If you are not redirected within 30 seconds, please click here to continue.

Samedi: 10h – 16h HAE

If you are not redirected within 30 seconds, please click here to continue.

If you are not redirected within 30 seconds, please click here to continue.

27% of Canadian holiday shoppers are spending less this year: survey

Table of Contents

Consumers are approaching this year’s holiday season with apprehension and concern. Grappling with higher cost of living, battling priorities for expenses, credit card debt, and looming fears of a possible recession, 60% of Canadians are re-evaluating just how festive the next few weeks will be.

A recent survey commissioned by Rates.ca using Leger confirmed only 7% of Canadians have a higher budget than they did last year. The majority of shoppers are either spending less this season (27%) or are planning on spending the same as they did last year (26%).

Two factors also affected their approach to spending over the holidays: Whether they had young kids to provide for, and whether they worry about an impending recession.

Tighter budgets are a reality for most Canadians

According to the survey, 60% of Canadians are prepared with a holiday budget. From them, 35% of shoppers are strict with spending, with a budget of under $500, and 9% plan to spend up to $100.

The survey also shows that 20% of shoppers expect to spend up to $1,000 and 7% have plans to spend up to $5,000 with only 1% planning a budget for expenses beyond that.

While 11% are non-shoppers with no plans for shopping, others are flush and festive, with big splurging plans this season – 36% of those aged 55+ don’t have a maximum spending limit. And a solid 26% plan to spend the same amount as they did last year.

A quick recap of holiday budgets for shoppers this year:

- 9% have a maximum budget of $100

- 20% have a budget of up to $1,000

- 7% have a budget of up to $5,000

- 1% have a budget of over $5,000

According to John Cabell, managing director of payments intelligence at JD Power, Canadians are more likely to budget holiday spending in 2023.

His own research is seeing more people spending less, even if they’re financially healthy. “As expected, consumers that are more financially challenged report plans to spend less this year.”

In line with this finding, 27% of those surveyed are spending less this year compared to the year before.

What’s being cut back on?

Doretta Thompson, financial literacy expert at CPA Canada shares CPA data to help paint a picture:

Gifts: More (16%), same (66%), less (18%)

Travel: More (30%), same (55%), less (15%)

Entertaining: More (16%), same (68%), less (16%)

Charitable donations: More (15%), same (74%), less (11%)

Note that the data above is of people planning to spend in these categories, so people not spending on travel for example, are not included.

Fiscal limits spoiling festive spirits

Canada saw the largest increase in the Consumer Price Index (CPI) in 2022 since 1982, with an increase of 6.8% since 2021. The largest increases were seen in transportation (+10.6%), food (+8.9%) and shelter (+6.9%). These prices have increased at a much faster pace than wages. For example, while average hourly wages of employees increased by 5.1% in the 12 months to December 2022, the CPI increased by 6.3%.

“Inflation will make the season much more difficult for Canadians compared to some previous years,” notes Thompson. “Despite these trying financial times, Canadians are determined to celebrate and spend this upcoming holiday season with what they have.”

According to Thompson, holiday spending may be impacted by the following factors:

Increased expenses: The holiday season often comes with additional financial obligations, such as buying gifts, hosting or attending parties, travel expenses, and decorations.

Social expectations: Cultural and societal expectations around gift-giving and celebrations during the holidays can create pressure to spend money beyond one's means.

Debt and other financial obligations: Existing financial obligations, such as credit card debt or loan repayments, can become more burdensome during the holidays and more difficult to plan for in the light of other expenses.

“Strategies to minimize stress include setting realistic budgets, prioritizing their spending, exploring affordable alternatives to expensive gifts or traditions, and seeking support from financial resources or counseling services,” she says.

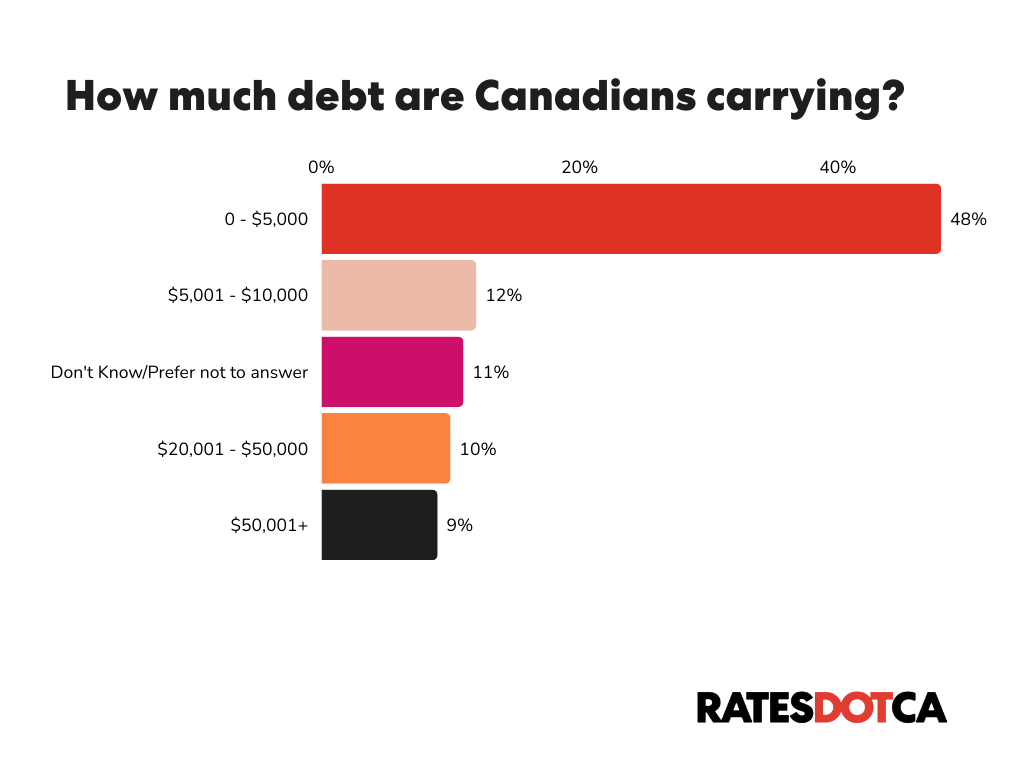

42% of survey respondents are carrying a debt of more than $5,000 into the new year

