drivers have witnessed it, while 5% admit having done it.

Some other dangerous behaviours that Ontario drivers engaged in include tailgating (15%), cutting off another driver (13%), or brake-checking (12%).

Road rage in Alberta

In Alberta, 80% drivers witnessed road rage, while 7% admit to having done it. Breaking it down to specific behaviours, 4% of drivers have rolled down their window to yell at someone, while 31% drivers have only witnessed it. Similarly, 8% of drivers have used obscene gestures on the road, while 41% claim they have observed it from other drivers.

Six per cent of Alberta drivers claim they’ve collided against another driver’s vehicle in a fit of road rage, as opposed to the 32% who have witnessed it. Additionally, Alberta drivers claim to have been involved in tailgating (16%), cutting off another driver (15%), or brake-checking (16%).

Impact of road rage on auto insurance

It only takes one incident of cutting off another driver or tailgating to cause serious personal and property damage.

Daniel Ivans, a RATESDOTCA auto insurance expert, explains that if a driver uses their vehicle unlawfully – in this case, tailgating, cutting off drivers, braking abruptly – and it results in a collision, the physical damage coverage would be void for the purposes of processing the claim.

“The insurance company will have to pay for injuries. However, they can still go back and sue the client to recuperate those losses that were paid out due to injury,” he says.

Road rage isn’t a chargeable offence — but careless driving is

While there is no conviction for road rage behaviours like obscene gesturing in law enforcement, there is a conviction for careless driving, as well as up to six demerit points on the line.

And careless drivers may still see their actions further penalized from their insurance provider.

“Usually, careless driving is the end result of an at-fault collision, where the driver has proved to be careless or reckless,” he says.

Careless driving is a major conviction, and anyone found to be engaging in it can expect to see higher auto premiums — in fact, one instance of careless driving could increase a driver’s premium by up to 221%.

Additionally, if you have three or more minor convictions (like driving tickets), or a major and/or serious conviction, like careless driving or collision on your record, you won’t be able to obtain insurance from standard insurance companies and may have to resort to a high-risk market.

“You would be obliged to go with a non-standard insurer where insurance premiums are three, five, or even ten times higher (depending on the incident and the number of tickets),” Ivans says.

For these drivers, that might mean playing the waiting game. That is, paying high premiums for three years, until the ticket falls off your record. “We're talking about possibly accumulating tens of thousands of dollars [in increased premium payments]," Ivans adds.

Read more: The Best Way for High-Risk Drivers to Get Car Insurance

It’s best to cool down, or it could cost you

In May last year, a Calgary mother of five was killed in an incident of road rage that later escalated to exchange of gunfire. Another road range incident from 2018 resulted in a 22-year-old Niagara woman being killed following a chain-reaction crash.

Even though most incidents of road rage don’t end in tragedy, according to CAA Manitoba, aggressive driving fuelled by anger is among the top four causes of vehicle collision.

When it comes to the causes of road rage, six per cent of drivers across Ontario and Alberta say that ongoing construction makes them angry while driving, and only 2% said that cyclists were more likely to piss them off. The main culprit of rage on the roads? Thirty-nine per cent of respondents pointed their fingers to other drivers around them.

To avoid going full Hulk mode on the streets, two per cent state that they pull over and calm down before getting back on the road after a rage-inducing incident, while 37% said they take deep breaths or find other ways to calm themselves down while driving.

“Driving aggressively due to road rage is never worth it,” says Ivans. “When people are angry, their judgement is clouded. Not only can recklessly driving result in a serious accident, a major, or even serious conviction can cost a driver tens of thousands of dollars in increased auto insurance premiums over the years that the conviction remains on their driving record.”

So, the next time someone cuts you off, keep your cool while on the road. Allowing your emotions to get the better of you can jeopardize your auto insurance premiums, your safety, and the safety of others on the road. You could also consider getting comprehensive coverage to protect yourself against other drivers’ exhibiting road rage and unexpected damages.

Methodology

Survey conducted by RATESDOTCA, and polled 745 Ontarians and 235 Albertans between July 12-13 that used RATESDOTCA’s auto insurance quoter.

Don't waste time calling around for auto insurance

Use RATESDOTCA to shop around, and compare multiple quotes at the same time.

Get money-saving tips in your inbox.

Stay on top of personal finance tips from our money experts!