If you are not redirected within 30 seconds, please click here to continue.

Samedi: 10h – 16h HAE

If you are not redirected within 30 seconds, please click here to continue.

If you are not redirected within 30 seconds, please click here to continue.

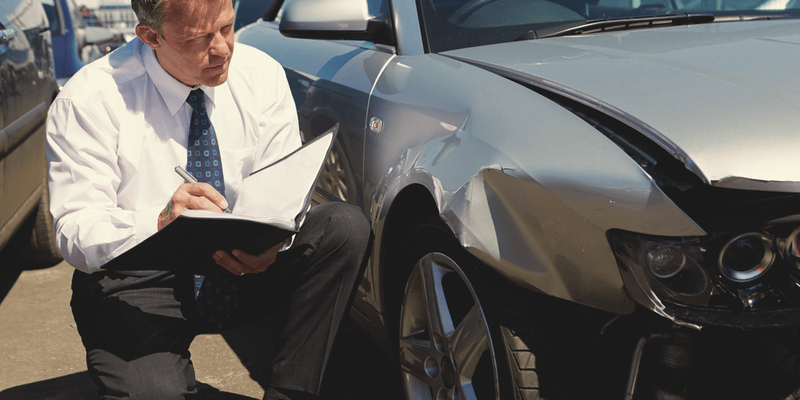

What does your auto insurance not cover?

Having insurance for your vehicle is important, there’s no doubt about it. By law, auto insurance is mandatory across all Canadian provinces and territories. And failure to comply can lead to serious repercussions, including having your driver’s licence suspended or your car seized.

However, whether your policy covers a specific peril, loss, or damage is really up to your coverage needs and what you can afford to pay for additional coverage.

Policy specifics: Collision and comprehensive coverage

Not all auto insurance is mandatory. Comparing your auto insurance policy on an annual basis ensures that you’re getting the lowest rates for your coverage needs.

Opting out of certain coverages will affect what is and isn’t covered by your auto insurance.

If you do not have collision coverage, your insurance will not cover:

- Damage: without collision coverage, any at-fault damage to your vehicle will not be covered. In fact, any damage caused while your vehicle is in motion is not covered – including hitting wildlife, street signs, or any other stationary objects.

If you do not have comprehensive coverage, your insurance will not cover:

- Theft: without comprehensive coverage (or specified perils or all perils), you cannot recover the loss of your car through insurance.

- Vandalism: if you have comprehensive or all perils coverage, you’ll be able to file a claim with your insurance provider if your car has been broken into or vandalized. Weather: damage caused by natural elements – think hail, ice, or falling tree limbs – is not covered by standard auto insurance policies.

- Wildlife or animal damage: collision coverage will apply if you hit an animal while driving, but comprehensive applies for non-collision related damage, such as rodents chewing your car wires.

Keep in mind that if you finance or lease a vehicle, it is often mandatory to have both collision and comprehensive coverage. Drivers should also be aware of behaviours that could make their policy void, leaving them without adequate coverage.

So, what does a standard auto insurance policy not cover?

While some coverages are based on the type of policy you choose, there are also some items that no standard auto insurance policy will cover. For instance, car parts like tires and batteries are not covered by standard auto insurance policies. Additionally, some modifications may not be insured by your policy.

Here's a roundup of some things that auto insurance does not cover:

Wear items

Auto insurance policies will not provide coverage for items that experience wear and tear, such as tires, batteries, or belts. That’s because these items simply break down as you use them over time, and it’s just expected that you’ll replace or budget for them over the life of the vehicle. Some vehicle manufacturers will offer tire maintenance or protection plans when you purchase a vehicle. This plan includes coverage for a set number of repairs or tire replacements that are caused by road hazards.

Mechanical failure

Just like wear items, mechanical failure is unfortunately considered one of those things that’s just part and parcel of owning a vehicle. As such, your auto insurance won’t cover mechanical breakdown or failure due to rusting or freezing. The only exception to this is if the failure is due to a covered peril, such as a collision.

Belongings left in rideshare vehicles

Forgot your wallet or laptop in your Uber? Sorry, your auto insurance won’t cover you. However, if you’ve left valuables in your own car and the car has been broken into, your home insurance might cover you for the replacement. Personal auto policies do not cover theft of contents, unless you have a commercial policy to cover tools that you require for work. Err on the side of caution, and be sure to read the fine print on your policy or speak with your insurance company to learn more about what may or may not be covered if valuables are stolen from your car.

Rental cars

Just because you have personal auto insurance, doesn’t mean that insurance will cover you while driving a rental vehicle. You need to have pre-purchased an endorsement for rental coverage, or purchase insurance through the rental company before hitting the road.

Impaired driving

if you or anyone driving your vehicle is under the influence of drugs or alcohol, your insurance provider can deny payment for any loss or damage caused to the vehicle in an accident.

Transporting dangerous goods

This one’s not too surprising, but your auto insurance will not cover you if you’re transporting dangerous goods such as radioactive materials or explosives. Best to leave that to the professionals!

Pre-existing damages

Auto insurance will not cover pre-existing damages from before you bought your vehicle, or purchased your policy. This includes previous damages that you didn’t repair, as well as regular wear-and-tear damages.

Pain and suffering

Undoubtedly, being involved in a motor vehicle collision can result in pain and suffering, mental anguish, and other emotional and psychological damages. These types of damages are typically not covered by your auto insurance policy. Your insurance company will determine fault and you’ll need to file a lawsuit or negligence claim against the other driver.

Don't waste time calling around for auto insurance

Use RATESDOTCA to shop around, and compare multiple quotes at the same time.

Get money-saving tips in your inbox.

Stay on top of personal finance tips from our money experts!