If you are not redirected within 30 seconds, please click here to continue.

Samedi: 10h – 16h HAE

If you are not redirected within 30 seconds, please click here to continue.

If you are not redirected within 30 seconds, please click here to continue.

Are electric vehicles (EV) still a popular choice for Canadians?

Table of Contents

KEY FINDINGS

- Rates.ca quoter data showed a 31% spike in EV insurance quotes in January 2025 due to the federal rebate program, but demand plummeted after its January 12 closure, with EV quotes down 6% year-over-year by April.

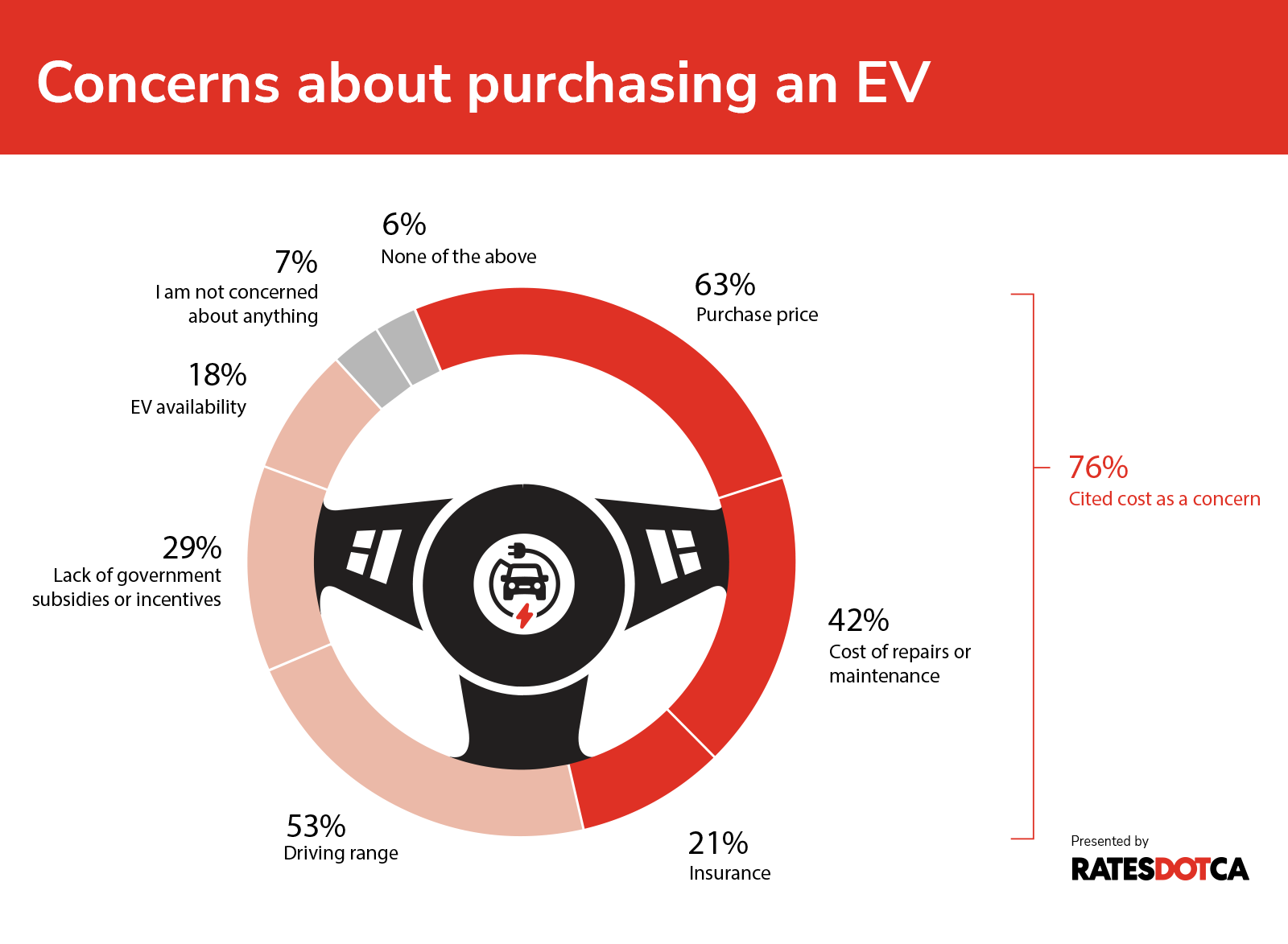

- Affordability is the number one barrier to EV adoption, with 63% of Canadians citing high purchase prices as their main concern, particularly among those aged 35+ (66% vs. 56% of younger respondents).

