If you are not redirected within 30 seconds, please click here to continue.

Samedi: 10h – 16h HAE

If you are not redirected within 30 seconds, please click here to continue.

If you are not redirected within 30 seconds, please click here to continue.

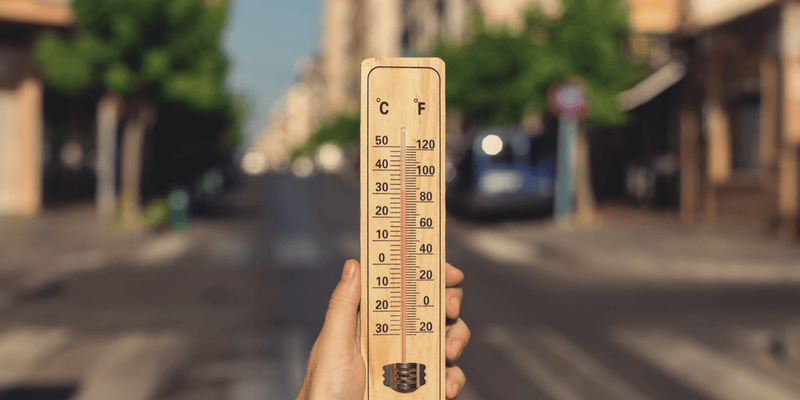

Mortgage temperature check 2023: rise in total mortgage quotes may signal a return of buyers to the housing market this spring

With the Bank of Canada delivering eight consecutive policy interest rates hikes between March 2022 and January 2023, potential homebuyers and mortgage holders have been on high alert for the greater part of a year. While many have stayed out of the housing market to avoid high interest rates, some buyers may be looking to jump in this spring, believing that home prices have bottomed.

After the most recent 25-basis-point overnight rate jump to 4.50%, new RATESDOTA data show that Canadian buyers may be making their move. Total mortgage quotes, including purchases, refinances, and renewals for primary and investment properties are rising, according to RATESDOTCA mortgage quoter data. Fixed-rate mortgages are favoured over variable rate, while down payment amounts are decreasing.

Whether the Bank pauses or continues its rate hikes depends on various economic factors, including consumer inflation, which fell to 5.9% in January. Although falling inflation lowers the likelihood of further policy rate increases, inflation could remain higher for longer than some expect, and the strength of Canada’s job market also weighs on the decision. Regardless, it appears the hope of rate stability is enough for buyers to accept the current rate environment — and enter the spring market.

Mortgage renewal and purchase quotes are up year-over-year

From December to January, the number of mortgage renewal quotes rose 107% and purchase quotes rose by almost 92%. While a month-over-month spike is to be expected after a slow season of home sales, what’s more telling is the rise in mortgage quotes our data show, year-over-year. In January, renewal quotes were up 49% and purchase quotes were up 48% from the same month last year. For mortgage quotes to surpass that of early 2022, when the market was still hot, indicates a new wave of interested buyers. Seeing more interest in renewals doesn’t come as a surprise, as rates are much higher than they were five years ago, incentivizing Canadians to shop around for better deals.

For example, according to RATESDOTCA mortgage expert Victor Tran, a homeowner with a $500,000 five-year, fixed rate insured mortgage who started with a 2.89% interest rate in Q1 of 2018 would have had a $2,338 monthly payment over a 25-year amortization. Now, five years later, paying off the remaining principal of $426,000 at 4.79% interest over a 20-year amortization, monthly payments would increase to $2,751. That’s $413 more a month in housing costs. Because of this increase, many are comparing their renewal options.

While renewing with a different lender at a lower rate can help you save, it does require that you pass the mortgage stress test, which now means qualifying at almost 7% interest. Despite this hurdle, an increase in quotes for both mortgage renewals and purchases indicates a willingness to make financial adjustments to enter — or remain in — the housing market this spring.

