If you are not redirected within 30 seconds, please click here to continue.

Samedi: 10h – 16h HAE

If you are not redirected within 30 seconds, please click here to continue.

If you are not redirected within 30 seconds, please click here to continue.

57% of Ontarians think distracted driving is the greatest threat to road safety, yet 24% drive distracted

Table of Contents

While most of us like to believe we’re safe drivers, there is a fine line between driving attentively and driving distracted. Virtually anything that distracts you from the road, regardless of how harmless it may seem, can make you more likely to be involved in a collision. This notion may seem like common sense, but there’s still a clear dissonance between thought and action when it comes to safe driving practices in Ontario. According to Transport Canada, distracted driving was the second leading factor contributing to road fatalities in 2020.

A recent RATESDOTCA survey reveals that more than half of Ontarians (57%) believe distracted driving to be a greater threat to road safety than impaired driving (40%), but nearly a quarter (24%) engage in distracting behaviours when driving. Despite the majority agreeing with the severity of driving distracted, a large portion of Ontarians engage in it anyway. Taking a closer look at the most common distracting behaviours and how they’re viewed by those that are most likely to commit them may prevent collisions and penalties in the future. Understanding the consequences of your actions behind the wheel can protect not only you and those around you, but also your auto insurance premium.

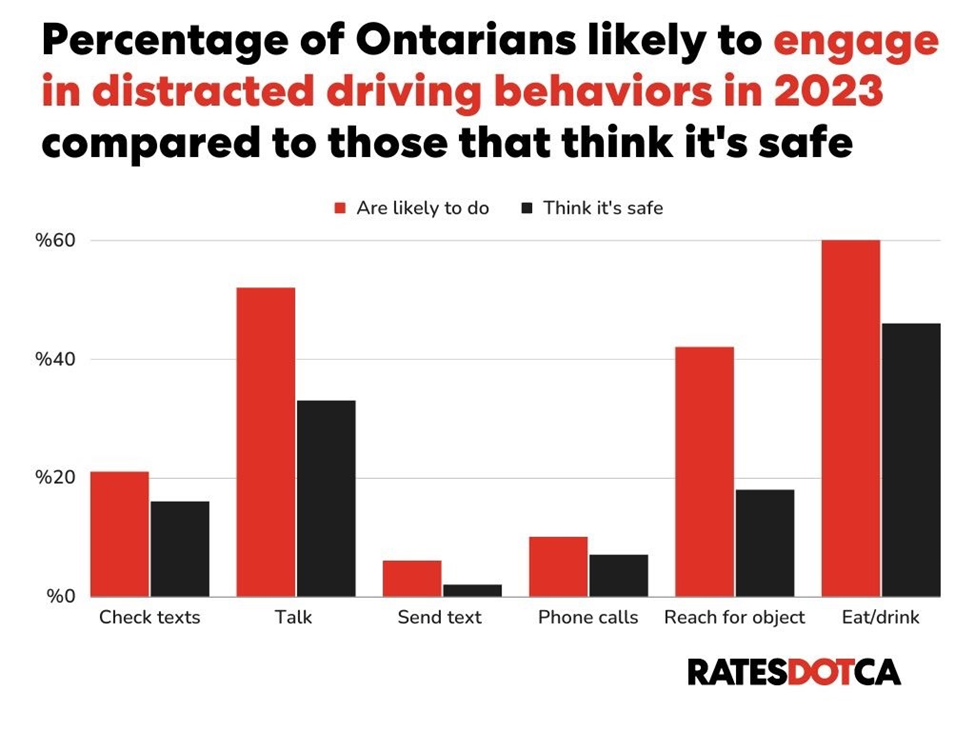

More admit to eating and drinking, talking to passengers, reaching for objects, and checking messages compared to other distracting behaviours

According to RATESDOTCA’s survey, drivers in Ontario are most likely to be distracted by non-electronic behaviours while driving. The top three actions drivers are at least somewhat likely to do while driving include:

- Eating or drinking a beverage (60%), though 46% think it’s safe

- Talking to a passenger (52%), though 33% think it’s safe, and

- Reaching for an object (42%), though 18% think it’s safe

Meanwhile, respondents were significantly less likely to admit to engaging in distracting behaviours that involve an electronic device.

In contrast to the above:

- 21% reported they were at least somewhat likely to check their phone for messages, though 16% think it’s safe

- 18% to use a geo navigation system, though 12% think it’s safe, and

- 10% to take a phone call, though 2% think it’s safe

Percentages dwindle even further for activities that may require your full attention.

