If you are not redirected within 30 seconds, please click here to continue.

Samedi: 10h – 16h HAE

If you are not redirected within 30 seconds, please click here to continue.

If you are not redirected within 30 seconds, please click here to continue.

Articles From Diane Peters

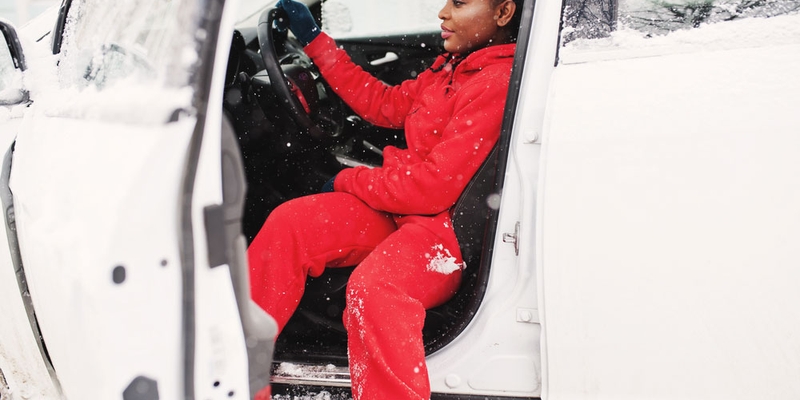

Now is an excellent time to assess your car and look for ways to save amid the snow and cold.

Thinking of renting out your cottage? It can be a great way to earn extra money, but it’s not as simple as handing over the keys. Check out these must-know tips for preparing your property for renters, from safety to rental insurance.

Wondering how to get money for gift cards? These days, there’s a bunch of sites to swap, sell or buy cards at a discount. Check out our top picks.

Get money-saving tips in your inbox.

Stay on top of personal finance tips from our money experts!