- EV insurance premiums surged by 18.9% year-over-year in Q1 2025, significantly outpacing the 7.8% increase for gas-powered vehicles, largely due to high repair costs for EV batteries.

- The simultaneous pause of the federal rebate program and February price hikes by Tesla initially boosted sales but ultimately led to a steep decline in EV demand.

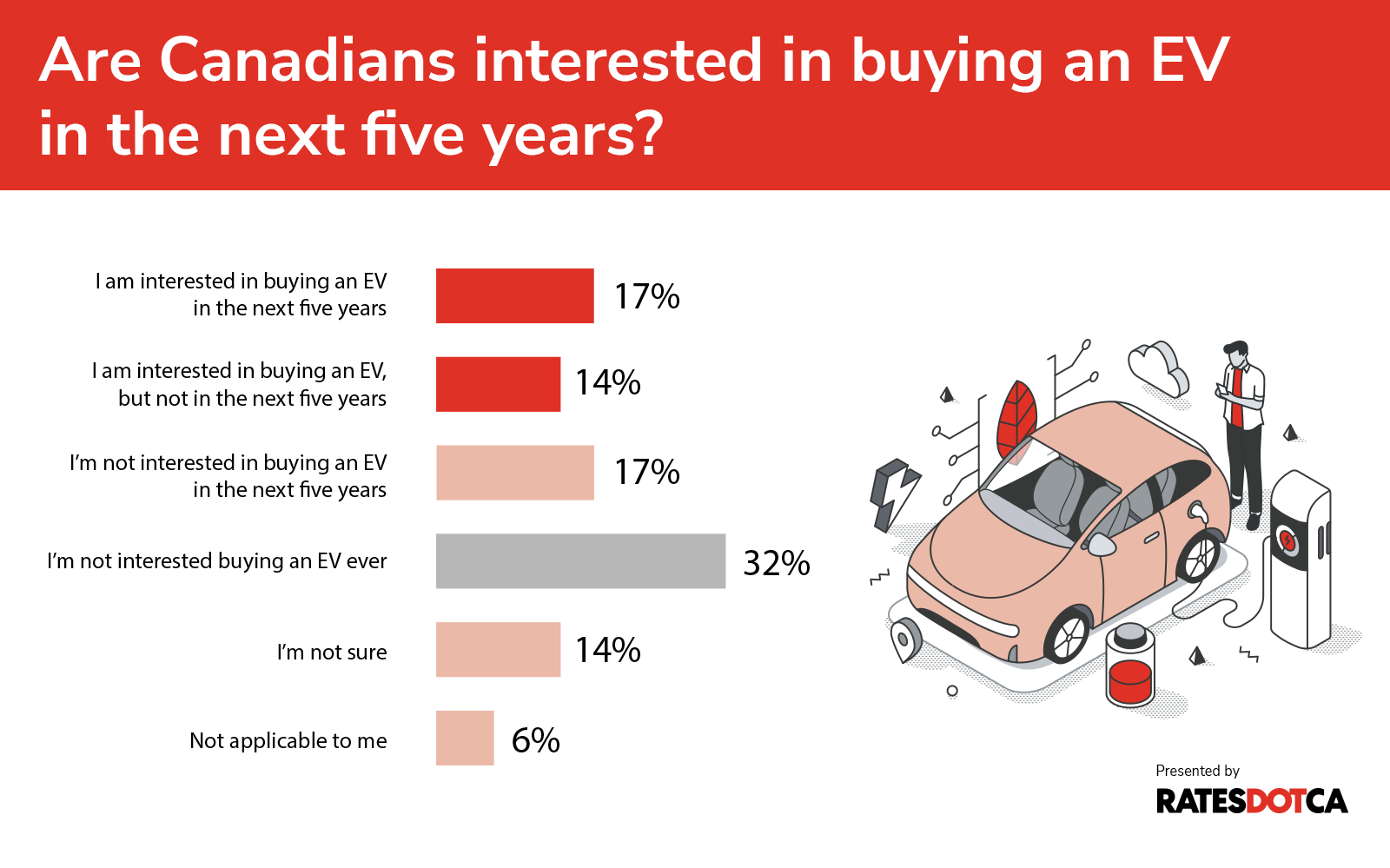

- While 31% of Canadians are interested in owning an EV, 49% have no plans for purchase, with younger Canadians (18–34) showing the highest interest at 41% despite concerns over insurance and repair expenses.