“Great properties are starting to sell quickly,” says David Li, Toronto realtor at HomeLife New World Realty. “Bidding wars are starting to come back, and this will only ramp up even more as we head into the spring market. There’s still a lack of inventory in the city of Toronto, which will also fuel the spring market.”

Fixed-rate mortgage quote volumes consistently higher than variable

According to our mortgage quoter data, fixed-rate quote volumes have been 75% higher than variable-rate quote volumes for the past four months. On a yearly basis, the number of fixed rate quotes is up a whopping 121%, compared to only a 46% increase in variable quotes.

This preference is a far cry from the influx of interest in variable rates spurred by the ultra-low interest rate environment prior to March 2022. After the long series of hikes that made variable mortgage rates exceed fixed since then, fixed interest rates have once again become the more favourable option.

Down payment amounts, another important decision to make when applying for a mortgage, decreased in January, dropping 7% from the same month last year. This could be partially due to the fall in home prices. As home prices fall below the $1 million mark, particularly in expensive cities like Toronto and Vancouver, buyers can choose to put less than 20% down (and opt for an insured mortgage), which often allows for lower interest rates than an uninsured mortgage. Plus, the cost to insure the mortgage is spread throughout the term, rather than one lump sum, making monthly payments more manageable, despite putting less down upfront.

Many buyers may also be accepting higher rates and taking a deeper look into payment structures to work around them. For example, opting for a longer amortization period can keep monthly payments lower, but it’s by no means a permanent decision. Shortening this period is always an option in the future if your monthly budget changes.

“It's better to buy an asset at a lower price with a higher interest rate because you can always refinance later when interest rates are lower,” says Li. “Demand and prices for Toronto real estate will continue to be strong once we get through this period of high interest rates due to macro factors that are driving buyers to Toronto. Buying now with higher interest rates means a higher monthly carrying cost for now, but leaves more room for capital appreciation in the future.”

Surge in primary and investment property quotes in January 2023

Our data show that quotes for primary properties were up almost 92% in January from December, while investment property quotes rose near 106%. Primary property quotes were still up 45% and investment property quotes up 78%, year-over-year. And according to Tran, quotes are leading to action.

“Recently, there has been a substantial uptick in mortgage pre-approvals following the Bank of Canada's indication that it would hit pause on raising rates,” says Tran. “People that were waiting on the sidelines over the past several months for the market to stabilize are now taking advantage of this window of opportunity.”

While this uptick in quotes could be due to the standard upswing that occurs after the seasonal slowdown in housing sales in December, there’s likely more behind this rise in applications.

Buyers may also be getting back into the market before The Office of the Superintendent of Financial Institutions (OSFI) potentially changes its loan-to-income threshold guidelines — or before rates go any higher.

Currently, a mortgage applicant could be given access to a mortgage of 4.5x their gross income. However, this figure may decrease, limiting buyers to lower mortgage loans.

For example, even a buyer with an above average salary of $100,000 could only qualify for a $350,000 mortgage if lending is capped at, say, 3.5x an applicant’s gross income.

If loan amounts decrease, those who require a larger mortgage will either face the reality of putting more down up front or explore alternative lending options, like working with a private or monoline lender — both of which often have higher interest rates than traditional mortgage lenders.

According to Tran, if OSFI’s public consultation leads to any revisions, they’re likely to take effect in Q3 or Q4 of this year.

Regardless of the current rate environment, buyers who are serious about securing a home are seeing an opportunity to purchase at a lower price, a more predictable interest rate, and potentially qualify for a larger mortgage early this year.

“Each year there is an uptick in volume during the spring market,” says Li. “And this year appears to be no different.”

Compare Mortgage Rates

Engaging a mortgage broker before renewing can help you make a better decision. Mortgage brokers are an excellent source of information for deals specific to your area, contract terms, and their services require no out-of-pocket fees if you are well qualified.

Here at RATESDOTCA, we compare rates from the best Canadian mortgage brokers, major banks and dozens of smaller competitors.

Get money-saving tips in your inbox.

Stay on top of personal finance tips from our money experts!