- 6% acknowledged they were at least somewhat likely to send a text message, though 2% think it’s safe

- 3% to take a video, though 2% think it’s safe, and

- 2% to watch a video, though 2% think it’s safe

Low engagement with any of these behaviours is a good sign. However, these results reveal a worrying difference in driver outlook on each category’s risk level. More people may assume engaging with an electronic device is more dangerous than, say, grabbing something from the backseat. But, in reality, the repercussions of both actions could be the same.

The most common distracted driving behaviours are less likely to be seen as chargeable offences

Many Ontarians have a limited view of which behaviours can constitute a driving offence. The overwhelming majority believe watching a video (91%), taking a video (90%), and sending a text message (90%) are distracted driving behaviours worthy of conviction. These percentages show a stark contrast to the number of those who consider the most common actions, including reaching for an object (65%), talking to a passenger (52%), and eating and drinking (45%), to be distracted driving behaviours.

Respondents may be right about Ontario’s distracted driving laws applying to hand-held devices, but other distracting behaviours still lead to a driving conviction. You can still be charged for careless or dangerous driving when committing non-device-related acts that distract you behind the wheel.

Penalties for a distracted driving conviction depend on your licence class and your driving experience. For a first conviction, you’ll receive up to a $1,000 fine, three demerit points, and a three-day licence suspension. Novice drivers (G1, G2, M1, M2 licences) will face a 30-day licence suspension, but won’t be hit with demerit points.

Careless driving convictions can be more severe, with fines ranging from $400 to $2,000. They may also result in six demerit points, six months in jail, and up to two years without a licence.

In addition, any conviction that results from distracted or careless driving will have a direct impact on your car insurance rate, too. According to the RATESDOTCA auto insurance quoter, a 35-year-old male driver living in downtown Toronto with a clean driving record could see his annual premium more than double from $2,610 to $5,845 after one distracted driving conviction. A careless driving conviction could increase his annual rate to a whopping $10,925. However, such high increases aren’t necessarily due to a surcharge for the ticket, but are indicative of the fact that there are far fewer insurance options available to those with these tickets.

While comparing car insurance rates in Ontario can always help you find an affordable premium, having a distracted, careless, or dangerous driving conviction on your record makes it even more crucial to shop the market before you renew your policy each year.

Respondents who are more likely to engage in distracted behaviour are more likely to think those behaviours are safe

The likelihood of a driver engaging in distracted behaviours appears to be linked to the likelihood of the offender believing the act is safe. This pattern suggests a knowledge gap around what safe and responsible driving looks like in Ontario.

For example:

- The age group most likely to check messages is 35 to 49 year olds, at 7%. They’re also the age group most likely to think it’s safe, at 6%.

- Similarly, respondents aged 50 to 65 are most likely to eat or drink while driving, at 21%. They’re also most likely to think it’s safe to do so, at 16%.

- Those 50 to 65 are also most likely to admit to occasionally reaching around for an object, at 14% and think it’s safe, at 6%.

- The same age group is most likely to talk to a passenger, at 16% and think it’s safe, at 11%.

If those drivers perceived each of the activities above to be unsafe behaviours that could lead to equally devastating accidents — with equally severe penalties depending on the outcome — perhaps they’d be less likely to engage.

A distracted driving conviction can stay on your driving record for years and impact your premium accordingly. Shopping the market before renewing your policy each year ensures you’re paying the least amount possible for car insurance. But the best way to avoid a high rate in the first place is to steer clear of both minor and major traffic tickets — and keep your eyes on the road.

Methodology

RATESDOTCA Survey:

*Survey conducted by RATESDOTCA and polled 665 Ontarians between March 3 and March 9 that used RATESDOTCA's auto insurance quoter.

Driver quotes based on:

- Number of vehicles: 1

- Number of drivers: 1

- Age: 35

- Gender: Male

- Lives in the M6H 1X1 postal code of Toronto, Ont.

- Driver licensing dates: G – Jan of 17 yrs ago, G2 – Jan of 18 yrs ago and G1 – Jan of 19 yrs ago.

- Listed on an insurance policy for 18 yrs

- With current insurance company for 2 yrs.

- Collision and comprehensive coverage

- 3rd party liability at $1,000,000

- Vehicle: 1 year old Honda Civic LX 4 Dr (financed)

- Parked: private driveway

- Drives five kilometres to and from work daily (10,000 kilometres annually)

- Personal use

- Winter tires

- Did not opt for any discounts related to telematics or bundling

Don't waste time calling around for auto insurance

Use RATESDOTCA to shop around, and compare multiple quotes at the same time.

Get money-saving tips in your inbox.

Stay on top of personal finance tips from our money experts!