Credit card debt is ballooning to a new record as higher costs of living squeezes Canadians. The Leger survey data notes that 42% of participants are carrying a non-mortgage debt of more than $5,000 this holiday season. This includes any credit card debt, loans, lines of credit, and others.

Among those who owe less (representing 48% of the group), 58% are older Canadians (aged 55+). On the other hand, one in ten Canadians (9%) hold a debt of more than $50,000, 11% of them being between the ages of 18 and 54, 14% of whom are parents to children under 18.

Respondents have accrued the following amount of debt:

- 12% owe between $5,000 and $10,000

- 11% owe between $10,000 and $20,000

- 10% owe between $20,000 and $50,000

- 9% owe above $50,000

Equifax Canada reports credit card balances amongst Canadians climbed to an all-time high of $107.4 billion in the second quarter of 2023. Fewer credit card users were successfully able to pay off their credit card balance in full each month compared to 12 months ago.

Not only are many people challenged with balancing just this year’s budget for holiday shopping, A report from Bloomberg found that 25% of Canadians are still paying off credit card debt from last year.

Read more: How to use credit cards to save money and tackle holiday debt

For some, it’s about prioritizing holiday cheer over financial fears

“Consumer spending has seen contractions in 2022 and 2023 vs. 2021. This period has coincided with inflation and other economic concerns,” says Cabell.

How much you’ve saved in the past can be your saving grace as interest rates balloon.

Canadians with higher savings can work to put those funds towards their fixed costs such as, car and mortgage payments, whereas those with little to no savings, or no cash at hand are forced to rely on credit card spending to manage living expenses fueled by interest rates at 20-year highs.

Nearly half (47%) in the 18-54 age cohort are carrying debt in excess of $5,000. This is also the group that's more likely to carry debt over $50,000 (11%). With plans to set a maximum spend this year, this cohort is more likely to spend a smaller amount than last year (29%), with 30% planning on spending up to $500.

However, people with kids are likelier to set higher budgets than those without (as expected).

'Tis the season for keeping, not giving – or maybe not?

Amidst an uncertain economic landscape, Canadian generosity is experiencing its lowest point in 20 years, according to the Fraser Institute. Generally, with household income being spread thinner to make ends meet, less individuals are likely to give to charity in the season of giving, and for those who continue, are giving less. Deloitte has also noted a 40% drop in charitable giving this holiday season.

However, there’s no reason to give up all hope in humanity. While cutting back expenses is still a reality, charitable giving is planned to be the least likely expense to be cut. In terms of giving back, Ipsos reveals that three in ten Canadians still intend to contribute money to charitable causes. And for those feeling the pinch of finances, 16% of them plan to volunteer their time, while others (19%) aim to buy brands that align with their values – shooting two birds with one stone, as they buy gifts for loved ones.

Financial risks to be wary of this holiday season

Thompson shares some credit card scenarios to avoid or at the very least, keep in mind as you continue to navigate through your expenses this season.

‘Buy now, pay later’ offers: Avoid “buy now, pay later” offers. If you can’t afford the item now, chances are you won’t be able to afford it when the holidays are over.

"A few years back ‘buy now, pay later’ offers were aimed at big-ticket items (furniture, appliances, etc.) but now it’s offered for smaller purchases like clothes, make-up,” says Thompson. It’s a slippery slope. And you do indeed have to pay later.

Credit card usage: Try to not charge more to a credit card than you can pay off the following month. Otherwise, interest charges will add significantly to the cost. Credit card debt is one of the most expensive types of debt you can have. If you carry a balance from month to month, the annualized interest rate on most credit cards is between 18 and 20%.

Cash advances: A cash advance on your credit card is even costlier. Cash advances carry higher interest rates than credit card purchases, often around 25%. There are also cash advance fees, ranging from 3–5%, and there is no grace period, which means interest starts accruing from the date you withdraw the funds, not when you receive your monthly bill.

Budget pressure: When you carry a balance on your credit card, you're required to pay a certain minimum amount each month. As your balance increases, so does your minimum payment. A higher minimum payment may mean you’re paying more towards interest charges - especially if the higher minimum doesn’t significantly reduce the principal amount owed. This can leave you with less disposable income come for other expenses (rent, utilities, groceries, etc.)

Credit card selection: If you do need to use credit, choose the credit card with the lowest interest rate - and prioritize paying it off as soon as possible.

Read more: Take the Quiz: Do you know your credit score fundamentals?

Methodology

The survey commissioned from Leger’s online platform gathered insights into the perspectives and experiences of 1,530 Canadian aged 18 and above conducted between December 8-10, 2023. For comparative context, a probability sample of 1,530 respondents would typically have a margin of error of ±2.5%, 19 times out of 20.

Read next: Top 5 credit cards for online shopping this holiday season

Get money-saving tips in your inbox.

Stay on top of personal finance tips from our money experts!