With certain provincial and federal rebates no longer available, EV prices are making some buyers hesitant. A new Rates.ca survey commissioned through Leger found that 29% of Canadians are concerned about buying EVs due to a lack of government subsidies or incentives. Meanwhile, Rates.ca internal quoter data shows that demand for EVs saw consistent growth throughout 2024, followed by a noticeable decline in the first quarter of 2025.

A third of Canadians are interested in purchasing an electric vehicle in the next 5 years, but 49% are not

Currently, 31% of Canadians express interest in purchasing an EV, the majority being men (37% vs. 25% of women). This interest is split between those with near-term plans and those who see EV ownership as a more distant possibility.

- Within 5 years: 17% of Canadians are interested in purchasing an EV within the next five years.

- Beyond 5 years: 14% are interested in purchasing an EV, but not within the next five years.

On the other hand, almost half (49%) of Canadians aren’t interested in buying an EV anytime soon. 32% say they have no plans for EV ownership ever.

“By the end of 2024, zero-emission vehicles made up roughly 15% of new vehicle registrations in Canada,” says Irina Im, industrials senior analyst at RSM Canada. She adds, “while that’s still a notable year-over-year increase, the adoption growth rate has plateaued.”

Read more: Higher car expenses leading more Canadians to make changes to their driving

How much does the average EV cost in Canada?

“Affordability is especially critical in the current economic climate,” says Im. “With government rebates scaling back, high cost of capital and manufacturers under cost pressures, the price gap between EVs and internal combustion engine (ICE) vehicles remains a major concern.”

It’s worth noting that while many find EVs pricey, their costs have actually decreased. According to a Statistics Canada report released in April 2025, an increase in supply and decrease in demand has led to lower EV price tags.

The report highlights that as of December 2024:

- New EV prices dropped 7.8% from a year earlier, averaging $70,682 as of December 2024.

- Used EVs saw a significant decline of 18.4%, averaging $42,045.

The semiconductor shortage that once drove up EV prices during the pandemic has eased, bringing slight price reductions.

However, savings may not be enough for the 76% of survey respondents who still cite cost concerns, keeping affordability a major hurdle.

63% identified the purchase price of EVs as their main concern when considering a purchase.

This concern is even more pronounced among older respondents (35+), with 66% of them citing purchase price as a barrier compared to 56% of younger respondents.

EV rebate paused: Rising ownership costs for Canadians

Compounding the issue of affordability is the disappearing rebates. Previously, the Zero Emissions Vehicle (iZEV) program played a pivotal role in driving EV adoption, supporting the sales of hundreds of thousands of vehicles across Canada by providing rebates of up to $5,000 for eligible EV purchases.

On January 12, 2025, the federal government paused its program indefinitely once the funds ran out due to surging demand, leaving prospective buyers without this critical financial support.

While 42% of those interested in purchasing an EV earn over $100,000 annually, the lack of rebates could deter middle-income buyers. 29% also stated they were worried about the lack of government rebates and support.

Niel Hiscox is the CEO of the automotive research firm Clarify Group Inc. and publisher of Canadian Auto Dealer magazine.

“EVs are still much pricier than internal combustion engine (ICE) vehicles. Government rebates used to narrow that gap, making EVs more appealing,” says Hiscox. “Without those incentives, buying an EV is a far more expensive choice for consumers.”

This latest pause of the iZEV rebate continues a pattern seen in provincial markets across Canada.

“If we look back to 2018, Ontario had a Liberal government with a rebate program that offered up to $14,000 per vehicle,” Hiscox notes. “However, when the Ford government ended the program, EV sales dropped sharply.”

Similarly, Quebec recently ended its rebate program. Among Quebec respondents, 37% cited the lack of government incentives as a concern. This is significantly higher than the 26% in the rest of Canada.

However, Im believes that the shift to electric vehicles needs to be driven by consumer demand, not just regulations. If EVs are affordable, reliable, and easy to charge, she says, people will naturally choose them.

She explains that the early wave of EV buyers—those motivated by cutting-edge technology, environmental concerns, and generous government incentives—has largely passed.

“The next wave of mass adopters is more focused on the economic viability of EV ownership,” she says. “They're concerned about affordability, the availability of charging infrastructure, driving range reliability (especially in cold climates or remote areas), and vehicle resale value.”

Over half of our survey respondents (53%) reported being deterred by EVs due to their driving range.

Related: When is the right time to upgrade your car?

Want to learn more about the future of EVs in Canada?

Ask an Auto Expert is a regular column where Mark Whinton, 40+ year automotive expert and owner of the CarQuestions Youtube channel dives into what’s going on in the world of car repair and auto insurance.

We got a chance to chat with him about where he thinks EVs are headed. Read the full Q&A.

Canadians clear our EV stock before Tesla price hikes and rebate program closes

The pause of Canada’s federal EV rebate program, coupled with the withdrawal of provincial incentives in B.C. and Quebec and a February price hike on Tesla models, triggered a brief surge in EV purchases across the country.

On January 10, the government reported $71 million remaining in the rebate account, but just two days later, it was completely depleted.

Rates.ca quoter data shows a 31% spike in EV insurance quotes in January 2025 compared to the previous year. The momentum fell sharply following the program’s closure, declining over February, March, culminating in April, which marked the largest year-over-year drop so far, as EV quotes fell 6% compared to April 2024.

Some manufacturers, like Polestar, have responded to the sales slump by slashing prices for some models by more than 12%, while others are shifting strategies altogether. Ford has postponed the $1.8 billion EV assembly project in Oakville to prioritize gasoline trucks. Today, Honda postponed their $15 billion EV investment project in Ontario.

Related: The 10 most stolen vehicles in Canada for 2024

Some provincial incentives still available across Canada

Though the federal rebate is paused, several provinces still offer their own EV purchase incentives:

- British Columbia: Up to $4,000, subject to income qualifications.

- Nova Scotia: Up to $3,000, with funds likely exhausted without notice.

- Yukon: Up to $5,000, including plug-in hybrids (PHEVs) with an electric range over 50 km.

- New Brunswick: Up to $5,000, contingent on funding availability.

- Prince Edward Island: Up to $5,750.

- Manitoba: Up to $4,000, with a program end date of March 2026.

Provinces such as Alberta, Saskatchewan, Ontario, Quebec, and Newfoundland and Labrador, as well as territories like Nunavut and the Northwest Territories, some of which used to offer rebates, no longer do.

Related: Can you negotiate the price of a used car in today's market?

Donald Trump’s trade war is weakening Canada’s manufacturing sector

On March 12, Trump imposed 25 per cent tariffs on all aluminum and steel imports to the U.S. The sector is being disrupted, says Im, with “a profound shift in U.S. trade policies and stiff tariffs imposed on the sector and its entire supply chain (e.g., steel and aluminum, auto parts, reciprocal tariffs).”

In April, Canadian manufacturing experienced its weakest month since the height of the COVID-19 pandemic on the S&P Global Canada Manufacturing Purchasing Managers' Index (PMI), which tracks output and new orders.

“Policy unpredictability and its impact on the market make it difficult for companies to plan long-term and commit to multibillion-dollar capital investments,” explains Im.

Hundreds of layoffs and production cutbacks have been reported. Stellantis temporarily paused production at its Windsor, Ontario, plant, resulting in an estimated 6,000 job losses. General Motors is scaling back operations at its Oshawa truck plant, as well.

The uncertainty surrounding tariffs and the U.S. government also raises questions about recent commitments from significant automotive players.

For example, Hiscox says. “Honda made a major commitment for battery production in Ontario, and Stellantis partnered with LG for a new battery plant, but neither project has broken ground yet. Will these projects move forward? It’s unclear.”

Rising claims costs for EVs could drive up insurance premiums, and 42% of Canadians feel the repair expenses aren't worth it

According to our survey, 42% of respondents cite the cost of EV repair and maintenance as major concern to getting an EV, and 21% are specifically concerned about insurance expenses.

This concern may be well-founded. Rates.ca quoter data shows In Q1 2025, non-EV insurance premiums rose 7.8% year-over-year, while EV premiums surged by 18.9%, nearly 20%.

One reason EVs often cost more to repair — and subsequently, to insure — is because fixing battery damage is so expensive, says Hiscox. And even minor collisions can damage the battery, which can cost tens of thousands of dollars to replace.

This differs from gas-powered cars (ICE vehicles), where no single part makes up such a big chunk of the car’s value.

Additionally, Hiscox notes that the Canadian auto industry is still at a stage where there aren’t enough auto shops certified to work on EVs. Limited availability of specialized labor and tools further drives up repair costs.

A driver in Vancouver was shocked when small damage to his car’s battery cost $60,000 to fix — more than a new car.

“From an insurance view, EVs are more likely to be totaled because repairs cost so much, often reaching 60 to 70% of the car’s value. When this threshold is surpassed, the vehicle is often deemed a total loss,” Hiscox explains.

This burden is heaviest on younger Canadians aged 18–34. They are the largest group of potential EV buyers, making up 41% of those interested in buying an EV. However, 29% of young people see insurance costs as a big problem, compared to only 17% of older people. Younger Canadians also tend to face higher insurance premiums in general, a result of being categorized as higher-risk drivers due to their age and limited years of driving experience.

Learn more: Thinking of upgrading to a 2024 Dodge Ram? Prepare to pay 408% more for comprehensive insurance

Is Tesla losing its shine? Vandalism and sales slump continue

Tesla’s facing a rough ride lately. In Ontario, vandals damaged nearly 80 cars at a Hamilton dealership, and a Model S fire caused $140,000 in damages. Add to that a 13% sales slump, protests at showrooms, and Elon Musk’s controversial political moves, and the brand’s spotlight is looking dimmer than ever.

And speaking of Tesla, we couldn’t help but wonder—how much would it actually cost to insure a Tesla Cybertruck Beast Crew Cab AWD? Insuring one in Toronto will set you back about $496/month or $5,952/year in premiums.

This estimate is based on a profile of a 35-year-old male in Toronto with a clean driving record, no traffic violations, and includes both comprehensive and collision coverage.

Chinese EVs could be a gamechanger for the Canadian market

There is one X factor that could change the whole EV market in Canada: Chinese EVs. If allowed in Canada, EVs from manufacturers like BYD, Nio, and Xiaomi could soon shake up Canada's auto market, “bringing more choices and more affordable prices to consumers,” Im says.

Currently, Canada’s 100% tariff on Chinese-made EVs currently limit their availability, while Europe imposes up to 38%. But even with the heavy duties on EVs in Europe, sales of Chinese EVs have skyrocketed in Europe, growing from around 3% to more than 20% between 2019 and 2023.

“Even with 100% tariffs,” says Im, “competing with China’s low-cost EVs would be extremely difficult, as Chinese automakers offer affordable models at a price as low as $10,000.”

If these tariffs are lifted or reduced, it could pave the way for brands like BYD to grab a bigger share of the Canadian market. BYD has already surpassed Tesla as the world’s top EV maker by sales, reporting revenue of over $100 billion USD.

In the meantime, U.S. tariffs on Chinese components could raise Tesla's production costs, potentially increasing vehicle prices in Canada. This may make Chinese EVs even more appealing if they gain traction locally. Although Hiscox notes there is no certainty around the timeline of this, or if it’s on the table at all.

After a recent trip to China to meet with Chinese original equipment manufacturers (OEMs) and review their latest EV offerings, Hiscox shares, “from a quality, design, and innovation standpoint, Canadian legacy manufacturers have their work cut out for them because Chinese auto products are impeccable.”

Ultimately, while many surveyed Canadians have doubts about the price efficiency of EVs—concerns that are well-founded given the high upfront costs, repair expenses, and reduced incentives—these hesitations don’t tell the whole story.

Spending less on fuel doesn’t always mean lower ownership costs, but for many, going electric is about more than money—it’s about the way we move through the world with purpose. EVs can symbolize sustainability, innovation, and a commitment to reducing their environmental footprint.

Read next: Over half of drivers of connected cars are concerned about data privacy

Methodology

An online survey of 1,593 Canadians was completed between April 25 and April 28, 2025, using Leger’s LEO panel. For comparative purposes, a probability sample of this size yields a margin of error of ±2.5% (19 times out of 20). Results were weighted by gender, age, region, education, and language based on Statistics Canada data.

Don't waste time calling around for auto insurance

Use RATESDOTCA to shop around, and compare multiple quotes at the same time.

Get money-saving tips in your inbox.

Stay on top of personal finance tips from our money experts!